Question: F G H 4 A B D E 1 Mixer Up (MU) manufactures cordless mixers for use in the kitchens of retail consumers. MU sells

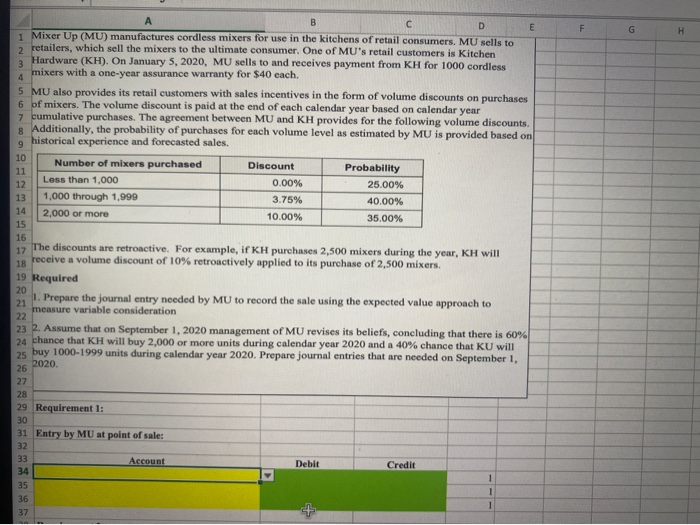

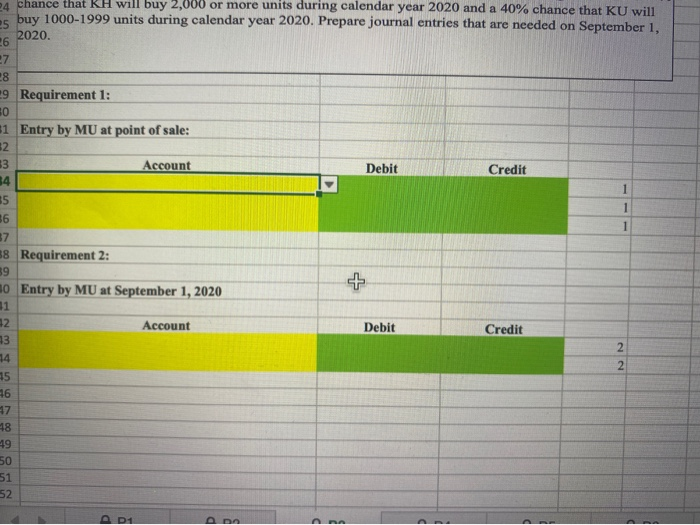

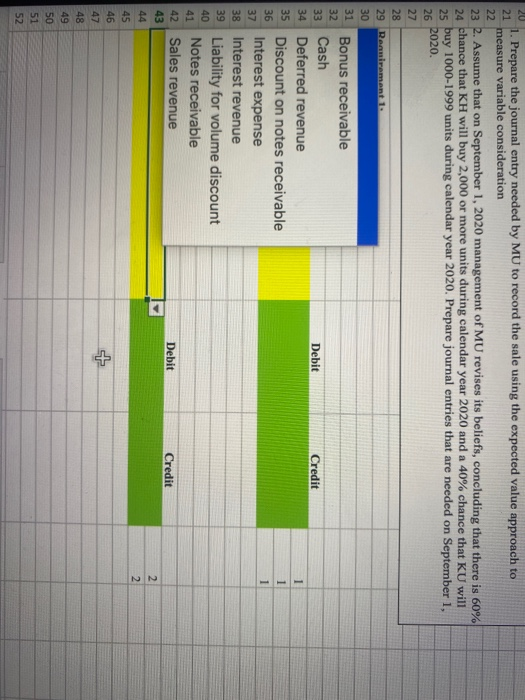

F G H 4 A B D E 1 Mixer Up (MU) manufactures cordless mixers for use in the kitchens of retail consumers. MU sells to 2 retailers, which sell the mixers to the ultimate consumer. One of MU's retail customers is Kitchen 3 Hardware (KH). On January 5, 2020, MU sells to and receives payment from KH for 1000 cordless mixers with a one-year assurance warranty for $40 each. 5 MU also provides its retail customers with sales incentives in the form of volume discounts on purchases 6 of mixers. The volume discount is paid at the end of each calendar year based on calendar year 7 cumulative purchases. The agreement between MU and KH provides for the following volume discounts. 8 Additionally, the probability of purchases for each volume level as estimated by MU is provided based on 9 historical experience and forecasted sales. 10 Number of mixers purchased Discount 11 Probability 12 Less than 1,000 0.00% 25.00% 13 1,000 through 1,999 3.75% 40.00% 14 2,000 or more 10.00% 35.00% 15 16 17 The discounts are retroactive. For example, if KH purchases 2,500 mixers during the year, KH will 18 receive a volume discount of 10% retroactively applied to its purchase of 2,500 mixers. 19 Required 20 1. Prepare the journal entry needed by MU to record the sale using the expected value approach to 21 measure variable consideration 22 23 2. Assume that on September 1, 2020 management of MU revises its beliefs, concluding that there is 60% 24 chance that KH will buy 2,000 or more units during calendar year 2020 and a 40% chance that KU will 25 buy 1000-1999 units during calendar year 2020. Prepare journal entries that are needed on September 1, 26 2020, 27 28 29 Requirement 1: 30 31 Entry by MU at point of sale: 32 Account Debit Credit 1 34 35 36 37 1 1 24 chance that KH will buy 2,000 or more units during calendar year 2020 and a 40% chance that KU will Es buy 1000-1999 units during calendar year 2020. Prepare journal entries that are needed on September 1, 2020. 26 27 28 9 Requirement 1: 0 1 Entry by MU at point of sale: 52 3 Account Debit Credit 34 1 35 1 36 1 37 58 Requirement 2: 39 10 Entry by MU at September 1, 2020 + 11 12 Account Debit Credit 13 2 14 2 15 46 47 18 49 50 51 52 AD1 31 32 33 20 1. Prepare the journal entry needed by MU to record the sale using the expected value approach to 21 measure variable consideration 22 23 2. Assume that on September 1, 2020 management of MU revises its beliefs, concluding that there is 60% 24 chance that KH will buy 2,000 or more units during calendar year 2020 and a 40% chance that KU will 25 buy 1000-1999 units during calendar year 2020. Prepare journal entries that are needed on September 1, 2020, 26 27 28 29 Reamirement 1. 30 Bonus receivable Cash Debit Credit 34 Deferred revenue 1 35 Discount on notes receivable 1 36 1 Interest expense 37 38 Interest revenue 39 Liability for volume discount Notes receivable 41 42 Sales revenue Debit Credit 43 2 44 2 45 46 + 47 48 49 50 51 52 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts