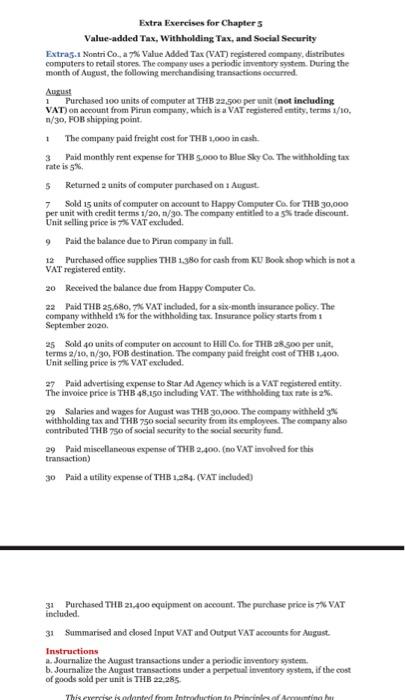

Question: Extra Exercises for Chapter 5 Value-added Tax, Withholding Tax, and Social Security Extra5.1 Nontri Co., a 7% Value Added Tax (VAT) registered company, distributes computers

Extra Exercises for Chapter 3 Value-added Tax, Withholding Tax, and Social Security Extra5.1 Nontri Co., a 7% Value Added Tax (VAT) registered compuny, distributes compaters to retail stores. The company uses a periodie imventory system. During the month of Angust, the following merchandising transactions eecurred. August 1 Purchased 100 units of compater at THB 22,500 per unit (not including VAT) on account from Pirun company, which is a VAT tegistered entity, terms 1/10. n/3O, FOB shipping point. 1 The company paid freight cost for THB 1,000 in cash. 3. Paid monthly rent expense for THB s,ooo to Bhe Sky Ca. The withholding tax rate is 5%. 5. Returned 2 units of compater purchased on 1 Aurgast. 7 Sold 15 units of computer os account to Happy Computer Ca. for THB 30,000 per unit with credit terms 1/20,n/30. The company entitied to a 5$ trade discount. Unit selling price is 7 VAT excluded. 9 Paid the balance dae to Pirun company in full. 12 Purchased office supplies THB 1,380 for cash from KU llook shop which is not a VAT registered entity. 20 Received the balance due from Happy Computer Ca. 22 Paid THB 25.680, 7 VAT included, for a six-month insurasee policy. The company withheld 1% for the withbolding tax. Insurance policy starts from 1 September 2020. 25 Sold 40 units of computer on account to Hill Co. for THB 28 spo per unit, terms 2/10,n/30, FOB destination. The company paid freight cont of This 1,400 Unit selling price is 7 VAT excluded. 27 Paid advertising expense to Star Ad Agency which is a VAT sexistered entity. The invoice price is THB 48,150 including, VAT. The withholding tax rate is 2%. 29 Solaries and wages for Augast was THB 30,000 . The company withbeld 3% withhoiding tax and THB750 social security from its employes. The company also eontributed THB 750 of social security to the social security fund. 29 Paid miscellaneons expense of THB 2,400, (no VAT involved for this transaction) 30 Paid a utility expense of THB 1,284. (VNT included) 31. Purchased THB 21,400 equipment on accoent. The perchase price is 7N VAT included. 31. Summarised and closed Inper VAT and Outpent VAT accoents for Angust. Instructions a. Journalize the August transactions under a periodic inventory system. b. Journalize the August transactions under a perpetual inventory system, if the cost of goods sold per unit is THB 22,285

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts