Question: Express Courier needs $ 1 4 1 million to support growth next year. After consulting with its investment banker, the company has determined that the

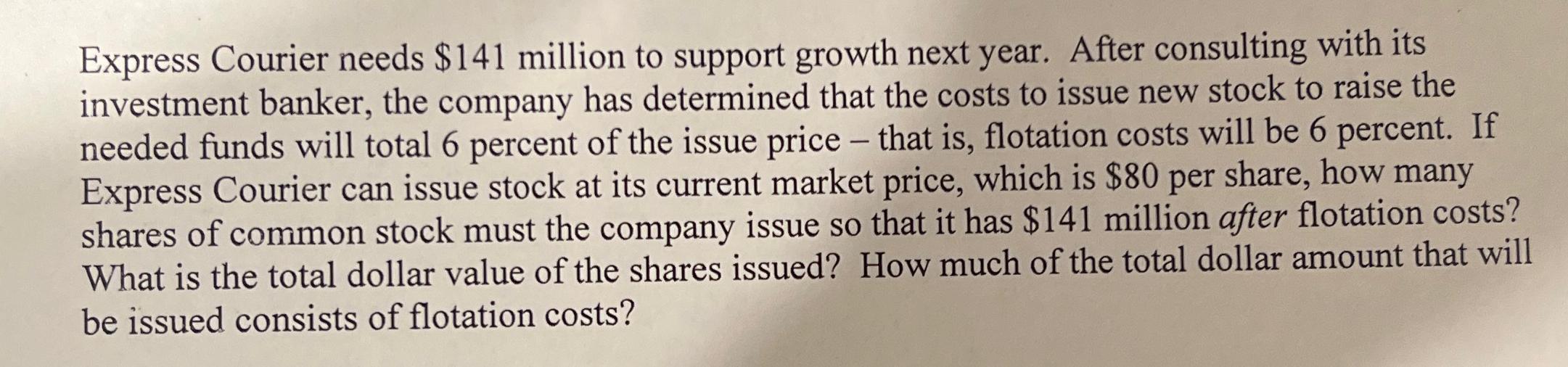

Express Courier needs $ million to support growth next year. After consulting with its investment banker, the company has determined that the costs to issue new stock to raise the needed funds will total percent of the issue price that is flotation costs will be percent. If Express Courier can issue stock at its current market price, which is $ per share, how many shares of common stock must the company issue so that it has $ million after flotation costs? What is the total dollar value of the shares issued? How much of the total dollar amount that will be issued consists of flotation costs?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock