Question: Revenue Recognition We generally recognize sales, net of estimated returns, at the time the member takes possession of merchandise or receives services. When we

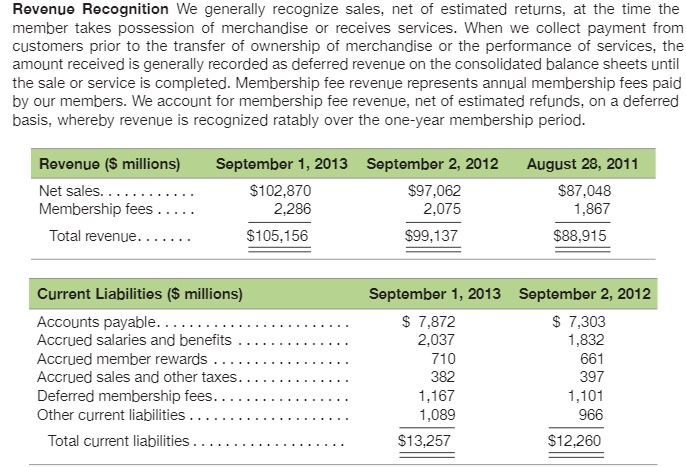

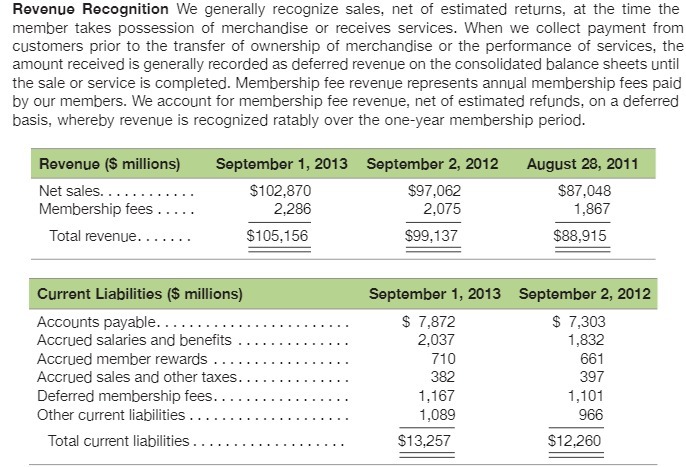

Revenue Recognition We generally recognize sales, net of estimated returns, at the time the member takes possession of merchandise or receives services. When we collect payment from customers prior to the transfer of ownership of merchandise or the performance of services, the amount received is generally recorded as deferred revenue on the consolidated balance sheets until the sale or service is completed. Membership fee revenue represents annual membership fees paid by our members. We account for membership fee revenue, net of estimated refunds, on a deferred basis, whereby revenue is recognized ratably over the one-year membership period. Revenue (S millions) Net sales.. Membership fees . Total revenue... . September 1, 2013 September 2, 2012 S102,870 2,286 $105,156 Curent Liabilities (S millions) Accounts payable.. Accrued salaries and benefits . . Accrued member rewards ..... . Accrued sales and other taxes. . Deferred membership fees.. Other current liabilities Total current liabilities.. 97,062 2,075 99,137 September 1, s 7,872 2,037 710 1,167 1 ,089 S13,257 2013 August 28, 2011 $87,048 1 ,867 S88,915 September 2, 2012 s 7,303 1,832 661 397 1,101 S12,260

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts