Question: - ( F V g= ) the future value (or accumulated value) of an ordinary general annuity - ( mathrm{PMT}= ) the size of the

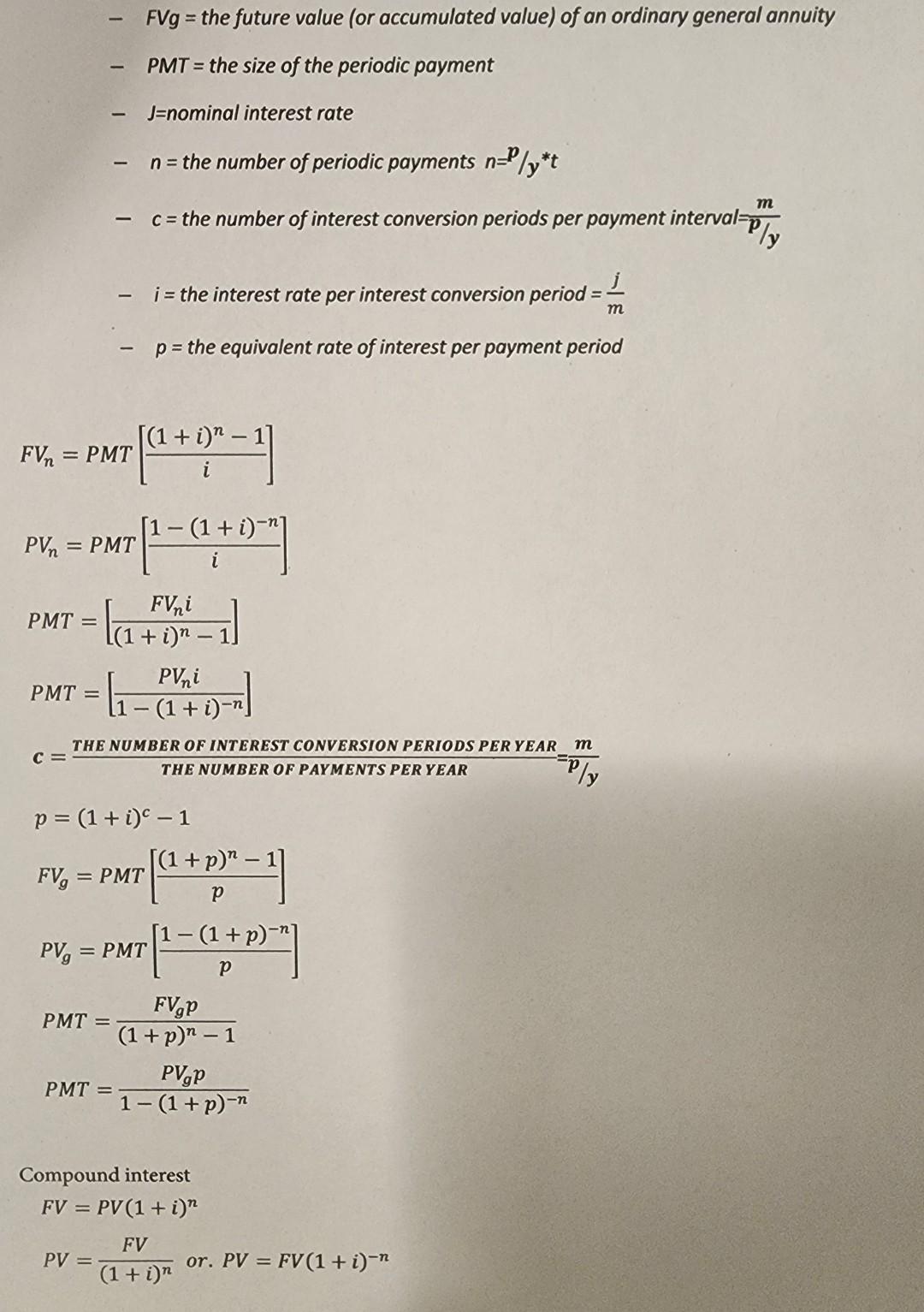

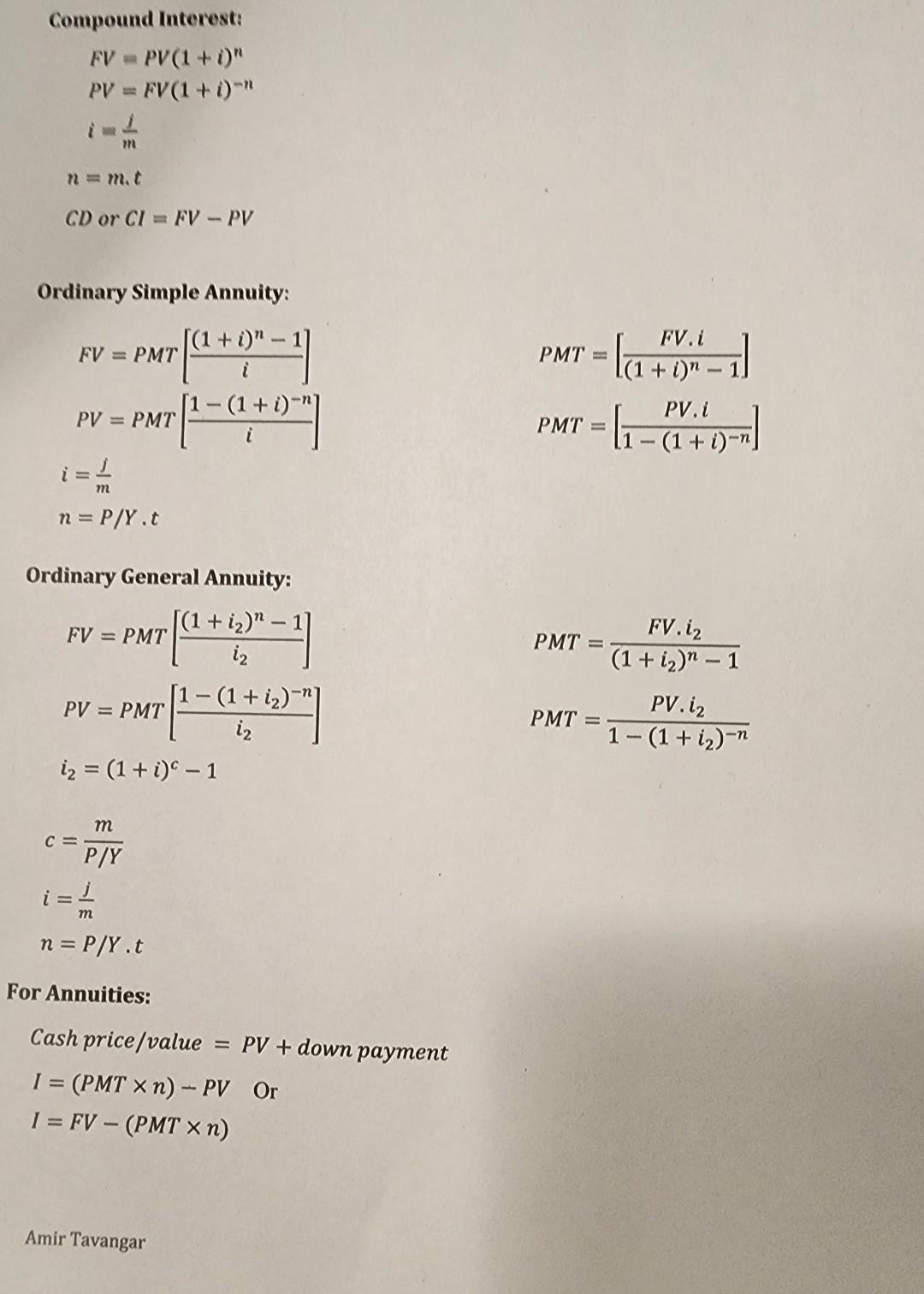

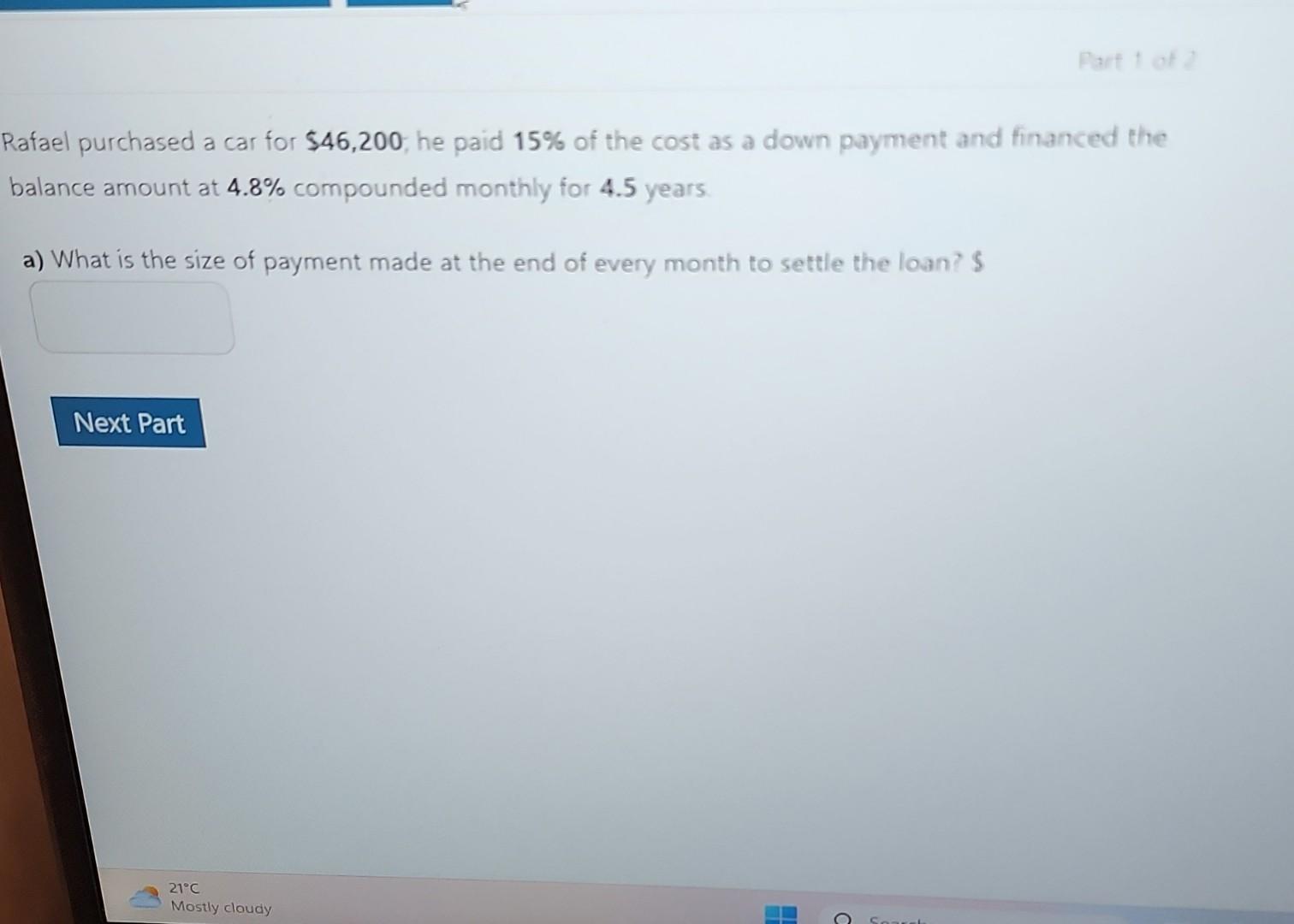

- \\( F V g= \\) the future value (or accumulated value) of an ordinary general annuity - \\( \\mathrm{PMT}= \\) the size of the periodic payment - \\( \\mathrm{J}= \\) nominal interest rate - \\( n= \\) the number of periodic payments \\( n=p / y^{*} t \\) - \\( c= \\) the number of interest conversion periods per payment interval \\( =\\frac{m}{p / y} \\) - \\( \\quad i= \\) the interest rate per interest conversion period \\( =\\frac{j}{m} \\) - \\( p= \\) the equivalent rate of interest per payment period \\[ \\begin{array}{l} F V_{n}=P M T\\left[\\frac{(1+i)^{n}-1}{i}\ ight] \\\\ P V_{n}=P M T\\left[\\frac{1-(1+i)^{-n}}{i}\ ight] \\\\ P M T=\\left[\\frac{F V_{n} i}{(1+i)^{n}-1}\ ight] \\\\ P M T=\\left[\\frac{P V_{n} i}{1-(1+i)^{-n}}\ ight] \\\\ C=\\frac{T H E N U M B E R \\text { OF INTEREST CONVERSION PERIODS PER YEAR }}{T H E N U M B E R \\text { OF PAYMENTS PER YEAR }}=\\frac{m}{p} \\\\ p=(1+i)^{c}-1 \\\\ F V_{g}=P M T\\left[\\frac{(1+p)^{n}-1}{p}\ ight] \\\\ P V_{g}=P M T\\left[\\frac{1-(1+p)^{-n}}{p}\ ight] \\\\ P M T=\\frac{F V_{g} p}{(1+p)^{n}-1} \\\\ P M T=\\frac{P V_{g} p}{1-(1+p)^{-n}} \\end{array} \\] Compound interest \\[ \\begin{array}{l} F V=P V(1+i)^{n} \\\\ P V=\\frac{F V}{(1+i)^{n}} \\text { or. } P V=F V(1+i)^{-n} \\end{array} \\] Rafael purchased a car for \\( \\$ 46,200 \\), he paid \15 of the cost as a down payment and financed the balance amount at \4.8 compounded monthly for 4.5 years a) What is the size of payment made at the end of every month to settle the loan? \\( \\mathrm{s} \\) Compound Interest: \\[ \\begin{array}{l} F V=P V(1+i)^{n} \\\\ P V=F V(1+i)^{-n} \\\\ i=\\frac{j}{m} \\\\ n=m \\cdot t \\\\ C D \\text { or } C I=F V-P V \\end{array} \\] Ordinary Simple Annuity: \\[ \\begin{array}{l} F V=P M T\\left[\\frac{(1+i)^{n}-1}{i}\ ight] \\\\ P V=P M T\\left[\\frac{1-(1+i)^{-n}}{i}\ ight] \\\\ i=\\frac{j}{m} \\\\ n=P / Y . t \\end{array} \\] \\[ \\begin{array}{l} P M T=\\left[\\frac{F V \\cdot i}{(1+i)^{n}-1}\ ight] \\\\ P M T=\\left[\\frac{P V \\cdot i}{1-(1+i)^{-n}}\ ight] \\end{array} \\] Ordinary General Annuity: \\[ \\begin{array}{l} F V=P M T\\left[\\frac{\\left(1+i_{2}\ ight)^{n}-1}{i_{2}}\ ight] \\\\ P V=P M T\\left[\\frac{1-\\left(1+i_{2}\ ight)^{-n}}{i_{2}}\ ight] \\\\ i_{2}=(1+i)^{c}-1 \\\\ c=\\frac{m}{P / Y} \\\\ i=\\frac{j}{m} \\\\ n=P / Y . t \\end{array} \\] \\[ \\begin{aligned} P M T & =\\frac{F V \\cdot i_{2}}{\\left(1+i_{2}\ ight)^{n}-1} \\\\ P M T & =\\frac{P V \\cdot i_{2}}{1-\\left(1+i_{2}\ ight)^{-n}} \\end{aligned} \\] For Annuities: \\[ \\text { Cash price } / \\text { value }=P V+\\text { down payment } \\] \\[ \\begin{array}{l} I=(P M T \\times n)-P V \\quad \\text { Or } \\\\ I=F V-(P M T \\times n) \\end{array} \\] Amir Tavangar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts