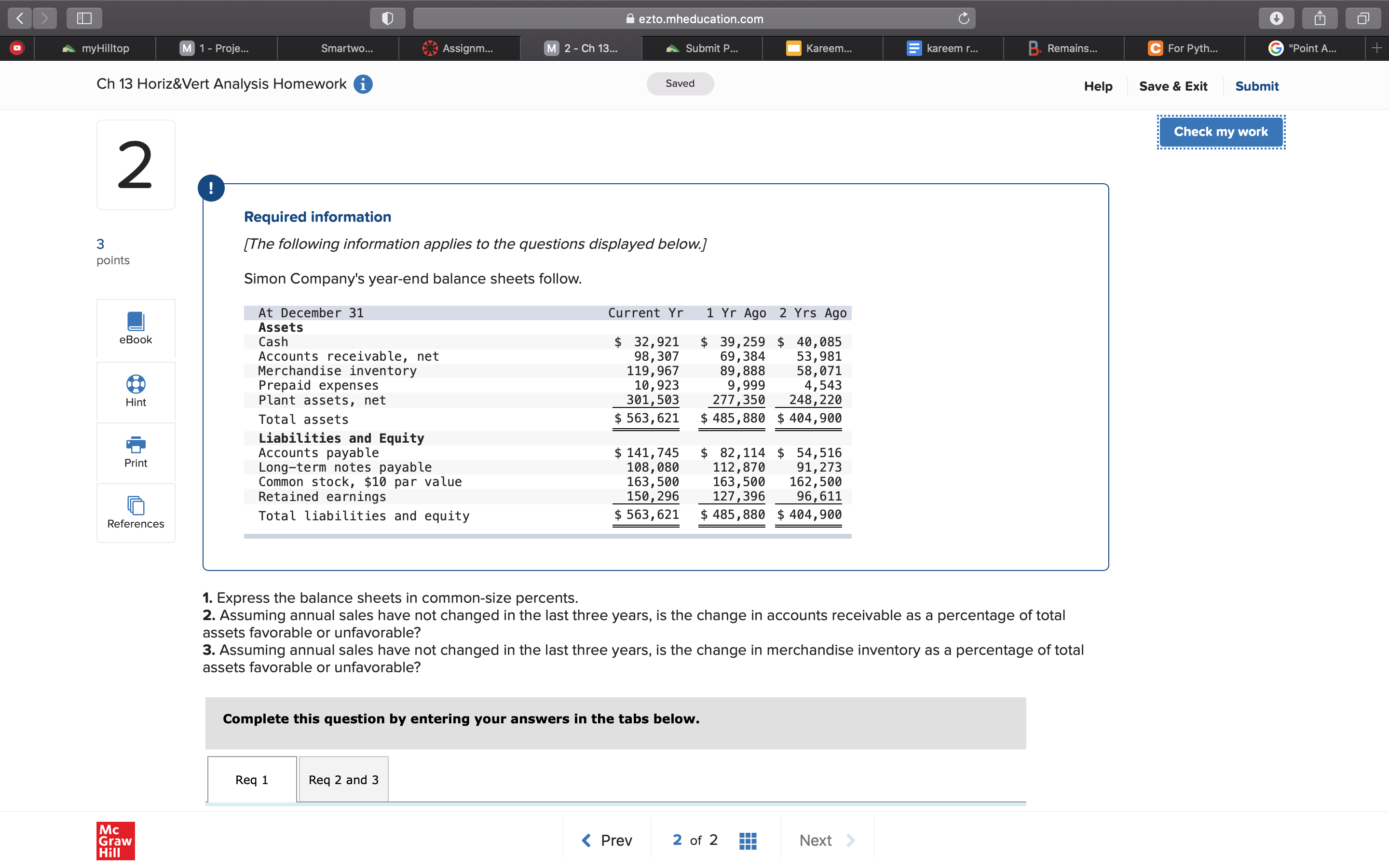

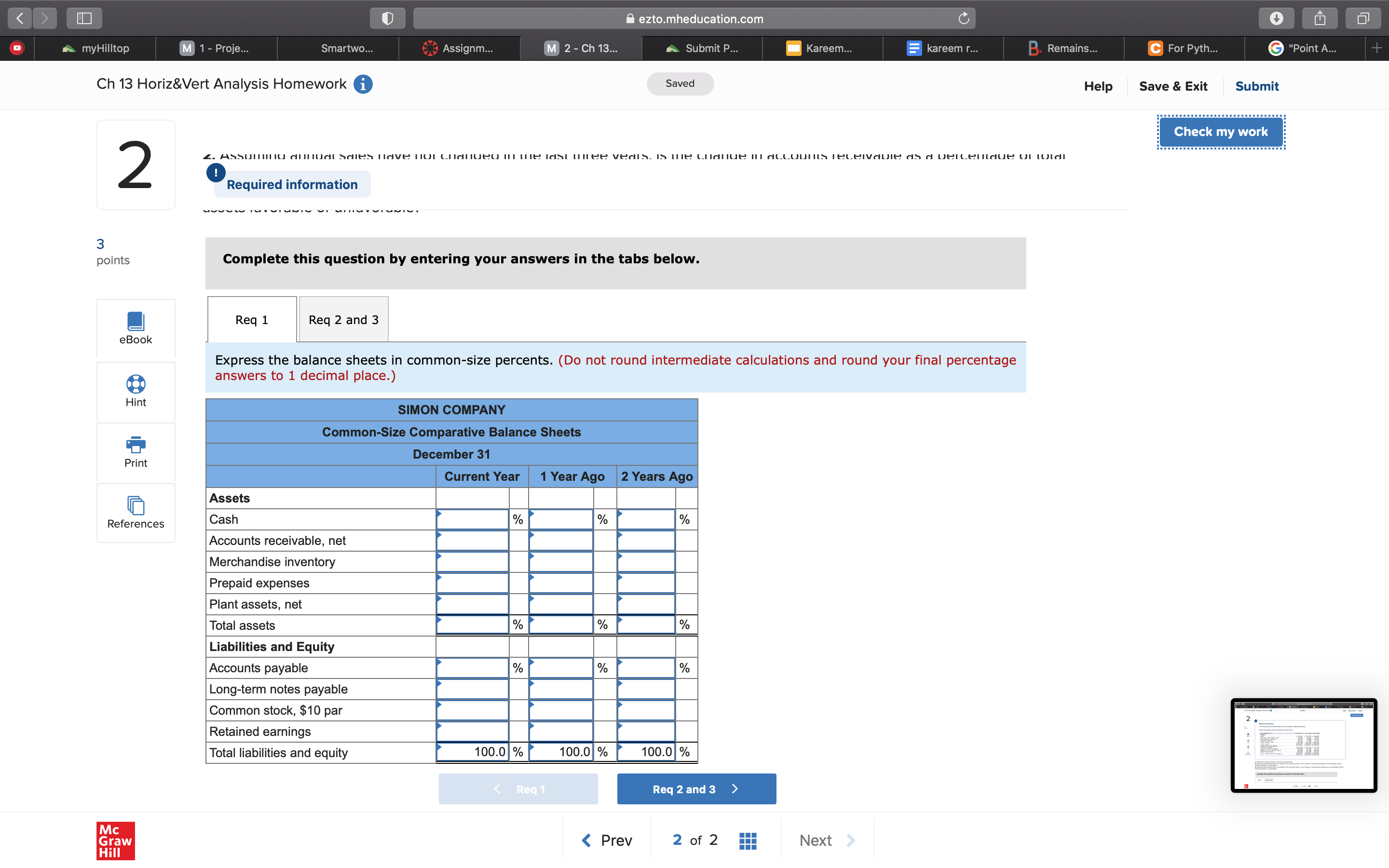

eztomheducationcom M27Cl'i13H p, '1 Ch 13 Horiz&Vert Analysis Homework 0 Saved Help Save & Exit Submit Check my work Required Information 3 [The following information applies to the questions displayed below] points Simon Company's yearend balance sheets follow. El At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets 93k Cash $ 32,921 $ 39,259 $ 40,085 Accounts receivable, net 98,307 69,384 53,981 Merchandise inventory 119,967 89,888 58,071 @ Prepaid expenses 10,923 9,999 4,543 Hint Plant assets, net 301,503 277,350 248,220 Total assets $ 563 621 $ 485,880 $ 404 900 Liabilities and Equity Accounts payable $ 141,745 $ 82,114 $ 54,516 Print Long-term notes payable 108,080 112,870 91,273 Common stock, $10 par value 163,500 163,500 162,500 ll: Retained earnings 150,296 127,396 96,611 R I Total liabilities and equity $563,621 $485,880 ,900 eferences = = 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete thls questlon by enterlng your answers In the tabs below. Req 1 Req 2 and 3 g A ezto.mheducation.com myHilltop M 1 - Proje Smartwo... Assignm. M 2 - Ch 13.. Submit P... Kareem... kareem r... B. Remains.. C For Pyth... G "Point A... Ch 13 HorizaVert Analysis Homework i Saved Help Save & Exit Submit Check my work 2 2. AsSulliIllu annual sales Have not chilled in the last three vedis. Is wie ciallue III accounts receivable as a berceunique UI Lal ! Required information 3 points Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 eBook Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place. Hint SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Print Current Year 1 Year Ago 2 Years Ago Assets References Cash % % % Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets % % % Liabilities and Equity Accounts payable % % % Long-term notes payable Common stock, $10 par Retained earnings Total liabilities and equity 100.0 % 100.0 % 100.0 % Req 1 Req 2 and 3 > Mc Graw Hill