Question: Fabien Ltd - continued: Required Task 3: Prepare the following planned values: . Contribution and contribution / sales ratio (for each product and in total)

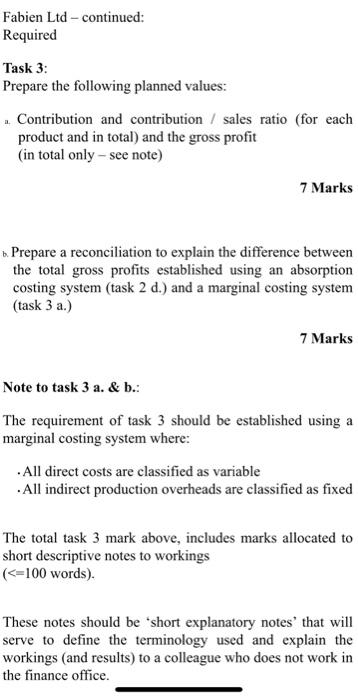

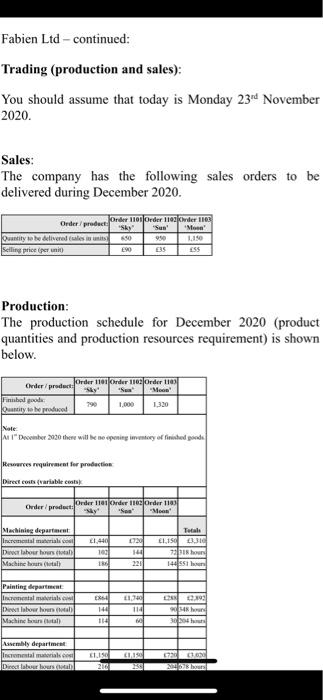

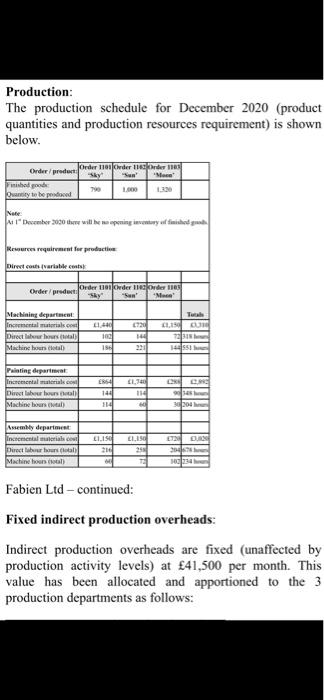

Fabien Ltd - continued: Required Task 3: Prepare the following planned values: . Contribution and contribution / sales ratio (for each product and in total) and the gross profit (in total only - see note) 7 Marks b. Prepare a reconciliation to explain the difference between the total gross profits established using an absorption costing system (task 2 d.) and a marginal costing system (task 3 a.) 7 Marks Note to task 3 a. & b. The requirement of task 3 should be established using a marginal costing system where: All direct costs are classified as variable - All indirect production overheads are classified as fixed The total task 3 mark above, includes marks allocated to short descriptive notes to workings (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts