Question: f Exercises Help Brief Exercise 11-11 Change in principle; change in depreciation method [LO11-6] At the beginning of 2016, Robotics Inc. acquired a manufacturing facility

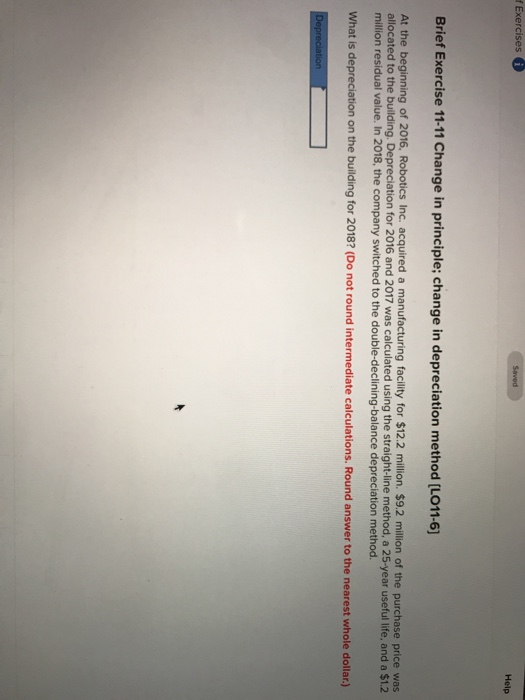

f Exercises Help Brief Exercise 11-11 Change in principle; change in depreciation method [LO11-6] At the beginning of 2016, Robotics Inc. acquired a manufacturing facility for $12.2 million. $9.2 million of the purchase price was allocated to the building. Depreciation for 2016 and 2017 was calculated using the straight-line method, a 25-year useful life, and a $1.2 million residual value. In 2018, the company switched to the double-declining-balance depreciation method What is depreciation on the building for 2018? (Do not round intermediate calculations. Round answer to the nearest whole dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts