Question: F) Financial Statement Analysis Kohls Corporation Projected Balance Sheets. Create/Predict Three years of projected balance statements, starting with the most recent year after the companys

- F) Financial Statement Analysis

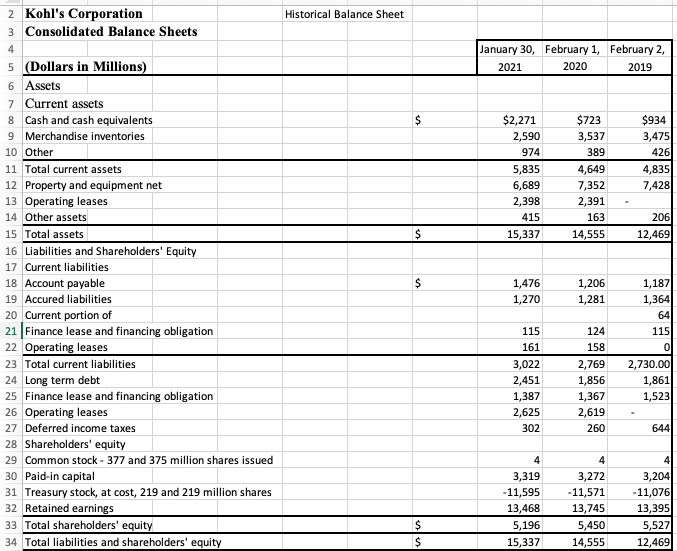

Kohls Corporation Projected Balance Sheets.

Create/Predict Three years of projected balance statements, starting with the most recent year after the companys last issued report.

Historical Balance Sheet 2 Kohl's Corporation 3 Consolidated Balance Sheets 4 January 30, February 1, February 2, 2021 2020 2019 $ $2,271 2,590 974 5,835 6,689 2,398 415 15,337 $723 3,537 389 4,649 7,352 2,391 163 14,555 $934 3,475 426 4,835 7,428 206 12,469 5 (Dollars in Millions) 6 Assets 7 Current assets 8 Cash and cash equivalents 9 Merchandise inventories 10 Other 11 Total current assets 12 Property and equipment net 13 Operating leases 14 Other assets 15 Total assets 16 Liabilities and Shareholders' Equity 17 Current liabilities 18 Account payable 19 Accured liabilities 20 Current portion of 21 Finance lease and financing obligation 22 Operating leases 23 Total current liabilities 24 Long term debt 25 Finance lease and financing obligation 26 Operating leases 27 Deferred income taxes 28 Shareholders' equity 29 Common stock - 377 and 375 million shares issued 30 Paid-in capital 31 Treasury stock, at cost, 219 and 219 million shares 32 Retained earnings 33 Total shareholders' equity 34 Total liabilities and shareholders' equity 1,476 1,270 1,206 1,281 1,187 1,364 64 115 115 161 124 158 0 3,022 2,451 1,387 2,625 302 2,769 1,856 1,367 2,619 260 2,730.00 1,861 1,523 644 4 3,319 -11,595 13,468 5,196 15,337 4 3,272 -11,571 13,745 5,450 14,555 3,204 -11,076 13,395 5,527 12,469 $ $ Historical Balance Sheet 2 Kohl's Corporation 3 Consolidated Balance Sheets 4 January 30, February 1, February 2, 2021 2020 2019 $ $2,271 2,590 974 5,835 6,689 2,398 415 15,337 $723 3,537 389 4,649 7,352 2,391 163 14,555 $934 3,475 426 4,835 7,428 206 12,469 5 (Dollars in Millions) 6 Assets 7 Current assets 8 Cash and cash equivalents 9 Merchandise inventories 10 Other 11 Total current assets 12 Property and equipment net 13 Operating leases 14 Other assets 15 Total assets 16 Liabilities and Shareholders' Equity 17 Current liabilities 18 Account payable 19 Accured liabilities 20 Current portion of 21 Finance lease and financing obligation 22 Operating leases 23 Total current liabilities 24 Long term debt 25 Finance lease and financing obligation 26 Operating leases 27 Deferred income taxes 28 Shareholders' equity 29 Common stock - 377 and 375 million shares issued 30 Paid-in capital 31 Treasury stock, at cost, 219 and 219 million shares 32 Retained earnings 33 Total shareholders' equity 34 Total liabilities and shareholders' equity 1,476 1,270 1,206 1,281 1,187 1,364 64 115 115 161 124 158 0 3,022 2,451 1,387 2,625 302 2,769 1,856 1,367 2,619 260 2,730.00 1,861 1,523 644 4 3,319 -11,595 13,468 5,196 15,337 4 3,272 -11,571 13,745 5,450 14,555 3,204 -11,076 13,395 5,527 12,469 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts