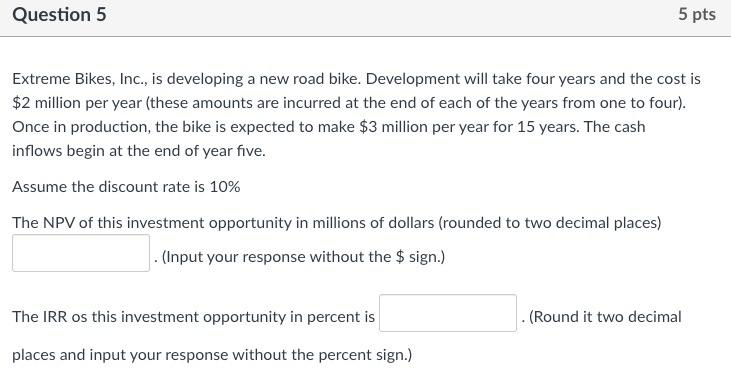

Question: Extreme Bikes, Inc., is developing a new road bike. Development will take four years and the cost is $2 million per year (these amounts are

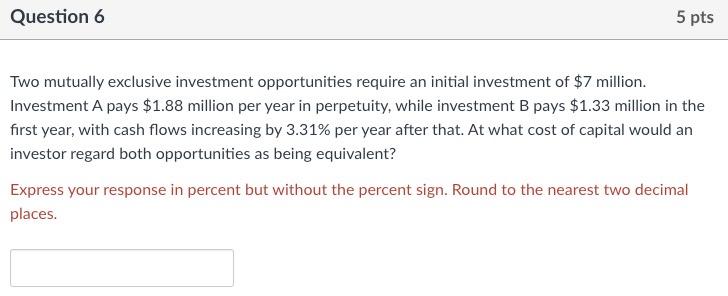

Extreme Bikes, Inc., is developing a new road bike. Development will take four years and the cost is $2 million per year (these amounts are incurred at the end of each of the years from one to four). Once in production, the bike is expected to make $3 million per year for 15 years. The cash inflows begin at the end of year five. Assume the discount rate is 10% The NPV of this investment opportunity in millions of dollars (rounded to two decimal places) . (Input your response without the $ sign.) The IRR os this investment opportunity in percent is (Round it two decimal places and input your response without the percent sign.) Two mutually exclusive investment opportunities require an initial investment of $7 million. Investment A pays $1.88 million per year in perpetuity, while investment B pays $1.33 million in the first year, with cash flows increasing by 3.31% per year after that. At what cost of capital would an investor regard both opportunities as being equivalent? Express your response in percent but without the percent sign. Round to the nearest two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts