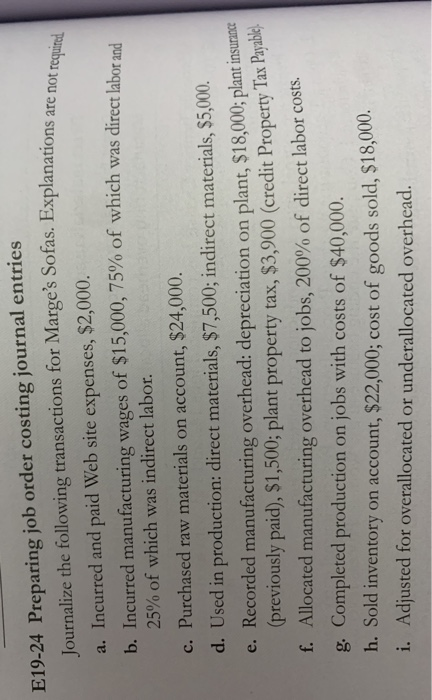

Question: Explanations are not required E19-24 Preparing job order costing journal entries Journalize the following transactions for Marge's Sofas. Explanations are a. Incurred and paid Web

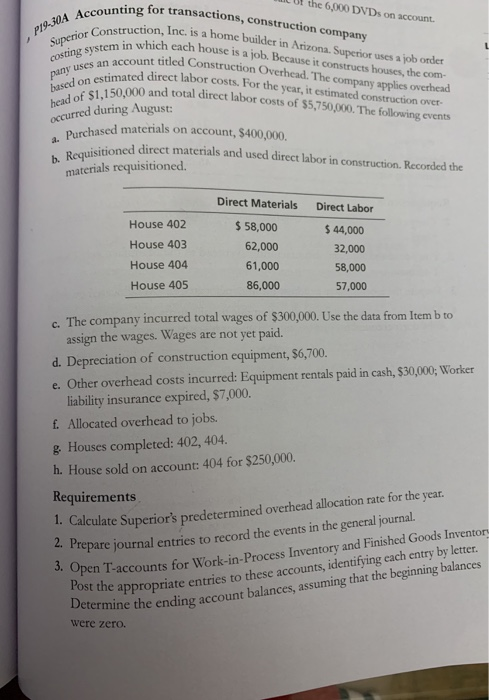

Explanations are not required E19-24 Preparing job order costing journal entries Journalize the following transactions for Marge's Sofas. Explanations are a. Incurred and paid Web site expenses, $2,000. b. Incurred manufacturing wages of $15,000, 75% of which was direct labor and 25% of which was indirect labor. c. Purchased raw materials on account, $24,000. d. Used in production direct materials, $7,500; indirect materials, $5,000. e. Recorded manufacturing overhead: depreciation on plant, $18,000; plant insurance (previously paid), $1,500; plant property tax, $3,900 (credit Property Tax Payan f. Allocated manufacturing overhead to jobs, 200% of direct labor costs. g. Completed production on jobs with costs of $40,000. h. Sold inventory on account, $22,000; cost of goods sold, $18,000. i. Adjusted for overallocated or underallocated overhead. p19-304 Accounting Superior Constructie costing system in wi pany uses an accoun based on estimated head of $1,150,00 IL Ul the 6,000 DVDs on account ating for transactions, construction company ruction, Inc. is a home builder in Arizona Superior uses a job order in which each house is a job. Because it constructs houses, the com- ccount titled Construction Overhead. The company applies overhead mated direct labor costs. For the year, it estimated construction over- 50.000 and total direct labor costs of $5,750,000. The following events curred during August: Purchased materials on account, $400,000. tioned direct materials and used direct labor in construction. Recorded the b. Requisitioned die materials requisitioned. Direct Materials Direct Labor House 402 $ 58,000 $ 44,000 House 403 62,000 32,000 House 404 61,000 58,000 House 405 86,000 57,000 . The company incurred total wages of $300,000. Use the data from Item b to assign the wages. Wages are not yet paid. d. Depreciation of construction equipment, $6,700. e. Other overhead costs incurred: Equipment rentals paid in cash, $30,000; Worker liability insurance expired, $7,000. f. Allocated overhead to jobs. & Houses completed: 402, 404. h. House sold on account: 404 for $250,000. Requirements Calculate Superior's predetermined overhead allocation rate for the year. Prepare journal entries to record the events in the general journal. 3. Open T-account Post the appropriate en Determine the ending acco were zero. pen T-accounts for Work-in-Process Inventory and Finished Goods Inventory he appropriate entries to these accounts, identifying each entry by letter. hine the ending account balances, assuming that the beginning balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts