Question: PROBLEM 5-3. Variable and Full Costing: Earnings Management with Full Costing; Changes in Production and Sales [LO 1, 2] Firemaster BBQ produces stainless steel

![in Production and Sales [LO 1, 2] Firemaster BBQ produces stainless steel](https://s3.amazonaws.com/si.experts.images/answers/2024/06/666e2eb3a9e8f_947666e2eb3818fe.jpg)

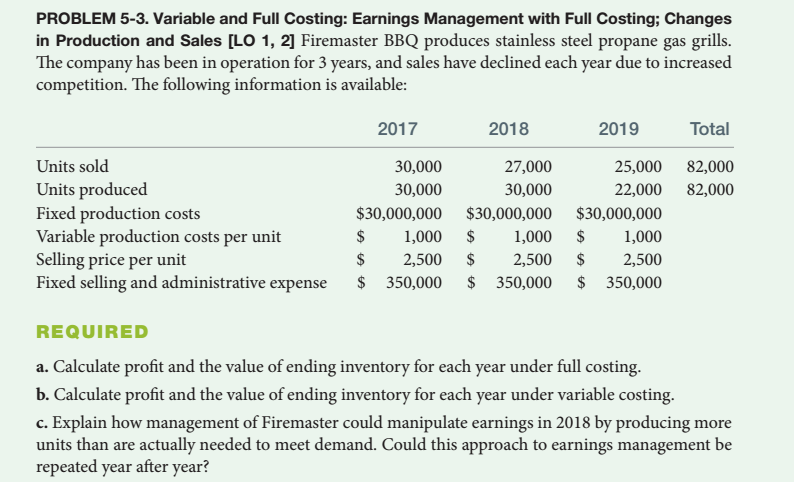

PROBLEM 5-3. Variable and Full Costing: Earnings Management with Full Costing; Changes in Production and Sales [LO 1, 2] Firemaster BBQ produces stainless steel propane gas grills. Ihe company has been in operation for 3 years, and sales have declined each year due to increased competition. Ihe following information is available: Units sold Units produced Fixed production costs Variable production costs per unit Selling price per unit Fixed selling and administrative expense REQUIRED 2017 30,000 30,000 $30,000,000 1,000 $ 2,500 $ 350,000 2018 27,000 30,000 $30,000,000 1,000 2,500 $ 350,000 2019 25,000 22,000 $30,000,000 1,000 2,500 $ 350,000 Total 82,000 82,000 a. Calculate profit and the value of ending inventory for each year under full costing. b. Calculate profit and the value of ending inventory for each year under variable costing. c. Explain how management of Firemaster could manipulate earnings in 2018 by producing more units than are actually needed to meet demand. Could this approach to earnings management be repeated year after year?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts