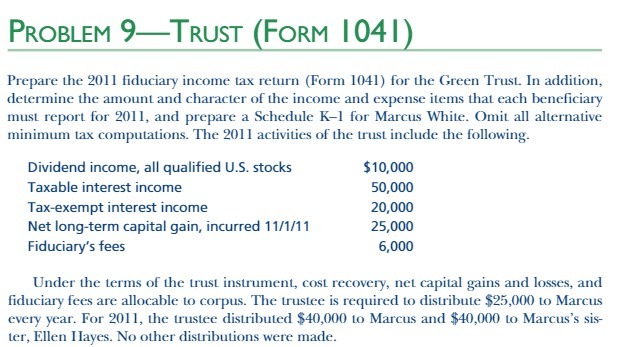

Question: PROBLEM 9TRUST (FORM 104 1 ) Prepare Lhe 2011 fiduciary income tax return (Form 1041) for the Green Trust. In addition, determine the amount

PROBLEM 9TRUST (FORM 104 1 ) Prepare Lhe 2011 fiduciary income tax return (Form 1041) for the Green Trust. In addition, determine the amount and character Of the income and expense items that each beneficiary must report for 2011, and prepare a Schedule for Marcus White. Omit all alternative minimum tax computations. The 2011 activities Of Lhe trust include the following. Dividend income, all qualified U.S. stocks Taxable interest income Tax-exempt interest income Net long-term capital gain, incurred 11/1/1 1 Fiduciary's fees 510,000 50,000 20,000 25,000 6,000 Under the terms Of the trust instrument, cost recovery, net capital gains and losses, and fiduciary fees ate allocable to corpus. The trustee is required to distribute $23,000 to MarctLs every year. For 2011, the trustee distributed $40,000 to Marcus and $40,000 to MarctLs's sis- ter, Ellen I I-ayes. NO other distributions were made.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts