Question: explain your numerical working as you do them please Suppose a trader wants to set up a short hedge using the futures contract selected. (

explain your numerical working as you do them please Suppose a trader wants to set up a short hedge using the futures contract selected.

a Explain clearly any two reasons why hedging with futures contracts works less than

perfectly in practice.

b Explain what is meant by basis risk when futures contracts are used for hedging.

Using the same example as part a explain when a long hedge would be appropriate.

Using your own numerical example from the futures contract used, explain why a long

hedgers position worsens when the basis strengthens unexpectedly and improves when the

basis weakens unexpectedly.

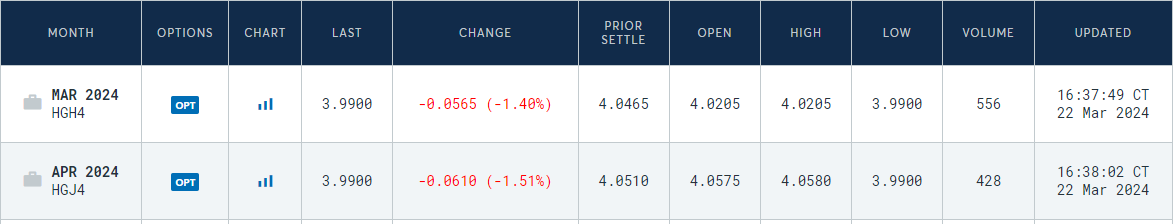

NB: For this question, you would also need the spot or cash price. MINIMUM PRICE FLUCTUATION

per pound $

TASTAM: Zero or ticks in the minimum tick increment of the outright

Spot TAS: Zero

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock