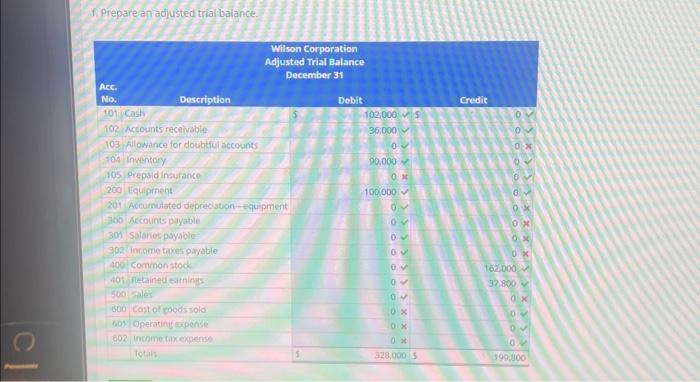

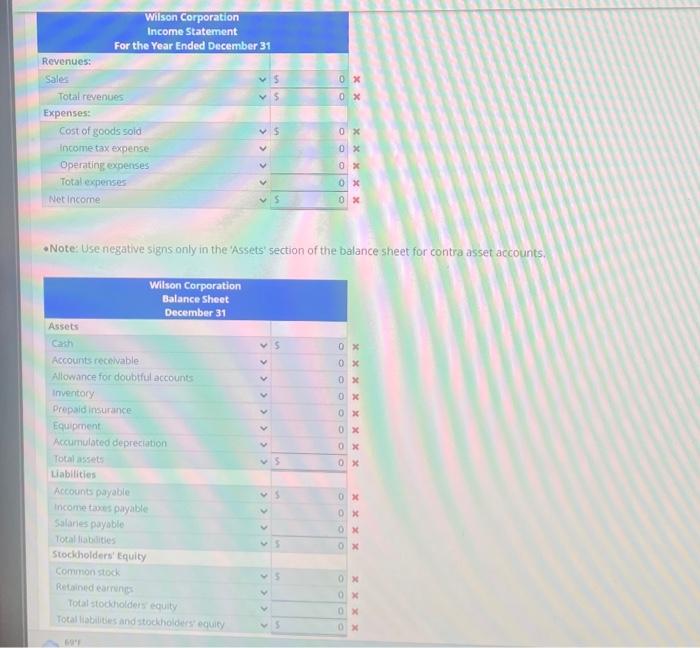

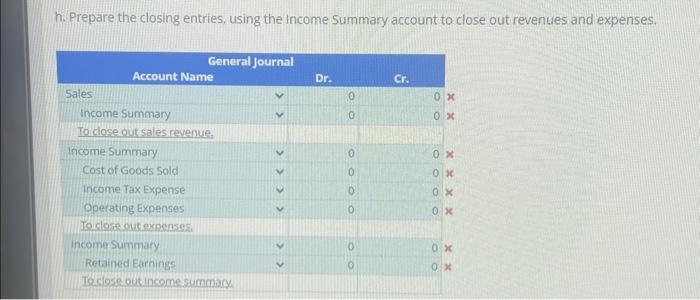

Question: f. Prepare an adjusted trial balance. h. Prepare the closing entries, using the income Summary account to close out revenues and expenses. Applying the Entire

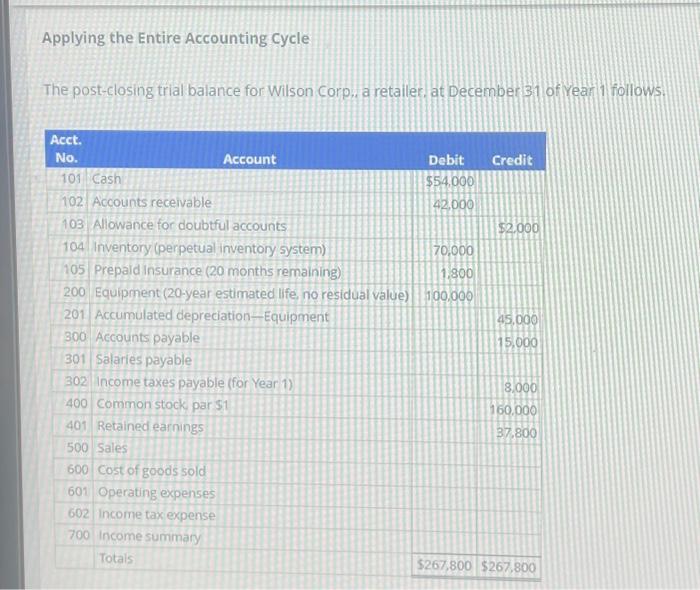

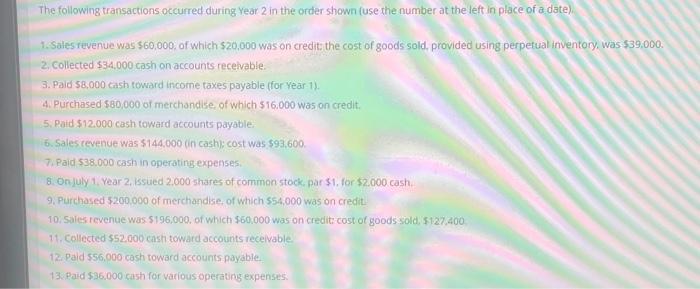

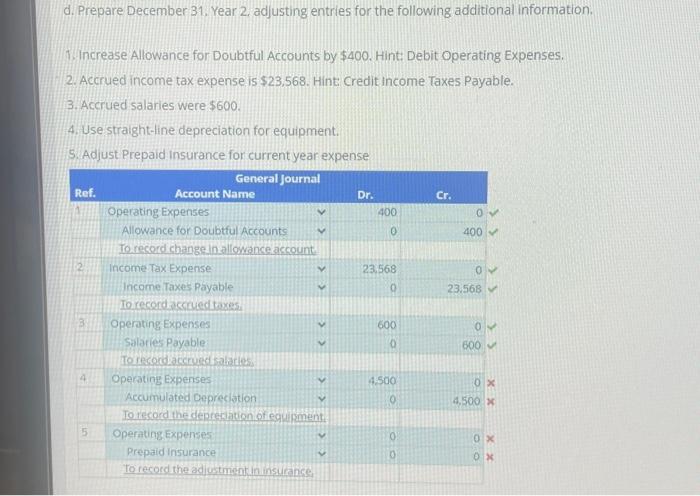

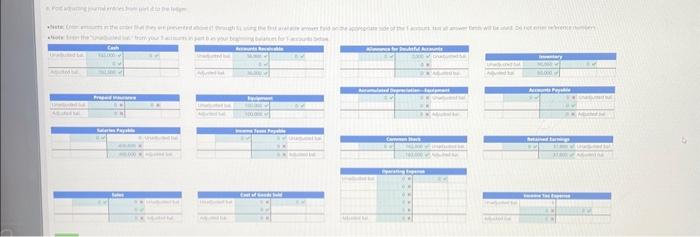

f. Prepare an adjusted trial balance. h. Prepare the closing entries, using the income Summary account to close out revenues and expenses. Applying the Entire Accounting cycle The post-closing trial balance for Wilson Corp, a retailer, at December 31 of Year 1 follows. - Note: Use negative signs only in the 'Assets' section of the balance sheet for contra asset accounts. The following transactions occurred during Year 2 in the order shown (use the number at the left in place of a date). 1. Sales revenue was $60,000, of which $20,000 was on credit: the cost of goods sold, provided using perpetual inventory, was $39,000. 2. collected $34,000 cash on accounts recelvable. 3. Paid $8,000 cash toward income taxes payable (for Year 1 ). 4. Purchased $80,000 of merchandise, of which $16.000 was on credit. 5. Paid \$12.000 cash toward accounts payable 6. Sales revenue was $144,000 (in cash); cost was $93,600 7. Paid $38.000 cash in operating expenses: 8. Onjuly 1, Year 2, issued 2,000 shares of common stock, par \$1, for \$2,000 cash. 9. Purchased $200,000 of merchandise, of which $54,000 was on credit. 10, Sales revenue was $196,000, of which $60,000 was on credit: cost of goods sold, $1,27,400 11. Collected \$52,000 cash toward accounts recelvable. 12. Paid $56,000 cash toward accounts payable. 13. Paid $36,000 cash for various operating expenses. d. Prepare December 31, Year 2, adjusting entries for the following additional information. 1. Increase Allowance for Doubtful Accounts by $400. Hint: Debit Operating Expenses. 2. Accrued income tax expense is $23,568. Hint credit income Taxes Payable. 3. Accrued salaries were $600. 4. Use straight-line depreciation for equipment. 5. Adjust Prepaid insurance for current year expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts