Question: The LZ company's income statement for year 2007 and balance sheet at the end of year 2007 are given as follow: Income Statement for

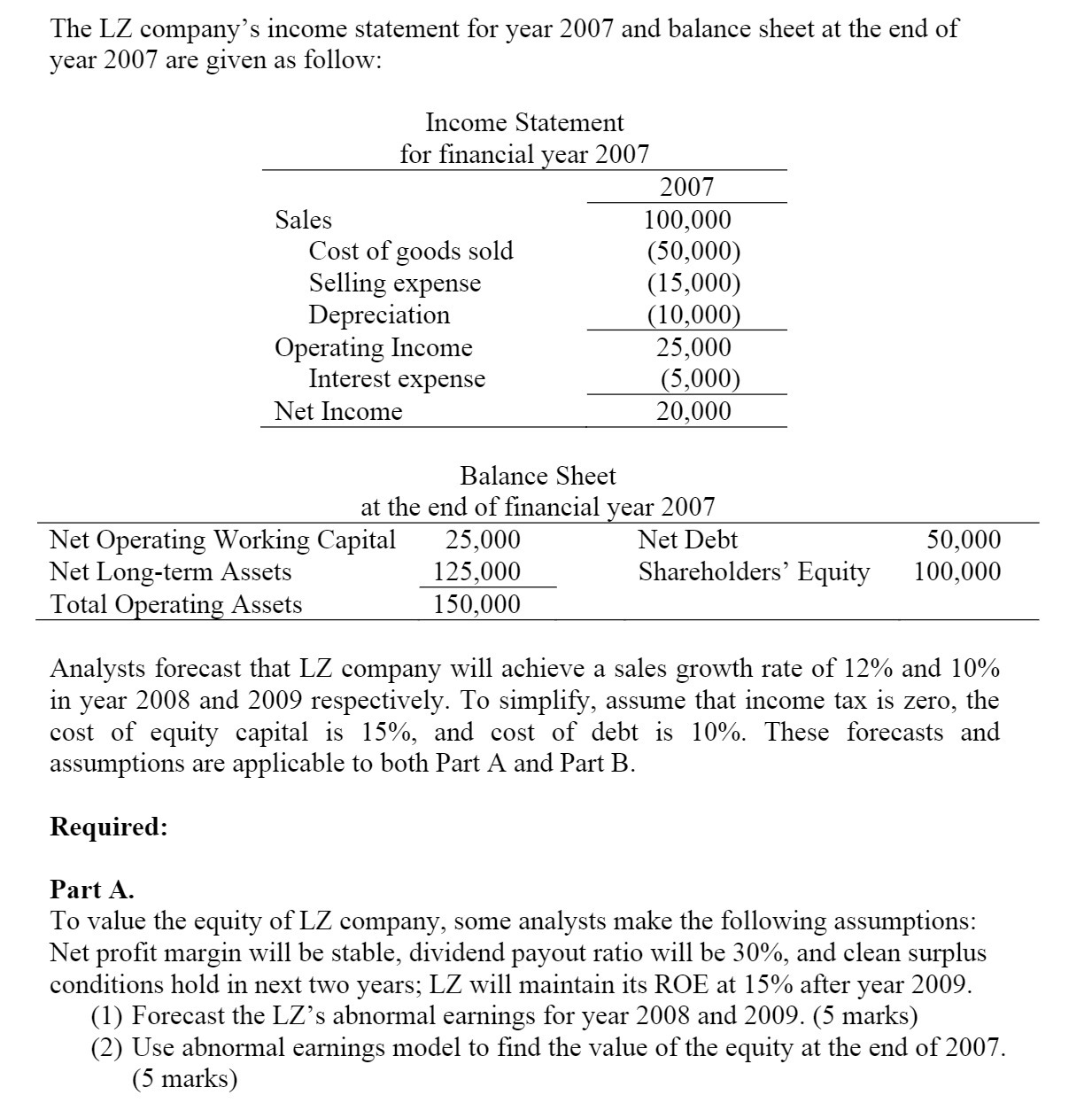

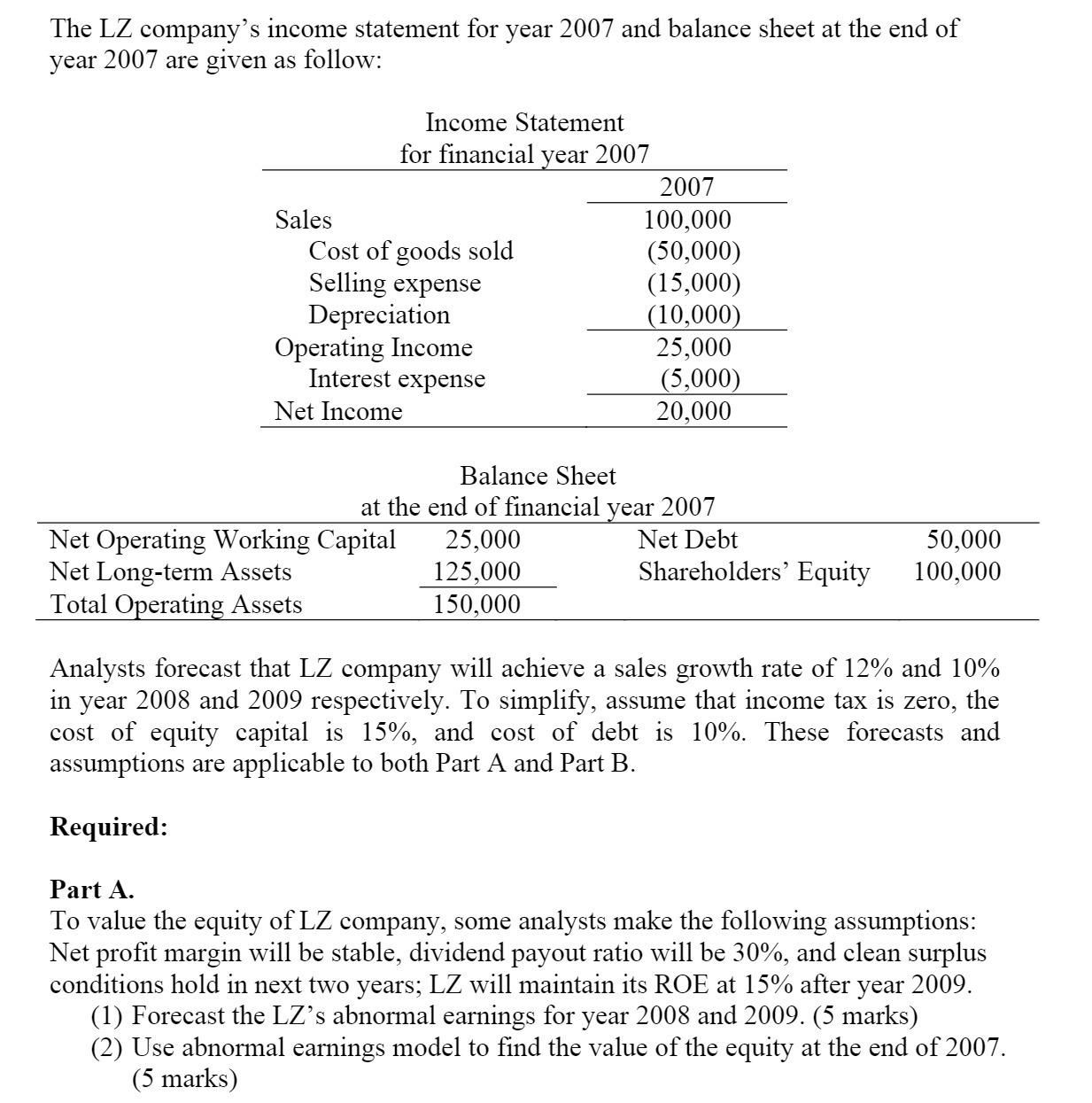

The LZ company's income statement for year 2007 and balance sheet at the end of year 2007 are given as follow: Income Statement for financial year 2007 Sales Cost of goods sold Selling expense Depreciation Operating Income Interest expense Net Income 2007 100,000 (50,000) (15,000) (10,000) 25,000 (5,000) 20,000 Balance Sheet at the end of financial year 2007 Net Operating Working Capital 25,000 Net Debt 50,000 Net Long-term Assets Total Operating Assets 125,000 150,000 Shareholders' Equity 100,000 Analysts forecast that LZ company will achieve a sales growth rate of 12% and 1000 in year 2008 and 2009 respectively. To simplify, assume that income tax is zero, the cost of equity capital is 15%, and cost of debt is 10%. These forecasts and assumptions are applicable to both Part A and Part B. Required: Part A. To value the equity of LZ company, some analysts make the following assumptions: Net profit margin will be stable, dividend payout ratio will be 300 0, and clean surplus conditions hold in next two years; LZ will maintain its ROE at 15% after year 2009. (1) Forecast the LZ's abnormal earnings for year 2008 and 2009. (5 marks) (2) Use abnormal earnings model to find the value of the equity at the end of 2007. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts