Question: FAC1602/101/3/2020 ASSIGNMENT 02 - FIRST SEMESTER (continued) as the correct amount that m QUESTION 4 ion of GerLamp CC Which one of the following a

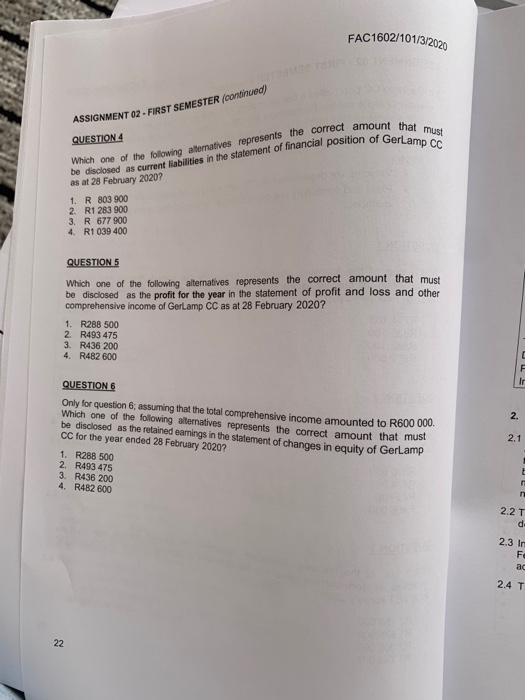

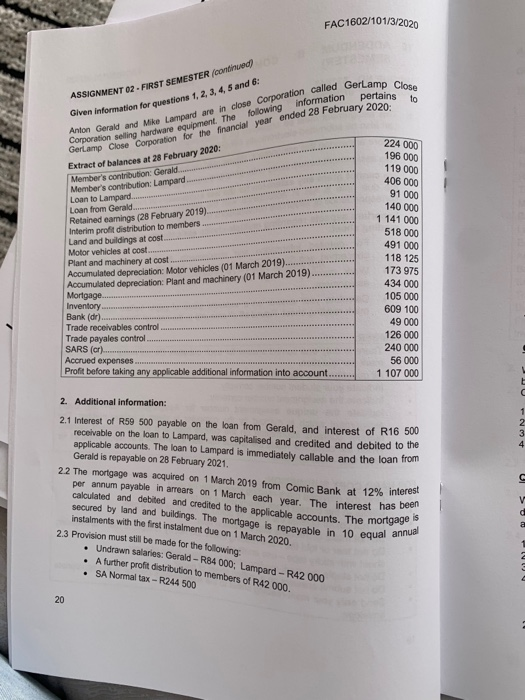

FAC1602/101/3/2020 ASSIGNMENT 02 - FIRST SEMESTER (continued) as the correct amount that m QUESTION 4 ion of GerLamp CC Which one of the following a Bernatives represents the correct amount be disclosed as current liabilities in the statement of financial position of Ger as at 28 February 2020? 1. R 803 900 2 R1 283 900 3. R 677 900 4. R1 039 400 QUESTION 5 Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income of GerLamp CC as at 28 February 2020? 1. R288 500 2 R493 475 3. R436 200 4. R482 600 QUESTION 6 Only for question 6; assuming that the total comprehensive income amounted to Row Which one of the following alternatives represents the correct amount that must be disclosed as the retained earnings in the statement of changes in equity of Gerlamp CC for the year ended 28 February 2020? 1. R288 500 2. R493 475 3. R436 200 4. R482 600 od 28 Februnings in the statements the correct mounted to R600 000 WEEEEE FAC1602/101/3/2020 d GerLamp Close ASSIGNMENT 02 - FIRST SEMESTER (continued information pertains Given information for questions 1, 2, 3, 4, 5 and 6: Anton Gerald and are in close Corporation called Gerlam Corporation selling hardware equipment. The following information Derta Gerlamp Close Comoration for the financial year ended 28 February 2020- Extract of balances at 28 February 2020: Member's contribution: Gerald.... Member's contribution: Lampard. Loan to Lampard........ Loan from Gerald...... Retained earnings (28 February 2019). Interim profit distribution to members.... Land and buildings at cost........ Motor vehicles at cost......................... Plant and machinery at cost ................... Accumulated depreciation: Motor vehicles (01 March 2019). Accumulated depreciation: Plant and machinery (01 March 2019)... 224 000 196 000 119 000 406 000 91 000 140 000 1 141 000 518 000 491 000 118 125 173 975 434 000 105 000 609 100 49 000 126 000 240 000 56 000 1 107 000 Mortgage... Inventory Bank (dr).... Trade receivables control.... Trade payales control SARS (or) Accrued expenses....... Profit before taking any applicable additional information into account.. 2. Additional information: 2.1 Interest of R59 500 payable on the loan from Gerald, and interest of R16 500 receivable on the loan to Lampard, was capitalised and credited and debited to the applicable accounts. The loan to Lampard is immediately callable and the loan from Gerald is repayable on 28 February 2021. AWN 22 The mortgage was acquired on 1 March 2019 from Comic Bank at 12% interest per annum payable in arrears on 1 March each year. The interest has bee calculated and debited and credited to the applicable accounts. The morgoy secured by land and buildings. The mortgage is repayable in 10 equal instalments with the first instalment due on 1 March 2020 2.3 Provision must still be made for the following: Undrawn salaries: Gerald - RB4000: Lampard -R42 000 A further profit distribution to members of R42 000 SA Normal tax-R244 500 as in s. The mortgage is qual annual FAC1602/101/3/2020 ASSIGNMENT 02 - FIRST SEMESTER (continued) as the correct amount that m QUESTION 4 ion of GerLamp CC Which one of the following a Bernatives represents the correct amount be disclosed as current liabilities in the statement of financial position of Ger as at 28 February 2020? 1. R 803 900 2 R1 283 900 3. R 677 900 4. R1 039 400 QUESTION 5 Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income of GerLamp CC as at 28 February 2020? 1. R288 500 2 R493 475 3. R436 200 4. R482 600 QUESTION 6 Only for question 6; assuming that the total comprehensive income amounted to Row Which one of the following alternatives represents the correct amount that must be disclosed as the retained earnings in the statement of changes in equity of Gerlamp CC for the year ended 28 February 2020? 1. R288 500 2. R493 475 3. R436 200 4. R482 600 od 28 Februnings in the statements the correct mounted to R600 000 WEEEEE FAC1602/101/3/2020 d GerLamp Close ASSIGNMENT 02 - FIRST SEMESTER (continued information pertains Given information for questions 1, 2, 3, 4, 5 and 6: Anton Gerald and are in close Corporation called Gerlam Corporation selling hardware equipment. The following information Derta Gerlamp Close Comoration for the financial year ended 28 February 2020- Extract of balances at 28 February 2020: Member's contribution: Gerald.... Member's contribution: Lampard. Loan to Lampard........ Loan from Gerald...... Retained earnings (28 February 2019). Interim profit distribution to members.... Land and buildings at cost........ Motor vehicles at cost......................... Plant and machinery at cost ................... Accumulated depreciation: Motor vehicles (01 March 2019). Accumulated depreciation: Plant and machinery (01 March 2019)... 224 000 196 000 119 000 406 000 91 000 140 000 1 141 000 518 000 491 000 118 125 173 975 434 000 105 000 609 100 49 000 126 000 240 000 56 000 1 107 000 Mortgage... Inventory Bank (dr).... Trade receivables control.... Trade payales control SARS (or) Accrued expenses....... Profit before taking any applicable additional information into account.. 2. Additional information: 2.1 Interest of R59 500 payable on the loan from Gerald, and interest of R16 500 receivable on the loan to Lampard, was capitalised and credited and debited to the applicable accounts. The loan to Lampard is immediately callable and the loan from Gerald is repayable on 28 February 2021. AWN 22 The mortgage was acquired on 1 March 2019 from Comic Bank at 12% interest per annum payable in arrears on 1 March each year. The interest has bee calculated and debited and credited to the applicable accounts. The morgoy secured by land and buildings. The mortgage is repayable in 10 equal instalments with the first instalment due on 1 March 2020 2.3 Provision must still be made for the following: Undrawn salaries: Gerald - RB4000: Lampard -R42 000 A further profit distribution to members of R42 000 SA Normal tax-R244 500 as in s. The mortgage is qual annual

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts