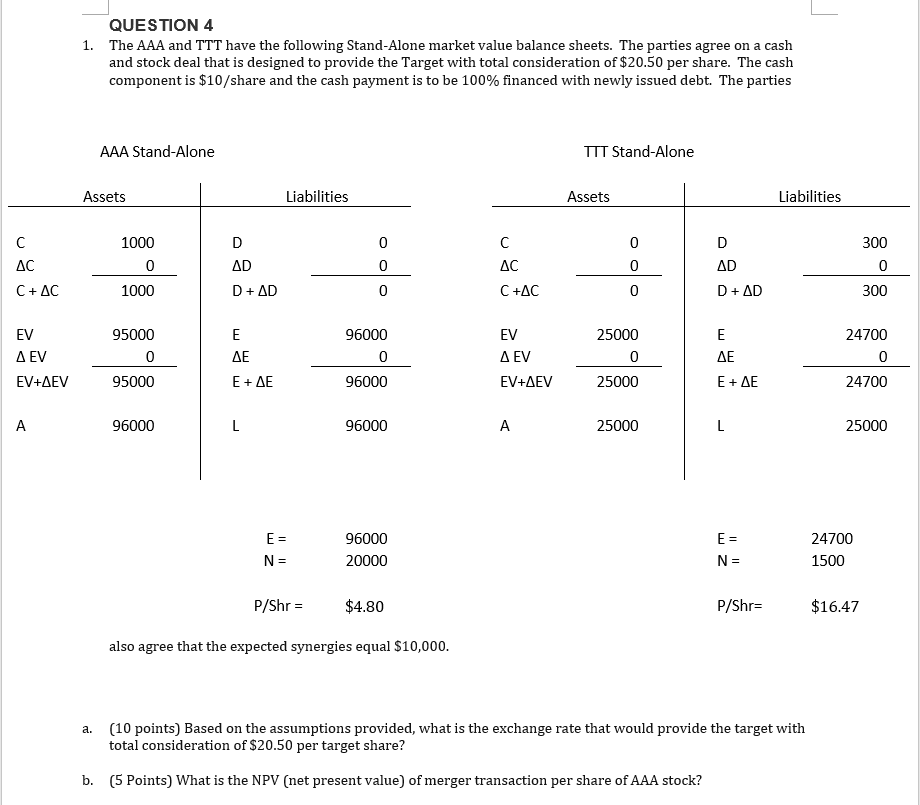

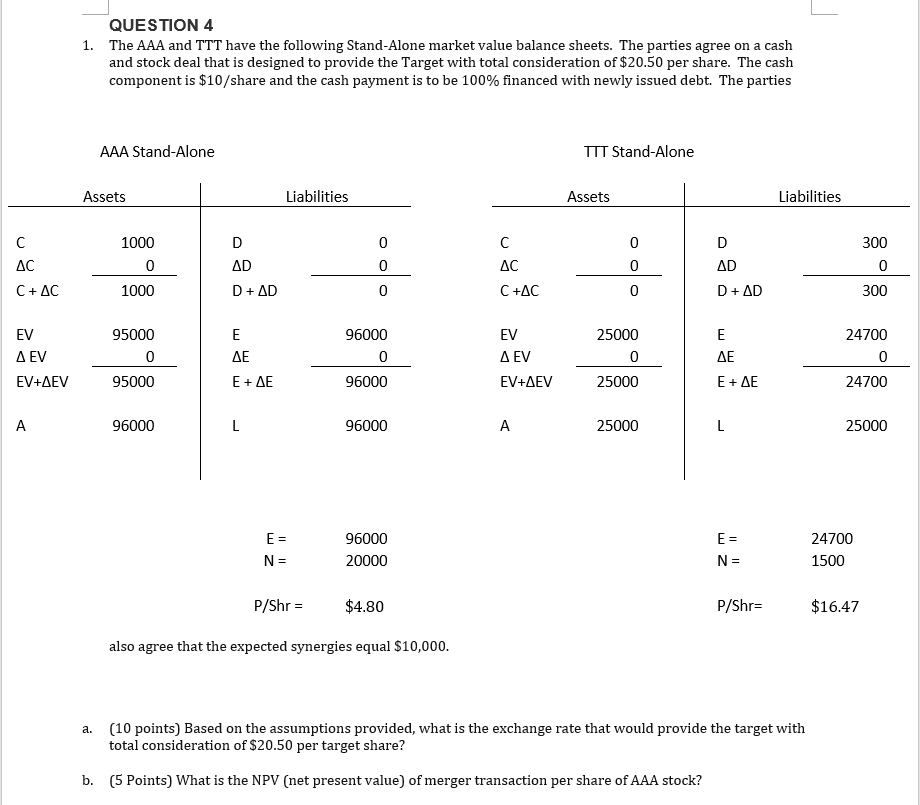

Question: 1. QUESTION 4 The AAA and TTT have the following Stand-Alone market value balance sheets. The parties agree on a cash and stock deal

1. QUESTION 4 The AAA and TTT have the following Stand-Alone market value balance sheets. The parties agree on a cash and stock deal that is designed to provide the Target with total consideration of $20.50 per share. The cash componentis $10/share and the cash payment is to be 100% financed with newly issued debt. The parties AAA Stand-Alone Assets Liabilities c AC C+AC EV+AEV a. b. 1000 1000 95000 95000 96000 D AD c AC EV+AEV ITT Stand-Alone Assets 25000 25000 25000 P/Shr - 96000 96000 96000 96000 20000 $4.80 D AD E- P/Shr= Liabilities 300 300 24700 24700 25000 24700 1500 $16.47 also agree that the expected synergies equal $10,000. (10 points) Based on the assumptions provided, what is the exchange rate that would provide the target with total consideration of $20.50 per target share? (5 Points) VVhat is the NPV (net present value) of merger transaction per share of AAA stock?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts