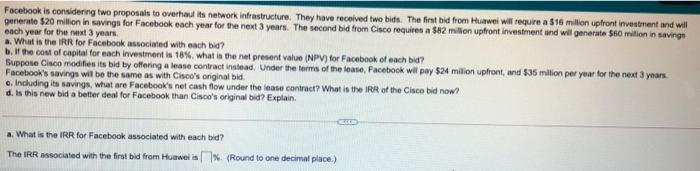

Question: Facebook is considering two proposals to overhaul its network infrastructure. They have received two bids. The first bid from Huawei will require a $16 million

Facebook is considering two proposals to overhaul its network infrastructure. They have received two bids. The first bid from Huawei will require a $16 million upfront investment and will generato $20 million in savings for Facebook each year for the next 3 years. The second bid from Cisco requires a $82 milion upfront investment and wil generate $60 milion in saving each year for the next 3 years a. What is the IRR for Facebook associated with each bid? b. If the cost of capital for each Investment is 18%. what is the net present value (NPV) for Facebook of each bid? Suppote Cinco modifier is bid by offering a lease contract instad. Under the terms of the lease, Facebook will pay $24 milion uphont, and $35 million per year for the next 3 years Facebook's savings will be the same as with Cisco's original bid. 6. Including its savings, what are Facebook's net cash flow under the lease contract? What is the IRR of the Cisco bid now? d. Is this new bid a better deal for Facebook than Cisco's original bid? Explain a. What is the IRR for Facebook associated with each bid? The IRR associated with the first bid from Howwel is 1 (Round to one decimal place) Facebook is considering two proposals to overhaul its network infrastructure. They have received two bids. The first bid from Huawei will require a $16 million upfront investment and will generato $20 million in savings for Facebook each year for the next 3 years. The second bid from Cisco requires a $82 milion upfront investment and wil generate $60 milion in saving each year for the next 3 years a. What is the IRR for Facebook associated with each bid? b. If the cost of capital for each Investment is 18%. what is the net present value (NPV) for Facebook of each bid? Suppote Cinco modifier is bid by offering a lease contract instad. Under the terms of the lease, Facebook will pay $24 milion uphont, and $35 million per year for the next 3 years Facebook's savings will be the same as with Cisco's original bid. 6. Including its savings, what are Facebook's net cash flow under the lease contract? What is the IRR of the Cisco bid now? d. Is this new bid a better deal for Facebook than Cisco's original bid? Explain a. What is the IRR for Facebook associated with each bid? The IRR associated with the first bid from Howwel is 1 (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts