Question: ExxonMobil Explain why you think Chevron and shell are comparable to ExxonMobil. (Updated: Data uploaded) Do an earnings analysis of ExxonMobil, Chevron, and shell and

ExxonMobil Explain why you think Chevron and shell are comparable to ExxonMobil. (Updated: Data uploaded)

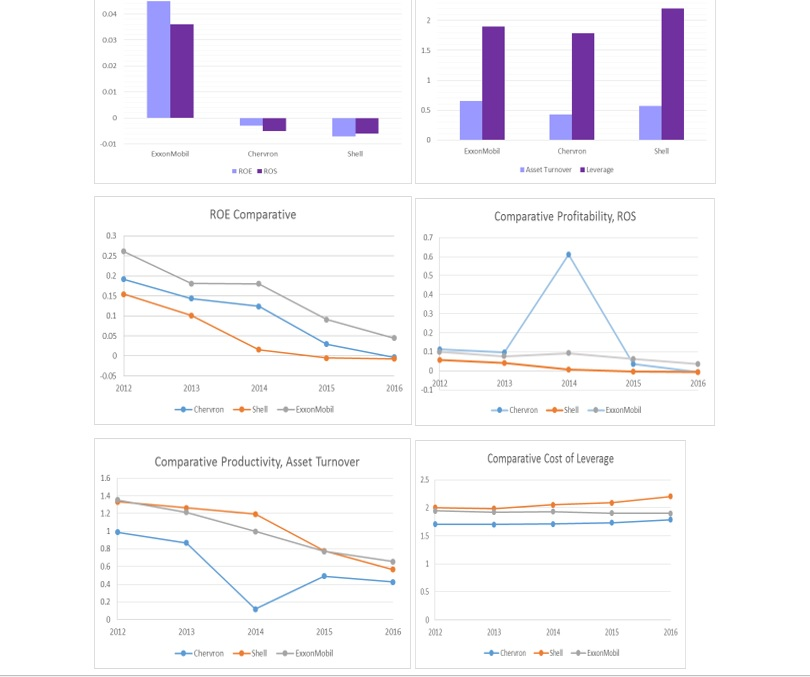

Do an earnings analysis of ExxonMobil, Chevron, and shell and Compare overtime ROE and ROA and their components

Compare ExxonMobil to Chevron and shell. Compare ROE and ROA current and over time

(in millions) 2012 2013 2014 2015 2016

Sales $451,509 $420,836 $349,105 $259,488 $218,608

Net Earnings $44,880 $ 32,580 $32,520 $16,150 $7,840

Assets $333,795 $346,808 $349,493 $336,758 $330,314

Equity $171,660 $180,495 $181,064 $176,810 $173,830

Growth (in percent) 2012 2013 2014 2015 2016 Avg

Sales -.068 -.170 -.257 -.158 -.163

Net Earnings -.274 -.002 -.503 -.515 -.324

Assets .039 .008 -.036 -.019 -.002

Equity .051 .003 -.023 -.017 .004

2012 2013 2014 2015 2016

Return on Equity .261 .181 .180 .091 .045

Return on Sales .099 .077 .093 .062 .036

Asset Turnover 1.352 1.213 .9988 .7705 .6557

Leverage 1.945 1.921 1.930 1.905 1.900

Market ROE ROS Sales/ Assets/

2016 Cap Assets Equity

ExxonMobil 376.31 .045 .036 .656 1.900

Chervon 223.17 -.003 -.005 .424 1.787

Shell 185.27 -.007 -.006 .568 2.204

001 Asset Turnover Leverage ROE Comparative Comparative Profitability, ROS 0.3 0.25 0.2 0.7 0S 04 0.3 02 0.1 0.05 -005 2012 2013 204 215 2016001 2014 2015206 Comparative Productivity, Asset Turnover Comparative Cost of Leverage 1.6 14 1.2 15 05 2013 2014 2016 201 2015 2013 2014 2015 2016 ChervronShellExxonMobil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts