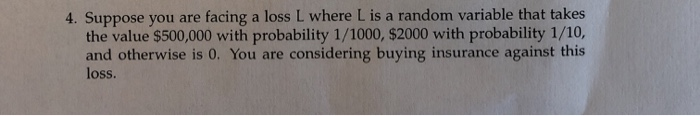

Question: facing a loss L where L is a random variable that takes 4. Suppose you are the value $500,000 with probability 1/1000, $2000 with probability

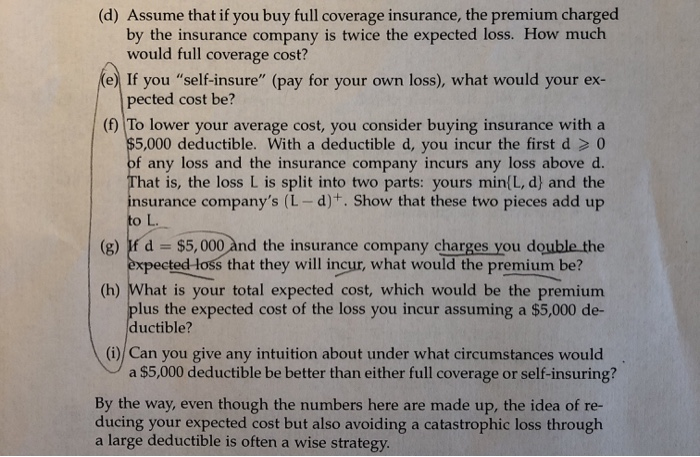

facing a loss L where L is a random variable that takes 4. Suppose you are the value $500,000 with probability 1/1000, $2000 with probability 1/10, and otherwise is 0. You are considering buying insurance against this loss. (d) Assume that if you buy full coverage insurance, the premium charged by the insurance company is twice the expected loss. How much would full coverage cost? (e) If you "self-insure" (pay for your own loss), what would your ex- pected cost be? (f) To lower your average cost, you consider buying insurance with a $5,000 deductible. With a deductible d, you incur the first d > 0 of any loss and the insurance company incurs any loss above d. That is, the loss L is split into two parts: yours min{L, d) and the insurance company's (L- d)+. Show that these two pieces add up to L (g) f d $5,000 and the insurance company charges you double the expected-loss that they will incur, what would the premium be? (h) What is your total expected cost, which would be the premium plus the expected cost of the loss you incur assuming a $5,000 de- ductible? (i) Can you give any intuition about under what circumstances would a $5,000 deductible be better than either full coverage or self-insuring? By the way, even ducing your expected cost but also avoiding a catastrophic loss through though the numbers here are made up, the idea of re- facing a loss L where L is a random variable that takes 4. Suppose you are the value $500,000 with probability 1/1000, $2000 with probability 1/10, and otherwise is 0. You are considering buying insurance against this loss. (d) Assume that if you buy full coverage insurance, the premium charged by the insurance company is twice the expected loss. How much would full coverage cost? (e) If you "self-insure" (pay for your own loss), what would your ex- pected cost be? (f) To lower your average cost, you consider buying insurance with a $5,000 deductible. With a deductible d, you incur the first d > 0 of any loss and the insurance company incurs any loss above d. That is, the loss L is split into two parts: yours min{L, d) and the insurance company's (L- d)+. Show that these two pieces add up to L (g) f d $5,000 and the insurance company charges you double the expected-loss that they will incur, what would the premium be? (h) What is your total expected cost, which would be the premium plus the expected cost of the loss you incur assuming a $5,000 de- ductible? (i) Can you give any intuition about under what circumstances would a $5,000 deductible be better than either full coverage or self-insuring? By the way, even ducing your expected cost but also avoiding a catastrophic loss through though the numbers here are made up, the idea of re

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts