Question: F II. TOPIC: MERGER AND OTHER CORPORATE RESTRUCTURING (35; 5 Marks for each question) Sopi intends to acquire Bankee. In accordance with the agreement between

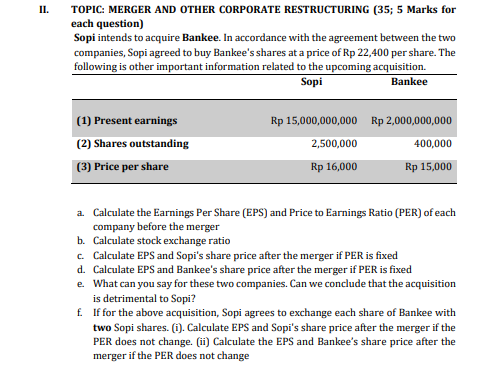

F II. TOPIC: MERGER AND OTHER CORPORATE RESTRUCTURING (35; 5 Marks for each question) Sopi intends to acquire Bankee. In accordance with the agreement between the two companies, Sopi agreed to buy Bankee's shares at a price of Rp 22,400 per share. The following is other important information related to the upcoming acquisition. Sopi Bankee (1) Present earnings (2) Shares outstanding (3) Price per share Rp 15,000,000,000 Rp 2,000,000,000 2,500,000 400,000 Rp 16,000 Rp 15,000 a Calculate the Earnings Per Share (EPS) and Price to Earnings Ratio (PER) of each company before the merger b. Calculate stock exchange ratio c. Calculate EPS and Sopi's share price after the merger if PER is fixed d. Calculate EPS and Bankee's share price after the merger if PER is fixed e What can you say for these two companies. Can we conclude that the acquisition is detrimental to Sopi? . If for the above acquisition, Sopi agrees to exchange each share of Bankee with two Sopi shares. (i). Calculate EPS and Sopi's share price after the merger if the PER does not change. (ii) Calculate the EPS and Bankee's share price after the merger if the PER does not change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts