Question: Extra Credit Assignment 3 Instructions: Please answer the following question and submit your responses in a single PDF file by Sunday ( April 1 4

Extra Credit Assignment

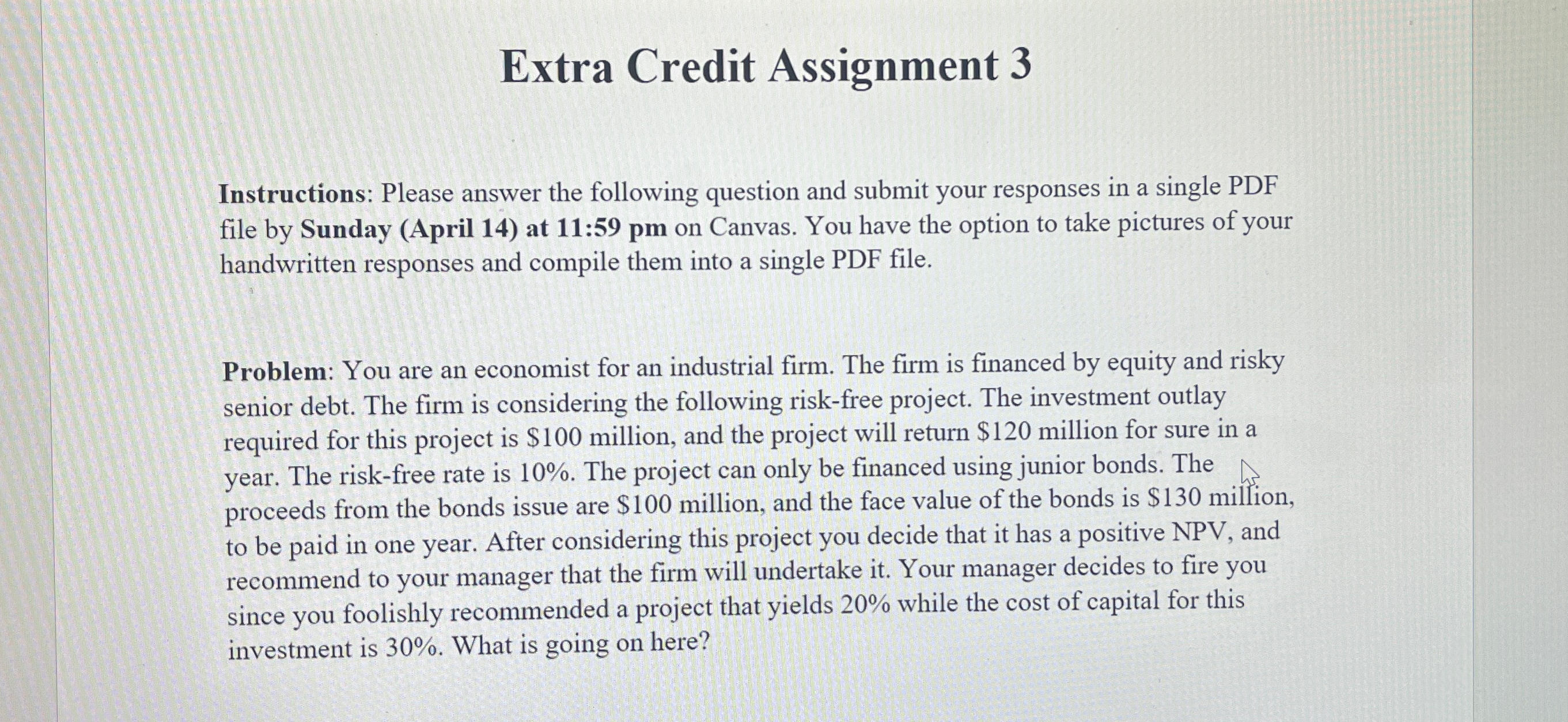

Instructions: Please answer the following question and submit your responses in a single PDF file by Sunday April at : pm on Canvas. You have the option to take pictures of your handwritten responses and compile them into a single PDF file.

Problem: You are an economist for an industrial firm. The firm is financed by equity and risky senior debt. The firm is considering the following riskfree project. The investment outlay required for this project is $ million, and the project will return $ million for sure in a year. The riskfree rate is The project can only be financed using junior bonds. The proceeds from the bonds issue are $ million, and the face value of the bonds is $ million, to be paid in one year. After considering this project you decide that it has a positive NPV and recommend to your manager that the firm will undertake it Your manager decides to fire you since you foolishly recommended a project that yields while the cost of capital for this investment is What is going on here?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock