Question: Explained With step by step T is planning to invest in a bond market. There are two bonds she take into consideration to choose. Information

Explained With step by step

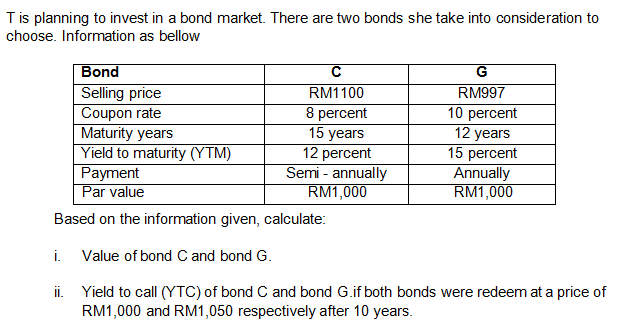

T is planning to invest in a bond market. There are two bonds she take into consideration to choose. Information as bellow 15 years Bond Selling price RM1100 Coupon rate 8 percent Maturity years Yield to maturity (YTM) 12 percent Payment Semi-annually Par value RM1,000 Based on the information given, calculate: G RM997 10 percent 12 years 15 percent Annually RM1,000 i Value of bond C and bond G. ii. Yield to call (YTC) of bond C and bond G.if both bonds were redeem at a price of RM1,000 and RM1,050 respectively after 10 years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock