Question: -------------------------------------------------------------------------------------------------------------------------------------------------------------------- Your firm purchased machinery with a 7-year MACRS life for S1020 million. The project, however, will end after 5 years. If the equipment can

--------------------------------------------------------------------------------------------------------------------------------------------------------------------

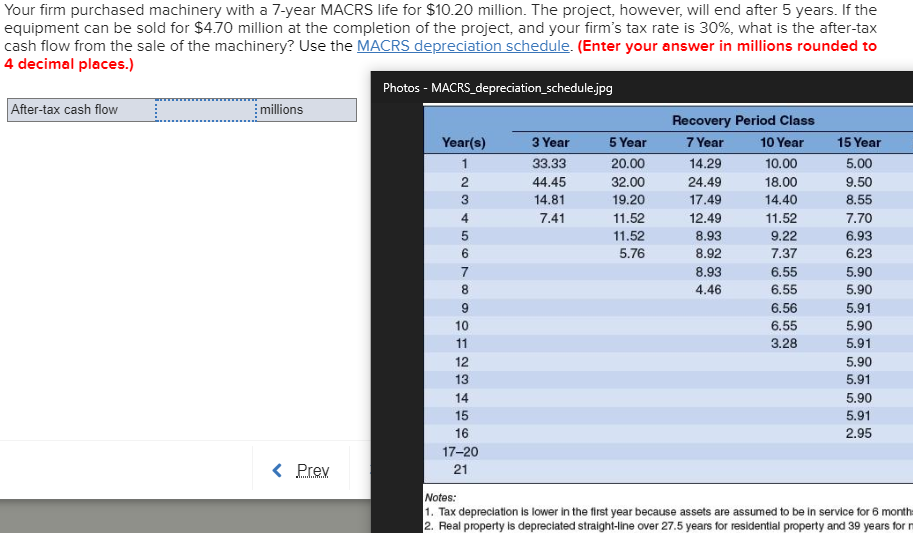

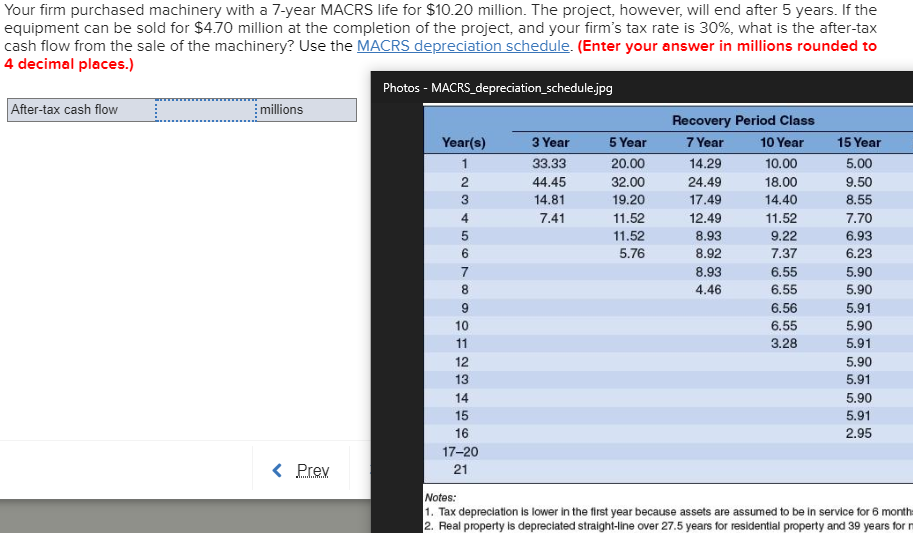

Your firm purchased machinery with a 7-year MACRS life for S1020 million. The project, however, will end after 5 years. If the equipment can be sold for $4.70 million at the completion of the project, and your firm's tax rate is 30%, what is the after-tax cash flow from the sale of the machinery? use the MACRS depreciation schedule. (Enter your answer in millions rounded to 4 decimal places.) After-tax cash flow Photos - MACRS_depreciation_scheduIe.jpg millions .?.r.ey Recovery Period Class Year(s 10 11 12 19 14 15 16 17-20 21 3 Year 99.99 44.45 14.81 7.41 S Year 20.00 32.00 19.20 11.52 11.52 5.76 7 Year 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10 Year 10.00 1800 1440 11.52 9.22 7.37 655 6.55 6.56 6.55 328 IS Year 5.00 9.50 8.55 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 Tax depreciation is the tirst year because are be in service 6 Real property is depreciated stra cwer 27.5 years tor residential property ara 39 years 'or r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts