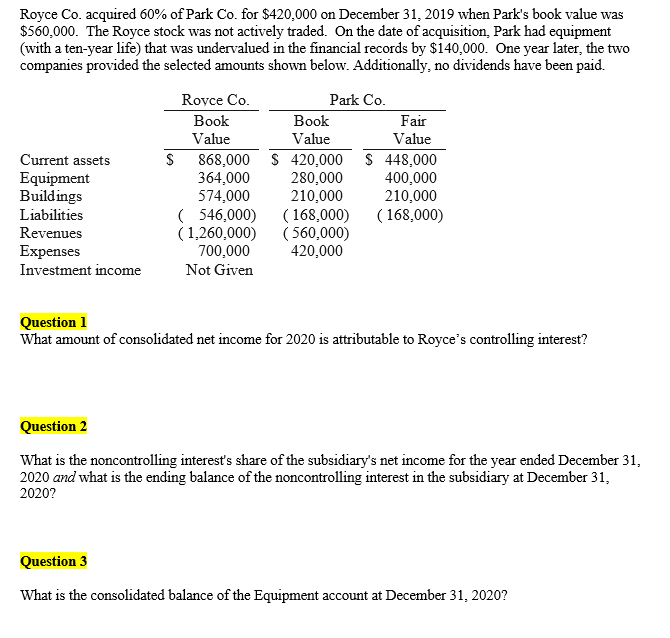

Question: Royce Co. acquired 60% ofPark Co. for $420,000 on December 3 1 2019 when Park's book value was 560,000. The Royce stock was not

Royce Co. acquired 60% ofPark Co. for $420,000 on December 3 1 2019 when Park's book value was 560,000. The Royce stock was not actively traded. On the date of Park had equipment (with a ten-year life) that was undervalued in the financial records by $140,000. One year later, the two companies provided the selected amounts shoun below. Additionally, no dividends have been paid. Current assets Equipment B uildmgs Liabilities Revenues Expenses Investment income Question 1 s Rovce Co. Book Value 868,000 364,000 574,000 ( 546,000) 700,000 Not Given Park Co. Book Value s 420,000 280,000 210,000 ( 168,000) ( 560,000) 420,000 F air Value s 448,000 400,000 210,000 ( 168,000) What amount of consolidated net income for 2020 is attributable to Royce' s controlling interest? Question 2 What is the noncontrolling interests share of the subsidiary's net income for the year ended December 31, 2020 and 'Ahat is the ending balance of the noncontrolling interest in the subsidiary at December 3 1, 2020? Question 3 What is the consolidated balance of the Equipment account at December 31 , 2020?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts