Question: Ext either a nominal or discounted basis? Check all that apply. 1. Application of Time Value of Money Skills Gavin Goldenarm has been playing baseball

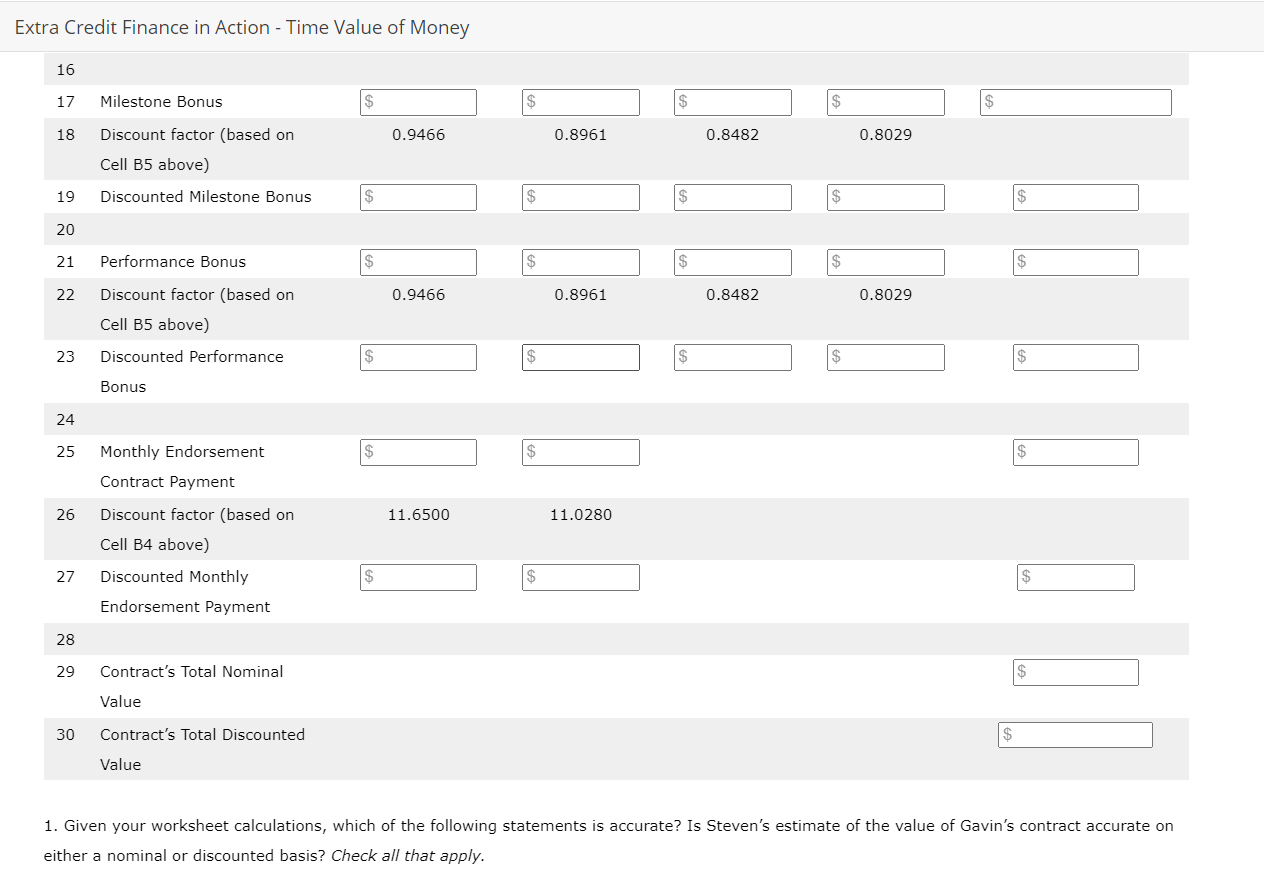

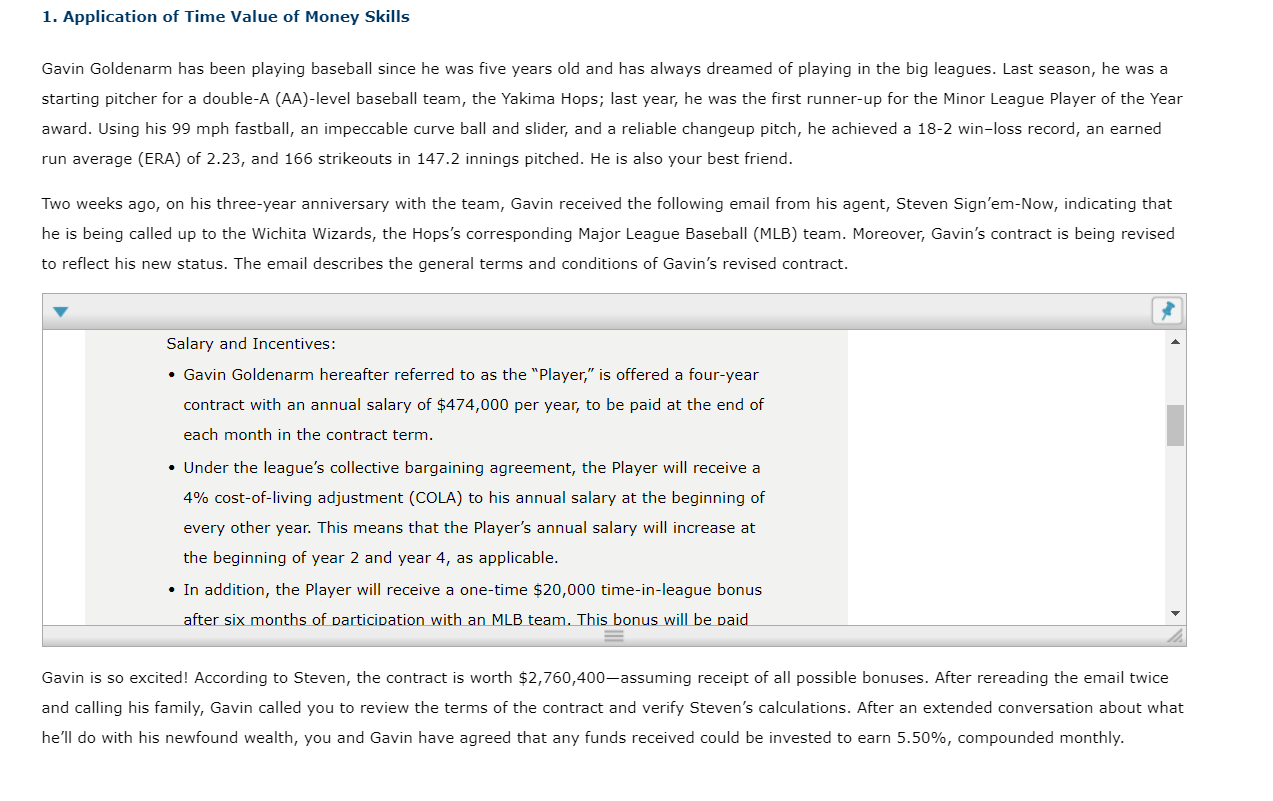

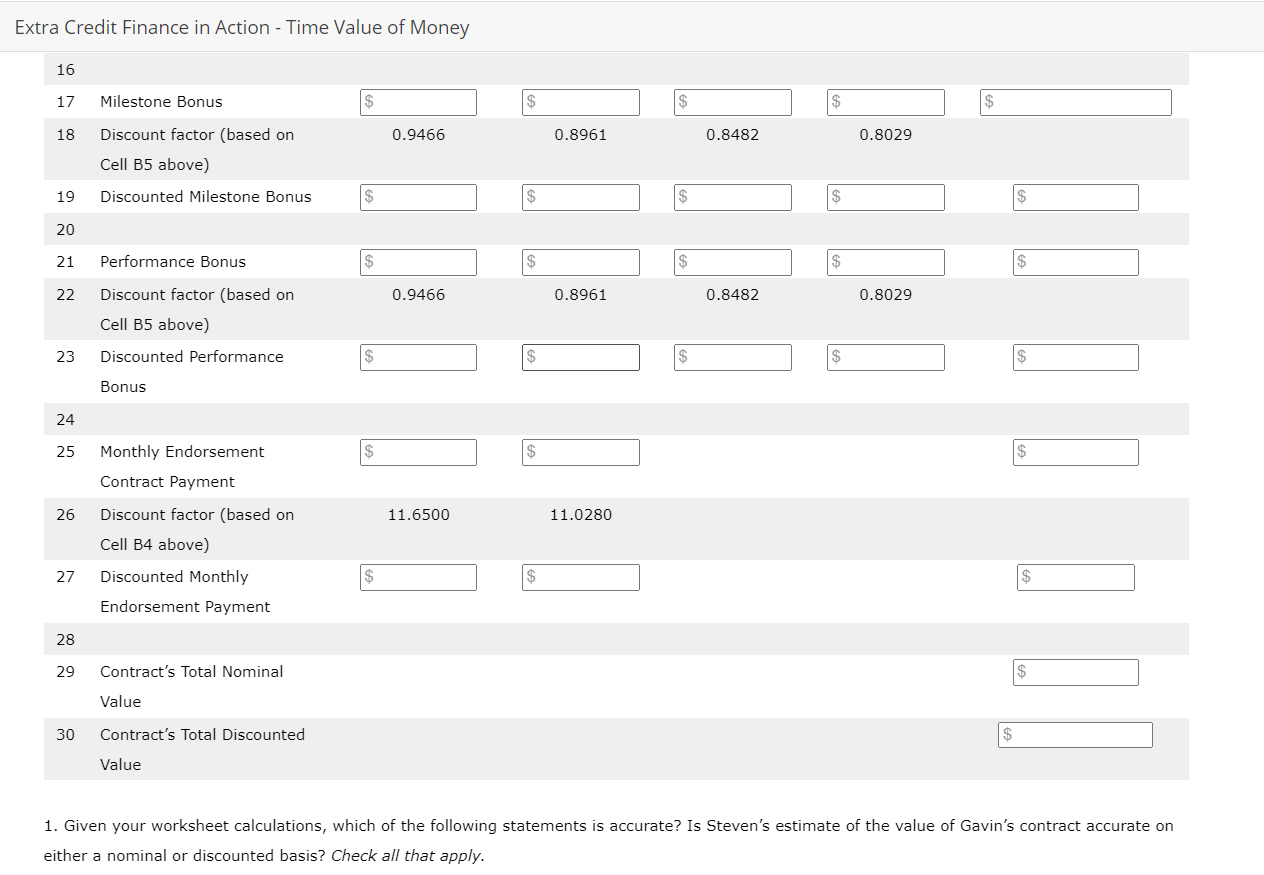

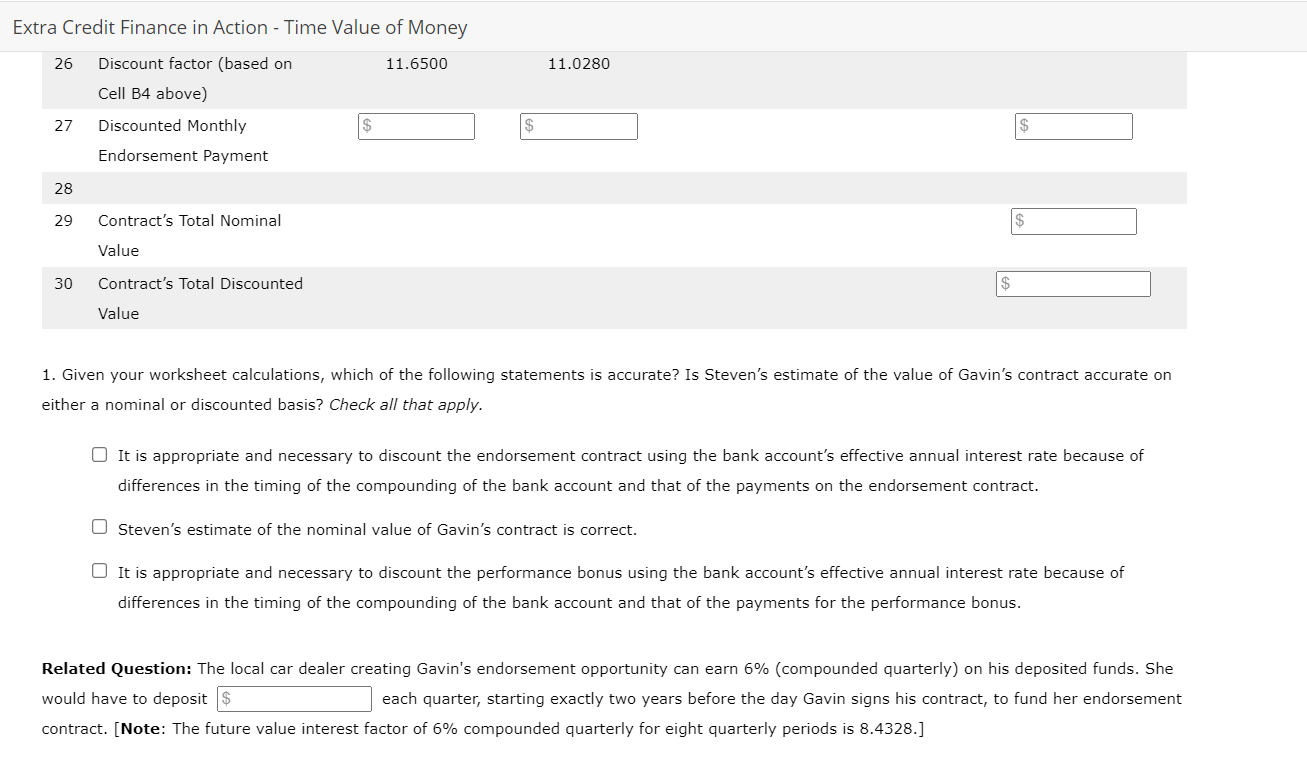

Ext either a nominal or discounted basis? Check all that apply. 1. Application of Time Value of Money Skills Gavin Goldenarm has been playing baseball since he was five years old and has always dreamed of playing in the big leagues. Last season, he was a starting pitcher for a double-A (AA)-level baseball team, the Yakima Hops; last year, he was the first runner-up for the Minor League Player of the Year award. Using his 99 mph fastball, an impeccable curve ball and slider, and a reliable changeup pitch, he achieved a 182 win-loss record, an earned run average (ERA) of 2.23 , and 166 strikeouts in 147.2 innings pitched. He is also your best friend. Two weeks ago, on his three-year anniversary with the team, Gavin received the following email from his agent, Steven Sign'em-Now, indicating that he is being called up to the Wichita Wizards, the Hops's corresponding Major League Baseball (MLB) team. Moreover, Gavin's contract is being revised to reflect his new status. The email describes the general terms and conditions of Gavin's revised contract. Gavin is so excited! According to Steven, the contract is worth $2,760,400-assuming receipt of all possible bonuses. After rereading the email twice and calling his family, Gavin called you to review the terms of the contract and verify Steven's calculations. After an extended conversation about what he'll do with his newfound wealth, you and Gavin have agreed that any funds received could be invested to earn 5.50%, compounded monthly. Ext either a nominal or discounted basis? Check all that apply. E) 1. Given your worksheet calculations, which of the following statements is accurate? Is Steven's estimate of the value of Gavin's contract accurate on either a nominal or discounted basis? Check all that apply. It is appropriate and necessary to discount the endorsement contract using the bank account's effective annual interest rate because of differences in the timing of the compounding of the bank account and that of the payments on the endorsement contract. Steven's estimate of the nominal value of Gavin's contract is correct. It is appropriate and necessary to discount the performance bonus using the bank account's effective annual interest rate because of differences in the timing of the compounding of the bank account and that of the payments for the performance bonus. Related Question: The local car dealer creating Gavin's endorsement opportunity can earn 6% (compounded quarterly) on his deposited funds. She would have to deposit each quarter, starting exactly two years before the day Gavin signs his contract, to fund her endorsement contract. [Note: The future value interest factor of 6% compounded quarterly for eight quarterly periods is 8.4328. ] Ext either a nominal or discounted basis? Check all that apply. 1. Application of Time Value of Money Skills Gavin Goldenarm has been playing baseball since he was five years old and has always dreamed of playing in the big leagues. Last season, he was a starting pitcher for a double-A (AA)-level baseball team, the Yakima Hops; last year, he was the first runner-up for the Minor League Player of the Year award. Using his 99 mph fastball, an impeccable curve ball and slider, and a reliable changeup pitch, he achieved a 182 win-loss record, an earned run average (ERA) of 2.23 , and 166 strikeouts in 147.2 innings pitched. He is also your best friend. Two weeks ago, on his three-year anniversary with the team, Gavin received the following email from his agent, Steven Sign'em-Now, indicating that he is being called up to the Wichita Wizards, the Hops's corresponding Major League Baseball (MLB) team. Moreover, Gavin's contract is being revised to reflect his new status. The email describes the general terms and conditions of Gavin's revised contract. Gavin is so excited! According to Steven, the contract is worth $2,760,400-assuming receipt of all possible bonuses. After rereading the email twice and calling his family, Gavin called you to review the terms of the contract and verify Steven's calculations. After an extended conversation about what he'll do with his newfound wealth, you and Gavin have agreed that any funds received could be invested to earn 5.50%, compounded monthly. Ext either a nominal or discounted basis? Check all that apply. E) 1. Given your worksheet calculations, which of the following statements is accurate? Is Steven's estimate of the value of Gavin's contract accurate on either a nominal or discounted basis? Check all that apply. It is appropriate and necessary to discount the endorsement contract using the bank account's effective annual interest rate because of differences in the timing of the compounding of the bank account and that of the payments on the endorsement contract. Steven's estimate of the nominal value of Gavin's contract is correct. It is appropriate and necessary to discount the performance bonus using the bank account's effective annual interest rate because of differences in the timing of the compounding of the bank account and that of the payments for the performance bonus. Related Question: The local car dealer creating Gavin's endorsement opportunity can earn 6% (compounded quarterly) on his deposited funds. She would have to deposit each quarter, starting exactly two years before the day Gavin signs his contract, to fund her endorsement contract. [Note: The future value interest factor of 6% compounded quarterly for eight quarterly periods is 8.4328. ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts