Question: F. Given the following X-Corp.'s options between two CD offerings, perform the following tasks by applying appropriate techniques/methods where necessary in M. Keep in

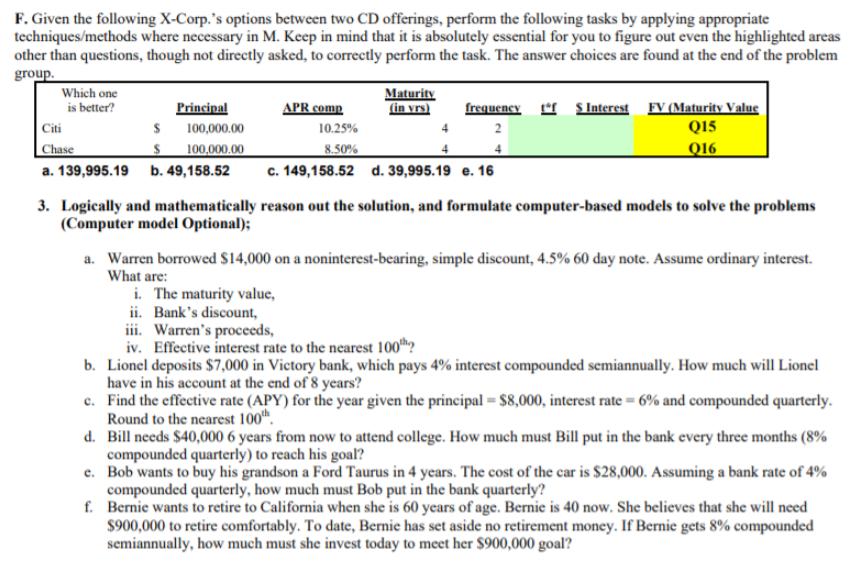

F. Given the following X-Corp.'s options between two CD offerings, perform the following tasks by applying appropriate techniques/methods where necessary in M. Keep in mind that it is absolutely essential for you to figure out even the highlighted areas other than questions, though not directly asked, to correctly perform the task. The answer choices are found at the end of the problem group. Which one is better? S Principal 100,000.00 100,000.00 Citi Chase a. 139,995.19 b. 49,158.52 APR comp 10.25% 8.50% Maturity (in vrs) i. The maturity value, ii. Bank's discount, 4 c. 149,158.52 d. 39,995.19 e. 16 frequency tf S Interest FV (Maturity Value 2 Q15 016 3. Logically and mathematically reason out the solution, and formulate computer-based models to solve the problems (Computer model Optional); a. Warren borrowed $14,000 on a noninterest-bearing, simple discount, 4.5% 60 day note. Assume ordinary interest. What are: iii. Warren's proceeds, iv. Effective interest rate to the nearest 100th b. Lionel deposits $7,000 in Victory bank, which pays 4% interest compounded semiannually. How much will Lionel have in his account at the end of 8 years? e. Find the effective rate (APY) for the year given the principal = $8,000, interest rate= 6% and compounded quarterly. Round to the nearest 100th. d. Bill needs $40,000 6 years from now to attend college. How much must Bill put in the bank every three months (8% compounded quarterly) to reach his goal? e. Bob wants to buy his grandson a Ford Taurus in 4 years. The cost of the car is $28,000. Assuming a bank rate of 4% compounded quarterly, how much must Bob put in the bank quarterly? f. Bernie wants to retire to California when she is 60 years of age. Bernie is 40 now. She believes that she will need $900,000 to retire comfortably. To date, Bernie has set aside no retirement money. If Bernie gets 8% compounded semiannually, how much must she invest today to meet her $900,000 goal?

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Q15 a The maturity value of the CD offered by Citi is 13999519 Citis APR comp is 1025 and it pays interest semiannually frequency of 2 The maturity value is calculated by multiplying the principal amo... View full answer

Get step-by-step solutions from verified subject matter experts