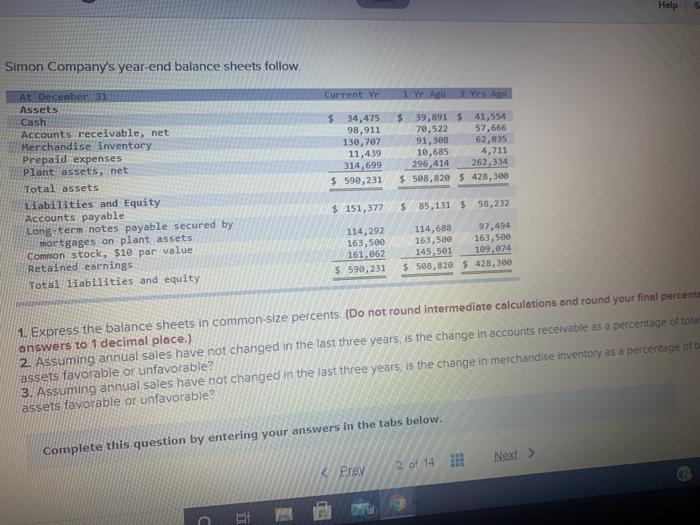

Question: express the balance sheets in common size percents Help Simon Company's year-end balance sheets follow Current Yr 1 Yr 2 yrs $ 34,475 98,911 130,707

Help Simon Company's year-end balance sheets follow Current Yr 1 Yr 2 yrs $ 34,475 98,911 130,707 11,439 314,699 $ 590, 231 $ 39,891 $ 41,554 70,522 57,666 91,308 62,035 10,685 4,711 296,414 262,334 $588,820 $ 428,300 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 151,377 $ 85,131 $ 58,232 114,2 163,500 161,062 $ 590,231 114,688 97,494 163,500 163,500 145,501 109,074 $ 588,820 $ 428,300 1. Express the balance sheets in common-size percents (Do not round intermediate calculations and round your final percent answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of te assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Prey 2 of 14 8 Next > C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts