Question: f. Faced with a zero nominal interest rate, suppose the Fed decides to purchase securities directly to facilitate the flow of credit in the financial

f. Faced with a zero nominal interest rate, suppose the Fed decides to purchase securities

directly to facilitate the flow of credit in the financial markets. This policy is called

quantitative easing. If quantitative easing is successful, so that it becomes easier for financial

and nonfinancial firms to obtain credit, what is likely to happen to the premium? What effect

will this have on the IS-LM diagram? If quantitative easing has some effect, is it true that the

Fed has no policy options to stimulate the economy when the federal funds rate is zero?

g. One argument for quantitative easing is that it increases expected inflation. Suppose

quantitative easing does increase expected inflation. How does that affect the LM curve in

Figure 1?

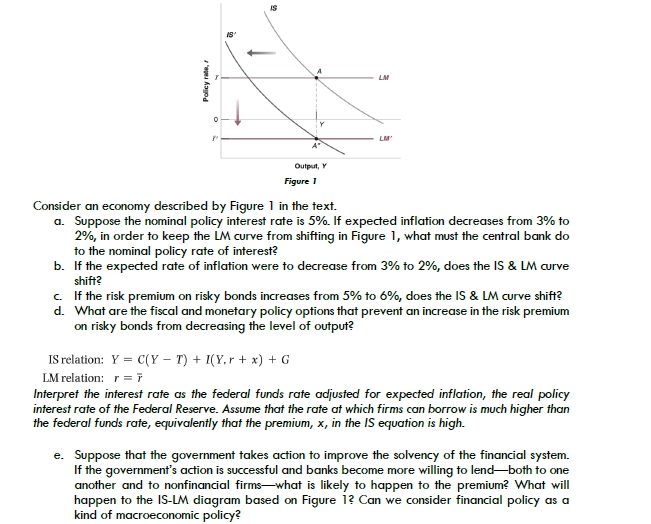

LM Policy rate, r Output, Y Figure 1 Consider an economy described by Figure 1 in the text. a. Suppose the nominal policy interest rate is 5% If expected inflation decreases from 3% to 2%, in order to keep the LM curve from shifting in Figure 1, what must the central bank do to the nominal policy rate of interest? b. If the expected rate of inflation were to decrease from 3% to 2%, does the IS & LM curve shift? c. If the risk premium on risky bonds increases from 5% to 6%, does the IS & LM curve shift? d. What are the fiscal and monetary policy options that prevent an increase in the risk premium on risky bonds from decreasing the level of output? IS relation: Y = C(Y - T) + I(Y, r + x) + G LM relation: r = T Interpret the interest rate as the federal funds rate adjusted for expected inflation, the real policy interest rate of the Federal Reserve. Assume that the rate at which firms can borrow is much higher than the federal funds rate, equivalently that the premium, x, in the IS equation is high. e. Suppose that the government takes action to improve the solvency of the financial system. If the government's action is successful and banks become more willing to lend-both to one another and to nonfinancial firms-what is likely to happen to the premium? What will happen to the IS-LM diagram based on Figure 1? Can we consider financial policy as a kind of macroeconomic policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts