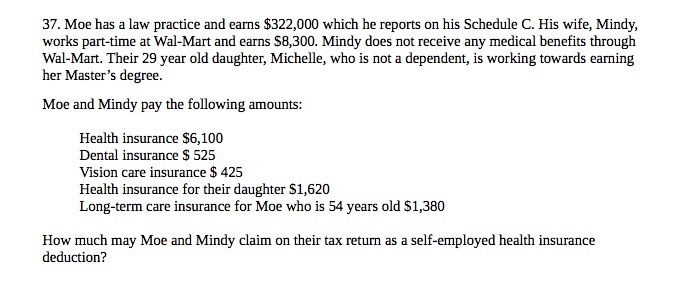

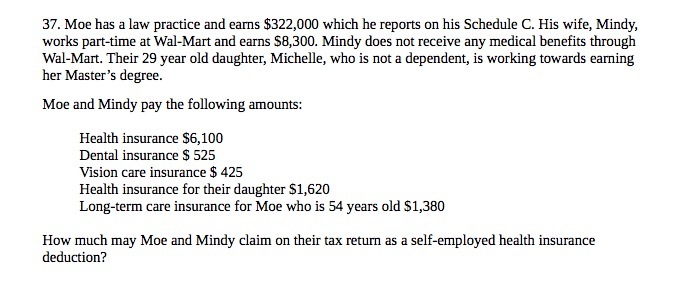

Question: 37. Moe has a law practice and earns $322,000 which he reports on his Schedule C. His wife, Mindy, works part-time at Wal-Mart and

37. Moe has a law practice and earns $322,000 which he reports on his Schedule C. His wife, Mindy, works part-time at Wal-Mart and earns S8,300. Mindy does not receive any medical benefits through Wal-Mart. Their 29 year old daughter, Michelle, who is not a dependent, is working towards earning her Master's degree. Moe and Mindy pay the following amounts: Health insurance $6, 100 Dental insurance S 525 Vision care insurance $ 425 Health insurance for their daughter Sl,620 Long-term care insurance for Moe who is 54 years old S 1,380 How much may Moe and Mindy claim on their tax return as a self-employed health insurance deduction?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts