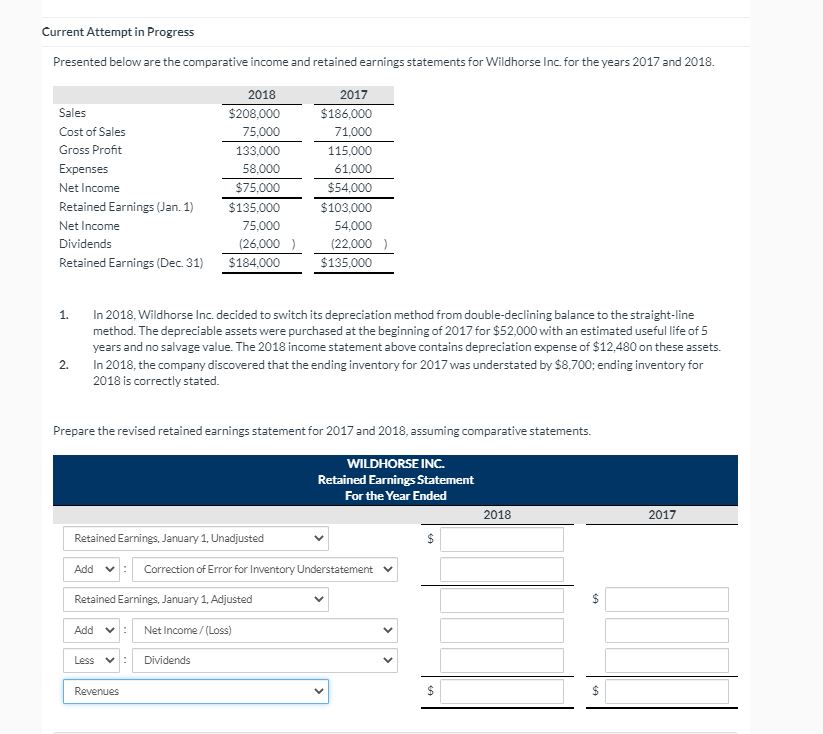

Question: Current Attempt in Progress Presented below are the comparative income and retained earnings statements for Wildhorse Inc for the years 2017 and 2018. Sales

Current Attempt in Progress Presented below are the comparative income and retained earnings statements for Wildhorse Inc for the years 2017 and 2018. Sales Cost of Sales Gross Profit Expenses Net Income Retained Earnings (Jan. I) Net Income Dividends Retained Earnings (Dec 31) 3208.000 75030 133,000 58.000 375.000 $135,000 75.000 (26,000 S184.ooo 3186.000 71.000 115,000 61,000 354.000 S103,ooo (22.000 ) 3135.000 I. 2. In 2018, Wildhorse Inc. decided to switch its depreciation method from double-declining balance to the straight-line method. The depreciable assets were purchased at the beginning of 2017 for $52,000 with an estimated useful life of S years and no selvage value. The 2018 income statement above contains depreciation expense of $12,480 on these assets. In 2018, the company discovered that the ending inventory for 2017 was understated by $8,700; endi ng inventory for 2018 is correctly stated. Prepare the revised retained earnings statement for 2017 and 2018, assuming comparative statements. WILDHORSE INC. Earnin For the Year Ended 2018 Retained Earnings. Jenuat'/ I. Unadjusted Correction of Err or Inventory Understatement v Retained Ear nine. Januaty I. Adjusted Net Inco me / (Loss) 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts