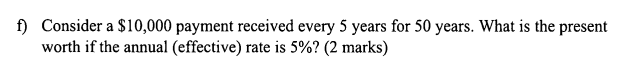

Question: f) Consider a $10,000 payment received every 5 years for 50 years. What is the present worth if the annual (effective) rate is 5%?

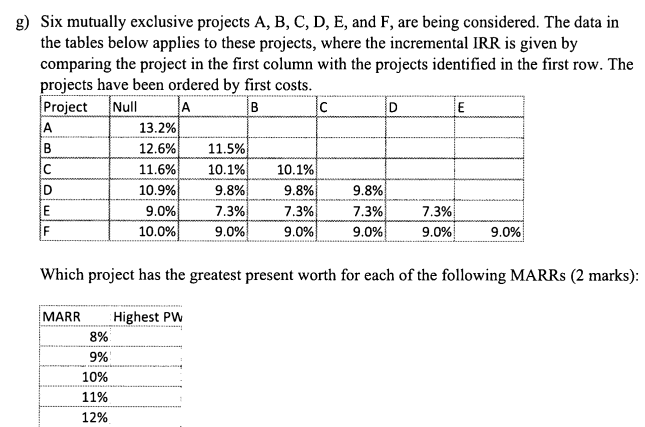

f) Consider a $10,000 payment received every 5 years for 50 years. What is the present worth if the annual (effective) rate is 5%? (2 marks) g) Six mutually exclusive projects A, B, C, D, E, and F, are being considered. The data in the tables below applies to these projects, where the incremental IRR is given by comparing the project in the first column with the projects identified in the first row. The projects have been ordered by first costs. Project Null A B C D E A 13.2% B 12.6% 11.5% C 11.6% 10.1% 10.1% D 10.9% 9.8% 9.8% 9.8% E 9.0% 7.3% 7.3% 7.3% 7.3% F 10.0% 9.0% 9.0% 9.0% 9.0% 9.0% Which project has the greatest present worth for each of the following MARRs (2 marks): MARR Highest PW 8% 9% 10% 11% 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts