Question: Fact Pattern B - Questions #6 through #9: The Purchaser is paying an account payable of $5,000 for previously purchased merchandise with cash and

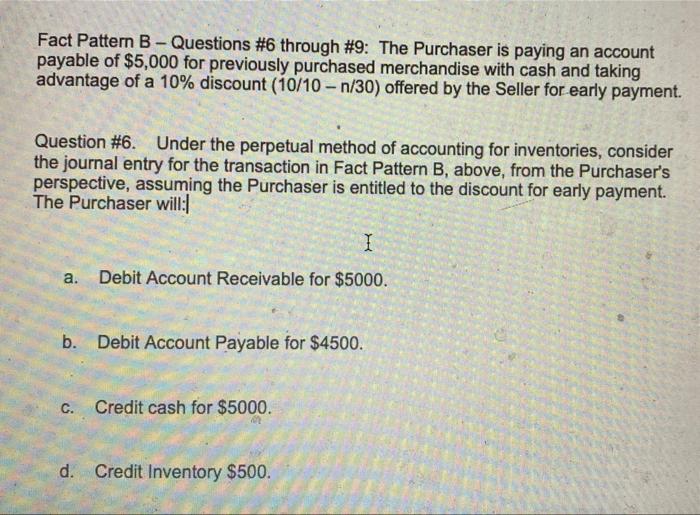

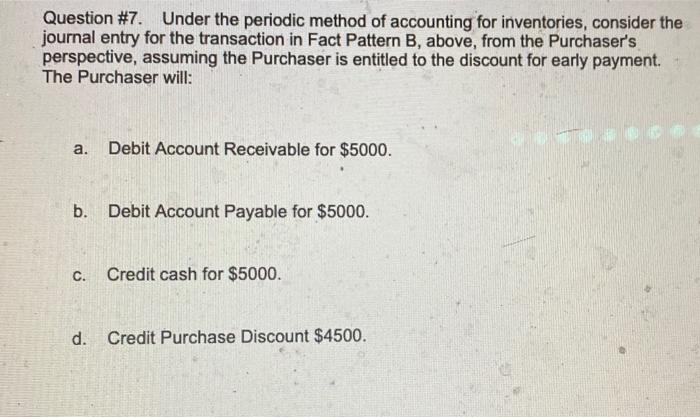

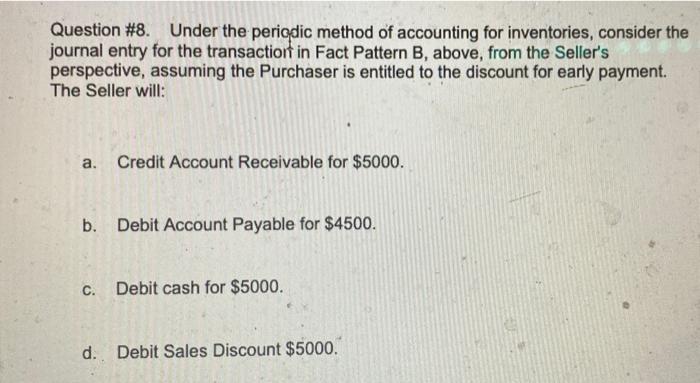

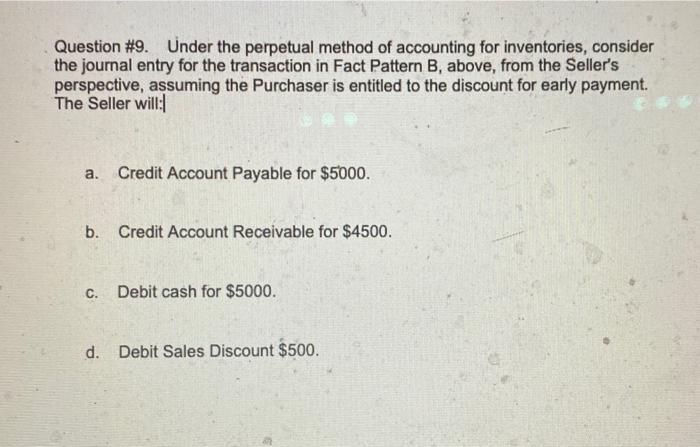

Fact Pattern B - Questions #6 through #9: The Purchaser is paying an account payable of $5,000 for previously purchased merchandise with cash and taking advantage of a 10% discount (10/10 - n/30) offered by the Seller for early payment. Question #6. Under the perpetual method of accounting for inventories, consider the journal entry for the transaction in Fact Pattern B, above, from the Purchaser's perspective, assuming the Purchaser is entitled to the discount for early payment. The Purchaser will: a. Debit Account Receivable for $5000. b. Debit Account Payable for $4500. C. Credit cash for $5000. d. Credit Inventory $500. Question #7. Under the periodic method of accounting for inventories, consider the journal entry for the transaction in Fact Pattern B, above, from the Purchaser's perspective, assuming the Purchaser is entitled to the discount for early payment. The Purchaser will: a. Debit Account Receivable for $5000. b. Debit Account Payable for $5000. C. Credit cash for $5000. d. Credit Purchase Discount $4500. Question #8. Under the pericdic method of accounting for inventories, consider the journal entry for the transactionrt in Fact Pattern B, above, from the Seller's perspective, assuming the Purchaser is entitled to the discount for early payment. The Seller will: a. Credit Account Receivable for $5000. b. Debit Account Payable for $4500. C. Debit cash for $5000. d. Debit Sales Discount $5000. Question #9. Under the perpetual method of accounting for inventories, consider the journal entry for the transaction in Fact Pattern B, above, from the Seller's perspective, assuming the Purchaser is entitled to the discount for early payment. The Seller will: a. Credit Account Payable for $5000. b. Credit Account Receivable for $4500. C. Debit cash for $5000. d. Debit Sales Discount $500.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Answer 6 option d Because purchase discount will reduce inventory directly in perpetual accounting ... View full answer

Get step-by-step solutions from verified subject matter experts