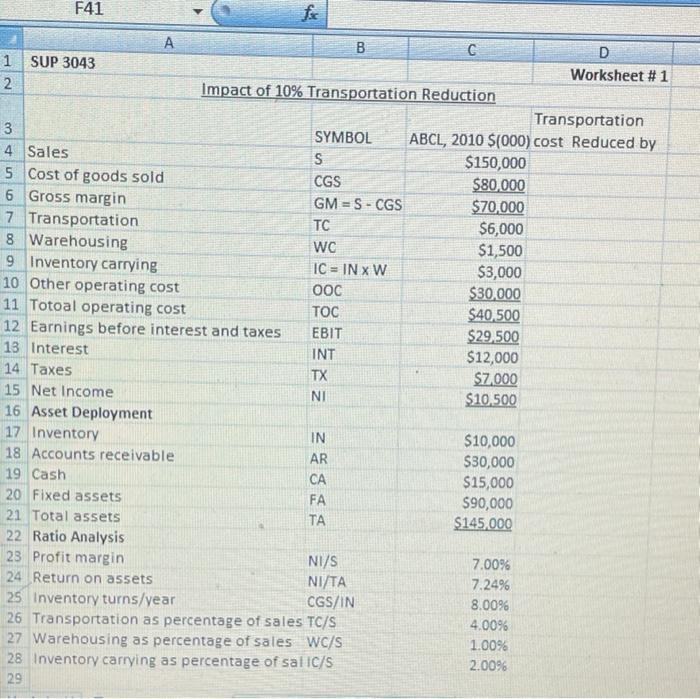

Question: F41 face NP B C D 1 SUP 3043 Worksheet #1 2 Impact of 10% Transportation Reduction Transportation 3 SYMBOL ABCL, 2010 $(000) cost Reduced

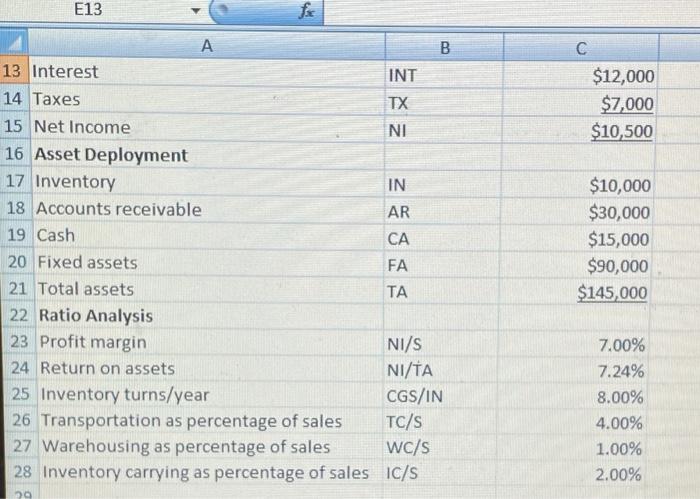

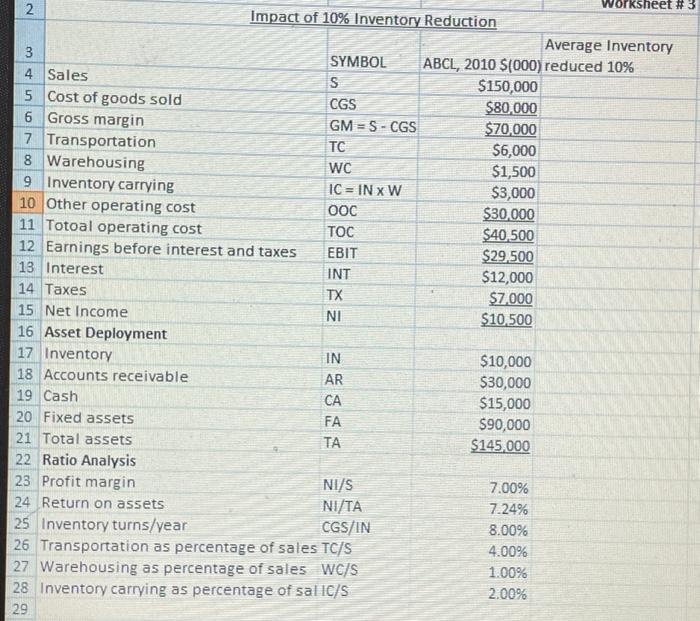

F41 face NP B C D 1 SUP 3043 Worksheet #1 2 Impact of 10% Transportation Reduction Transportation 3 SYMBOL ABCL, 2010 $(000) cost Reduced by 4 Sales S $150,000 5 Cost of goods sold CGS $80,000 6 Gross margin GM = S - CGS $70,000 7 Transportation TC $6,000 8 Warehousing WC $1,500 9 Inventory carrying IC = INXW $3,000 10 Other operating cost OOC $30,000 11 Totoal operating cost TOC $40,500 12 Earnings before interest and taxes EBIT $29.500 13 Interest INT $12,000 14 Taxes TX $7,000 15 Net Income NI $10.500 16 Asset Deployment 17 Inventory IN $10,000 18 Accounts receivable AR $30,000 19 Cash CA $15,000 20 Fixed assets FA 590,000 21 Total assets TA $145,000 22 Ratio Analysis 23 Profit margin NI/S 7.00% 24 Return on assets NI/TA 7.24% 25 Inventory turns/year CGS/IN 8.0096 26 Transportation as percentage of sales TC/S 4.00% 27 Warehousing as percentage of sales WC/S 1.00% 28 Inventory carrying as percentage of salic/s 2.0096 29 E13 fx C $12,000 $7,000 $10,500 IN A B 13 Interest INT 14 Taxes TX 15 Net Income NI 16 Asset Deployment 17 Inventory 18 Accounts receivable AR 19 Cash CA 20 Fixed assets FA 21 Total assets TA 22 Ratio Analysis 23 Profit margin NI/S 24 Return on assets NI/TA 25 Inventory turns/year CGS/IN 26 Transportation as percentage of sales TC/S 27 Warehousing as percentage of sales WC/S 28 Inventory carrying as percentage of sales IC/S $10,000 $30,000 $15,000 $90,000 $145,000 7.00% 7.24% 8.00% 4.00% 1.00% 2.00% 20 TX Ksheet # 3 2 Impact of 10% Inventory Reduction Average Inventory 3 SYMBOL ABCL, 2010 $(000) reduced 10% 4 Sales s $150,000 5 Cost of goods sold CGS $80,000 6 Gross margin GM=S - CGS $70,000 7 Transportation TC $6,000 8 Warehousing WC $1,500 9 Inventory carrying IC = IN XW $3,000 10 Other operating cost OOC $30,000 11 Totoal operating cost TOC $40,500 12 Earnings before interest and taxes EBIT $29,500 13 Interest INT $12,000 14 Taxes $7,000 15 Net Income NI $10.500 16 Asset Deployment 17 Inventory IN $10,000 18 Accounts receivable AR $30,000 19 Cash CA $15,000 20 Fixed assets FA $90,000 21 Total assets TA $145,000 22 Ratio Analysis 23 Profit margin NI/S 7.00% 24 Return on assets NI/TA 7.24% 25 Inventory turns/year CGS/IN 8.00% 26 Transportation as percentage of sales TC/S 4.00% 27 Warehousing as percentage of sales WC/S 1.00% 28 Inventory carrying as percentage of salIC/S 2.00% 29 F41 face NP B C D 1 SUP 3043 Worksheet #1 2 Impact of 10% Transportation Reduction Transportation 3 SYMBOL ABCL, 2010 $(000) cost Reduced by 4 Sales S $150,000 5 Cost of goods sold CGS $80,000 6 Gross margin GM = S - CGS $70,000 7 Transportation TC $6,000 8 Warehousing WC $1,500 9 Inventory carrying IC = INXW $3,000 10 Other operating cost OOC $30,000 11 Totoal operating cost TOC $40,500 12 Earnings before interest and taxes EBIT $29.500 13 Interest INT $12,000 14 Taxes TX $7,000 15 Net Income NI $10.500 16 Asset Deployment 17 Inventory IN $10,000 18 Accounts receivable AR $30,000 19 Cash CA $15,000 20 Fixed assets FA 590,000 21 Total assets TA $145,000 22 Ratio Analysis 23 Profit margin NI/S 7.00% 24 Return on assets NI/TA 7.24% 25 Inventory turns/year CGS/IN 8.0096 26 Transportation as percentage of sales TC/S 4.00% 27 Warehousing as percentage of sales WC/S 1.00% 28 Inventory carrying as percentage of salic/s 2.0096 29 E13 fx C $12,000 $7,000 $10,500 IN A B 13 Interest INT 14 Taxes TX 15 Net Income NI 16 Asset Deployment 17 Inventory 18 Accounts receivable AR 19 Cash CA 20 Fixed assets FA 21 Total assets TA 22 Ratio Analysis 23 Profit margin NI/S 24 Return on assets NI/TA 25 Inventory turns/year CGS/IN 26 Transportation as percentage of sales TC/S 27 Warehousing as percentage of sales WC/S 28 Inventory carrying as percentage of sales IC/S $10,000 $30,000 $15,000 $90,000 $145,000 7.00% 7.24% 8.00% 4.00% 1.00% 2.00% 20 TX Ksheet # 3 2 Impact of 10% Inventory Reduction Average Inventory 3 SYMBOL ABCL, 2010 $(000) reduced 10% 4 Sales s $150,000 5 Cost of goods sold CGS $80,000 6 Gross margin GM=S - CGS $70,000 7 Transportation TC $6,000 8 Warehousing WC $1,500 9 Inventory carrying IC = IN XW $3,000 10 Other operating cost OOC $30,000 11 Totoal operating cost TOC $40,500 12 Earnings before interest and taxes EBIT $29,500 13 Interest INT $12,000 14 Taxes $7,000 15 Net Income NI $10.500 16 Asset Deployment 17 Inventory IN $10,000 18 Accounts receivable AR $30,000 19 Cash CA $15,000 20 Fixed assets FA $90,000 21 Total assets TA $145,000 22 Ratio Analysis 23 Profit margin NI/S 7.00% 24 Return on assets NI/TA 7.24% 25 Inventory turns/year CGS/IN 8.00% 26 Transportation as percentage of sales TC/S 4.00% 27 Warehousing as percentage of sales WC/S 1.00% 28 Inventory carrying as percentage of salIC/S 2.00% 29