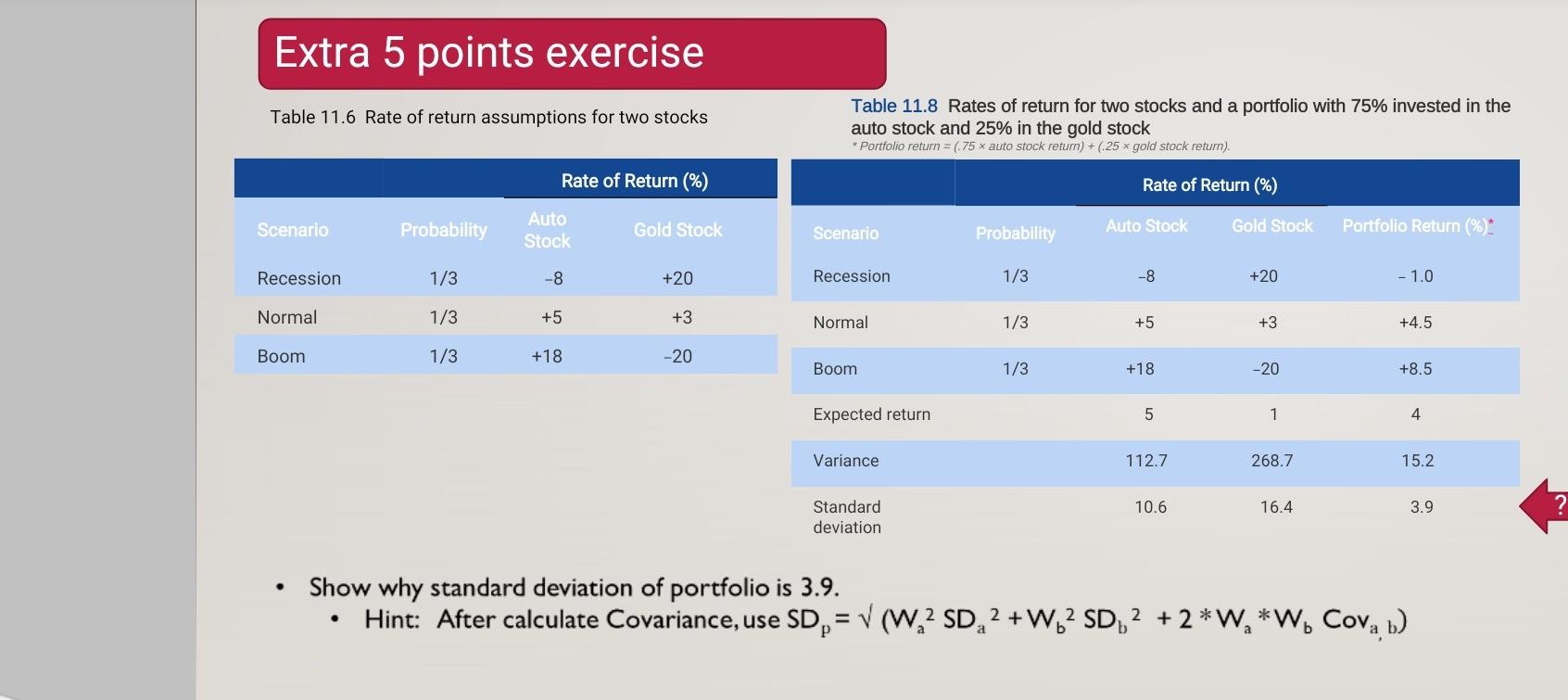

Question: Extra 5 points exercise Table 11.6 Rate of return assumptions for two stocks Table 11.8 Rates of return for two stocks and a portfolio with

Extra 5 points exercise Table 11.6 Rate of return assumptions for two stocks Table 11.8 Rates of return for two stocks and a portfolio with 75% invested in the auto stock and 25% in the gold stock * Portfolio return = (-75 * auto stock return) + ( 25 x gold stock return). Rate of Return (%) Rate of Return (%) Scenario Probability Auto Stock Gold Stock Gold Stock Scenario Auto Stock Probability Portfolio Return (%)* Recession 1/3 -8 +20 Recession 1/3 -8 +20 - 1.0 Normal 1/3 +5 +3 Normal 1/3 +5 +3 +4.5 Boom 1/3 +18 -20 Boom 1/3 +18 -20 +8.5 Expected return 5 1 4 Variance 112.7 268.7 15.2 10.6 16.4 3.9 Standard deviation . Show why standard deviation of portfolio is 3.9. Hint: After calculate Covariance, use SD, = V (W,2 SD2 +W.2 SD2 + 2 *W, *W. Cova b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts