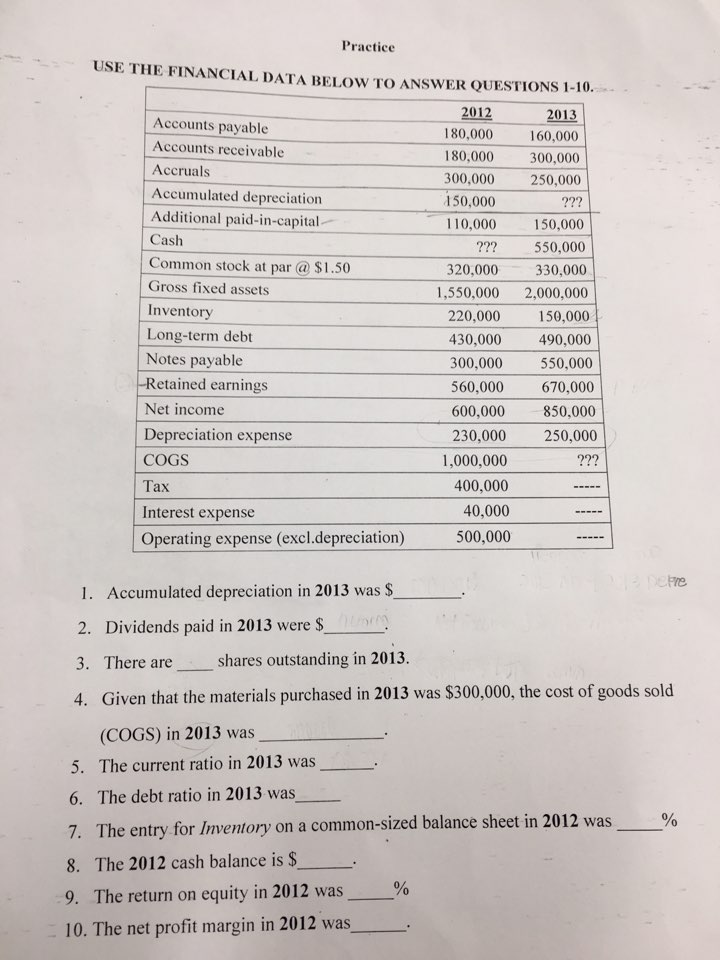

Question: Explain..all 1-10 Practice USE THE FINANCIAL DATA BELow TO ANSWER QUESTIONS 1-10 2012 180,000 160,000 180,000 300,000 300,000 250,000 150,000 110,000 150,000 2013 Accounts payable

Explain..all 1-10

Practice USE THE FINANCIAL DATA BELow TO ANSWER QUESTIONS 1-10 2012 180,000 160,000 180,000 300,000 300,000 250,000 150,000 110,000 150,000 2013 Accounts payable Accounts receivable Accruals Accumulated depreciation Additional paid-in-capital Cash Common stock at par @ $1.50 Gross fixed assets Inventory Long-term debt Notes payable ??? 550,000 320,000 330,000 1,550,000 2,000,000 220,000 50,000 430,000 490,000 300,000 550,000 560,000 670,000 600,000 850,000 230,000 250,000 -Retained earnings Net income Depreciation expense COGS Tax Interest expense Operating expense (excl.depreciation) 1,000,000 2?? 400,000 40,000 500,000 1. Accumulated depreciation in 2013 was $ 2. Dividends paid in 2013 were $ 3. There are shares outstanding in 2013. 4. Given that the materials purchased in 2013 was $300,000, the cost of goods sold (COGS) in 2013 was 5. The current ratio in 2013 was 6. The debt ratio in 2013 was 7. The entry for Inventory on a common-sized balance sheet in 2012 was 8. The 2012 cash balance is $ 9. The return on equity in 2012 was % 10. The net profit margin in 2012 was_ %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts