Question: EXTRA PROBLEM On January 1 , ABC Company had $ 1 9 0 , 0 0 0 in Accounts Receivable and during the month had

EXTRA PROBLEM

On January ABC Company had $ in Accounts Receivable and during the month had Credit sales of $ and Cash sales of $ During January, ABC collected $ on account and wrote off a $ receivable. Also, during January, ABC had Sales Allowances of $; Sales Discounts of $; and Sales Returns of $ ABC managed to collect $ of a previously written off account during January. The balance in the Allowance for Uncollectible Accounts on January was $

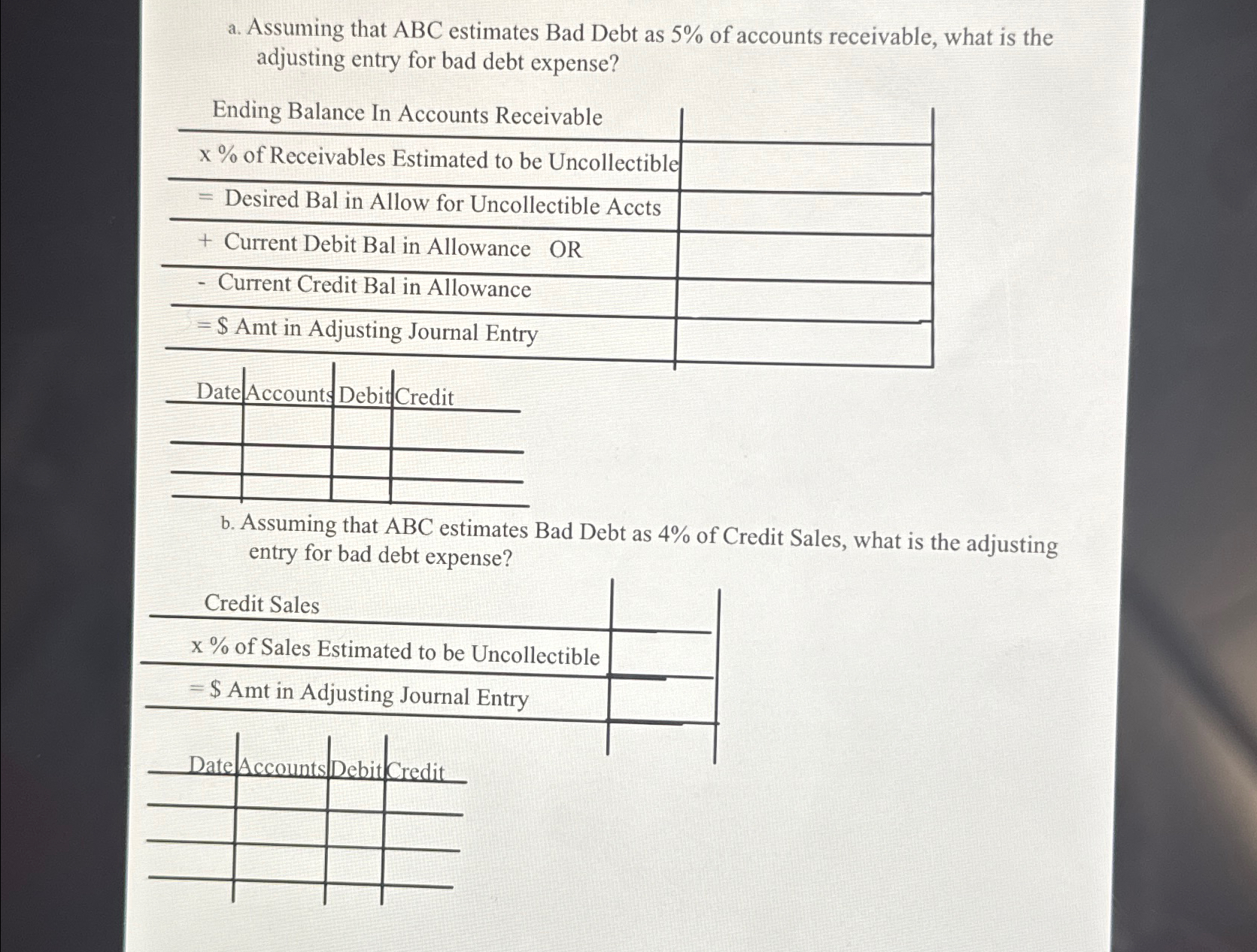

a Assuming that ABC estimates Bad Debt as of accounts receivable, what is the adjusting entry for bad debt expense?

tableEnding Balance In Accounts Receivable, of Receivables Estimated to be Uncollectible, Desired Bal in Allow for Uncollectible Accts, Current Debit Bal in Allowance OR Current Credit Bal in Allowance,$ Amt in Adjusting Journal Entry,

tableDateAccount,Debit,Credit

b Assuming that ABC estimates Bad Debt as of Credit Sales, what is the adjusting entry for bad debt expense?

tableCredit Sales, of Sales Estimated to be Uncollectible,$ Amt in Adjusting Journal Entry,Date Accounts Debit Credit,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock