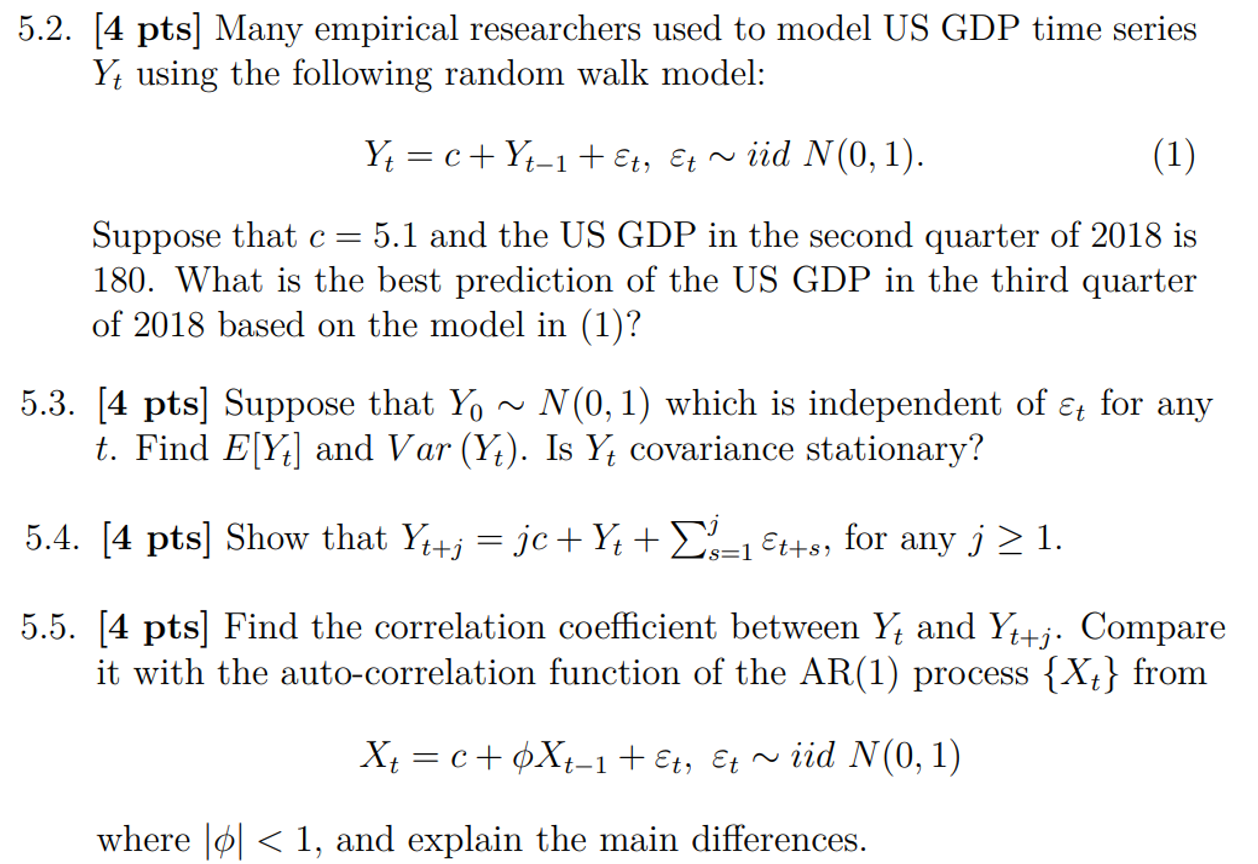

Question: 5.2. [4 pts] Many empirical researchers used to model US GDP time series Yt using the following random walk model: iid N (0, 1).

![5.2. [4 pts] Many empirical researchers used to model US GDP time](https://s3.amazonaws.com/si.experts.images/answers/2024/06/666dde5b9c45c_379666dde5b752d9.jpg)

5.2. [4 pts] Many empirical researchers used to model US GDP time series Yt using the following random walk model: iid N (0, 1). Yt C VtI + Et, (1) Suppose that c 5.1 and the US GDP in the second quarter of 2018 is 180. What is the best prediction of the US GDP in the third quarter of 2018 based on the model in (1)? 5.3. [4 pts] Suppose that Yo N (0, 1) which is independent of Et for any t. Find E[Yt] and Var (YD. Is Yt covariance stationary? 5.4. [4 pts] Show that Yt+j jc + Yt 4- DJs = 1 Et+s, for any j 2 1. 5.5. [4 pts] Find the correlation coefficient between Yt and Yt+j. Compare it with the auto-correlation function of the AR(I) process {Xt} from iid N (0, 1) where < 1, and explain the main differences.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts