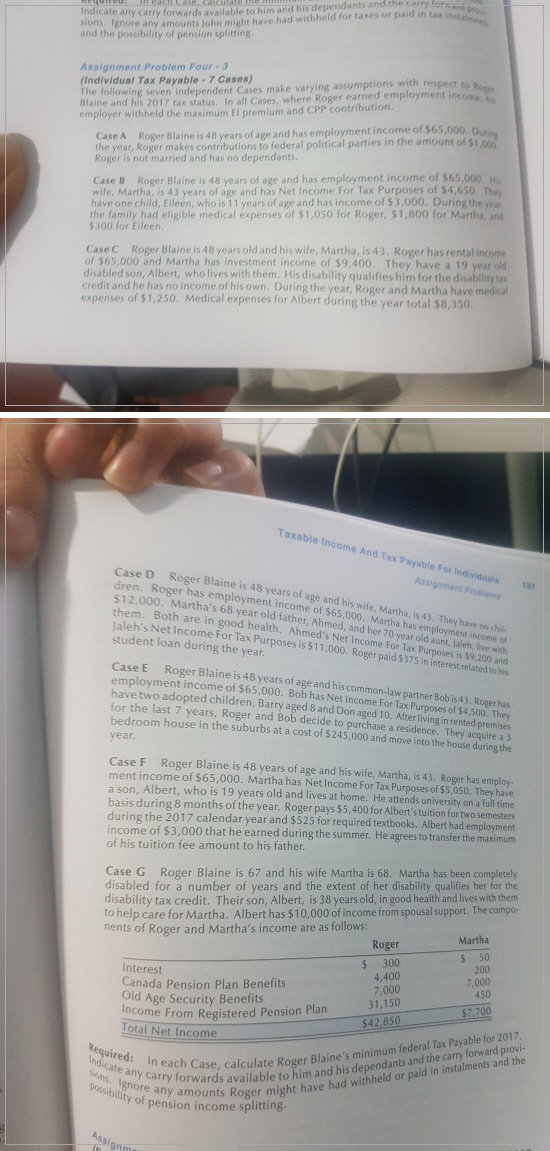

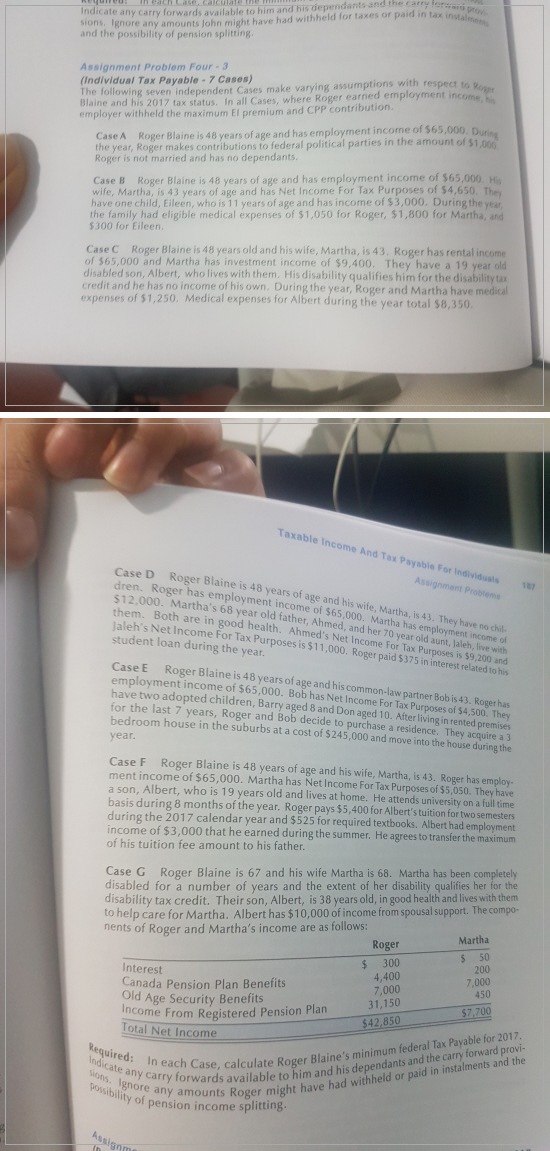

Question: payable - S Poger, 31,800 wife. is kr,ger has Manha have caseo Roger is 80th in Net caseE employment income of the last 7

payable - S Poger, 31,800 wife. is kr,ger has Manha have caseo Roger is 80th in Net caseE employment income of the last 7 years, Roger and gob decide to purchase residence. bedroom house in at a of and Case F Roger Blaine is 4B years ni age And his wife, Martha. ment income of S65,ooo. Martha has Net Income a son, Albert, who is 19 years old and lives at home He attends uninfton basis during B months of the year. Roger paysS5.4GO fur Albertstuition during the 201 7 calendar year and $523 for required textbooks. Atherthademployment income Of $3,000 that he earned during the summer. Heagreestotransferthemaimum oi his tuition fee amount to his father. Case G Roger Blaine is 67 and his wife Martha is Martha has been disabled for a number Of years and the extent of her disability qualifies her disability rax credit. Their son, Albert, is 3d years old. in good health and to holp care for Martha. Albert has $10,000 of income from Thecomgo nentS of Roger and Martha's income are as follows: Interest Canada pension Plan Benefits Old Age Security Benefits Martha Roger $ 300 4,400 7,C 7,000 Income From Registered pension Plan 42 1350 Net Income each case, calculate Roger Blaine's minimum federal any carry forwards available to him and his dependants and the II. any amounts Roger might have had withheld o, in the pension income splitting.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts