Question: F Question 2 View Policies Current Attempt in Progress Tarek has been watching money-guru YouTube@ videos. Some of these gurus have been forecasting a major

F

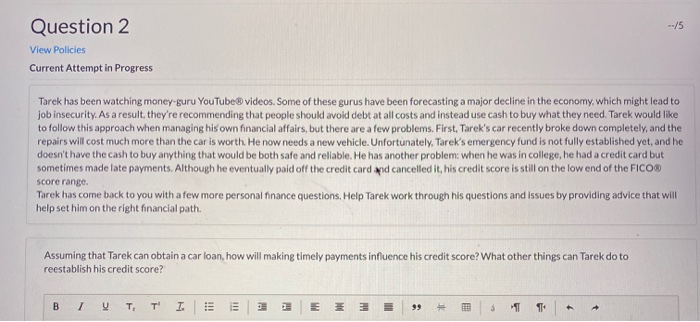

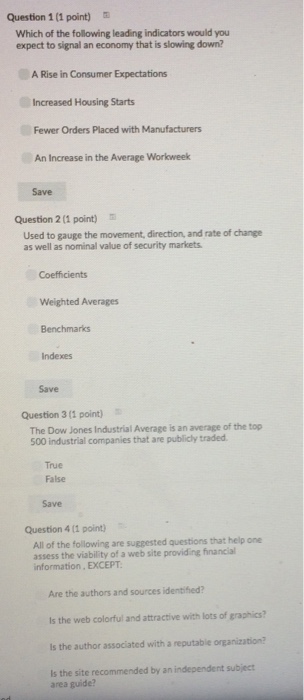

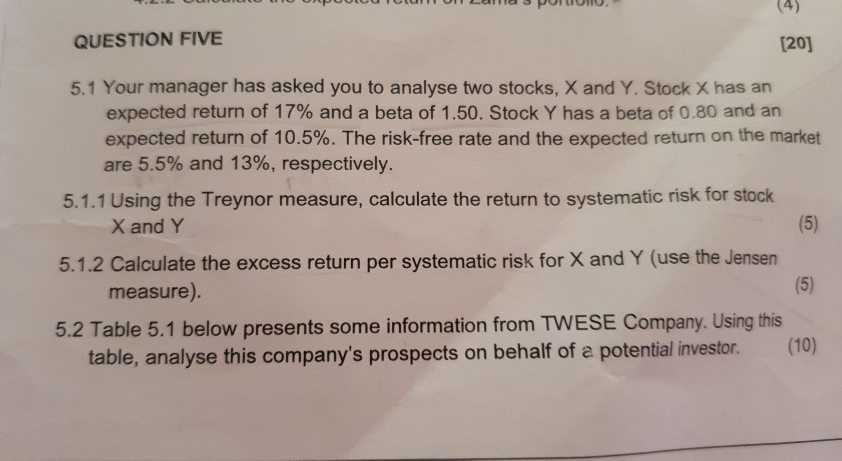

Question 2 View Policies Current Attempt in Progress Tarek has been watching money-guru YouTube@ videos. Some of these gurus have been forecasting a major decline in the economy, which might lead to job insecurity. As a result, they're recommending that people should avoid debt at all costs and instead use cash to buy what they need. Tarek would like to follow this approach when managing his own financial affairs, but there are a few problems. First, Tarek's car recently broke down completely, and the repairs will cost much more than the car is worth. He now needs a new vehicle. Unfortunately, Tarek's emergency fund is not fully established yet, and he doesn't have the cash to buy anything that would be both safe and reliable. He has another problem: when he was in college, he had a credit card but sometimes made late payments. Although he eventually paid off the credit card and cancelled it, his credit score is still on the low end of the FICO@ score range. Tarek has come back to you with a few more personal finance questions. Help Tarek work through his questions and issues by providing advice that will help set him on the right financial path. Assuming that Tarek can obtain a car loan, how will making timely payments influence his credit score? What other things can Tarek do to reestablish his credit score? B / UTTI E EQuestion 1 (1 point) Which of the following leading indicators would you expect to signal an economy that is slowing down? A Rise in Consumer Expectations Increased Housing Starts Fewer Orders Placed with Manufacturers An Increase in the Average Workweek Save Question 2 (1 point) Used to gauge the movement, direction, and rate of change as well as nominal value of security markets. Coefficients Weighted Averages Benchmarks Indexes Save Question 3 (1 point) The Dow Jones Industrial Average Is an average of the top 500 industrial companies that are publicly traded True False Save Question 4 (1 point) All of the following are suggested questions that help one assess the viability of a web site providing financial information , EXCEPT. Are the authors and sources identifed? Is the web colorful and attractive with lots of graphics? Is the author associated with a reputable organization? Is the site recommended by an independent subject area puide?(4) QUESTION FIVE [20] 5.1 Your manager has asked you to analyse two stocks, X and Y. Stock X has an expected return of 17% and a beta of 1.50. Stock Y has a beta of 0.80 and an expected return of 10.5%. The risk-free rate and the expected return on the market are 5.5% and 13%, respectively. 5.1.1 Using the Treynor measure, calculate the return to systematic risk for stock X and Y 5 5.1.2 Calculate the excess return per systematic risk for X and Y (use the Jensen measure). (5 5.2 Table 5.1 below presents some information from TWESE Company. Using this table, analyse this company's prospects on behalf of a potential investor.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts