Question: Fact Pattern: Early in Year 2 , a nongovernmental not - for - profit entity ( NFP ) received a $ 2 , 0 0

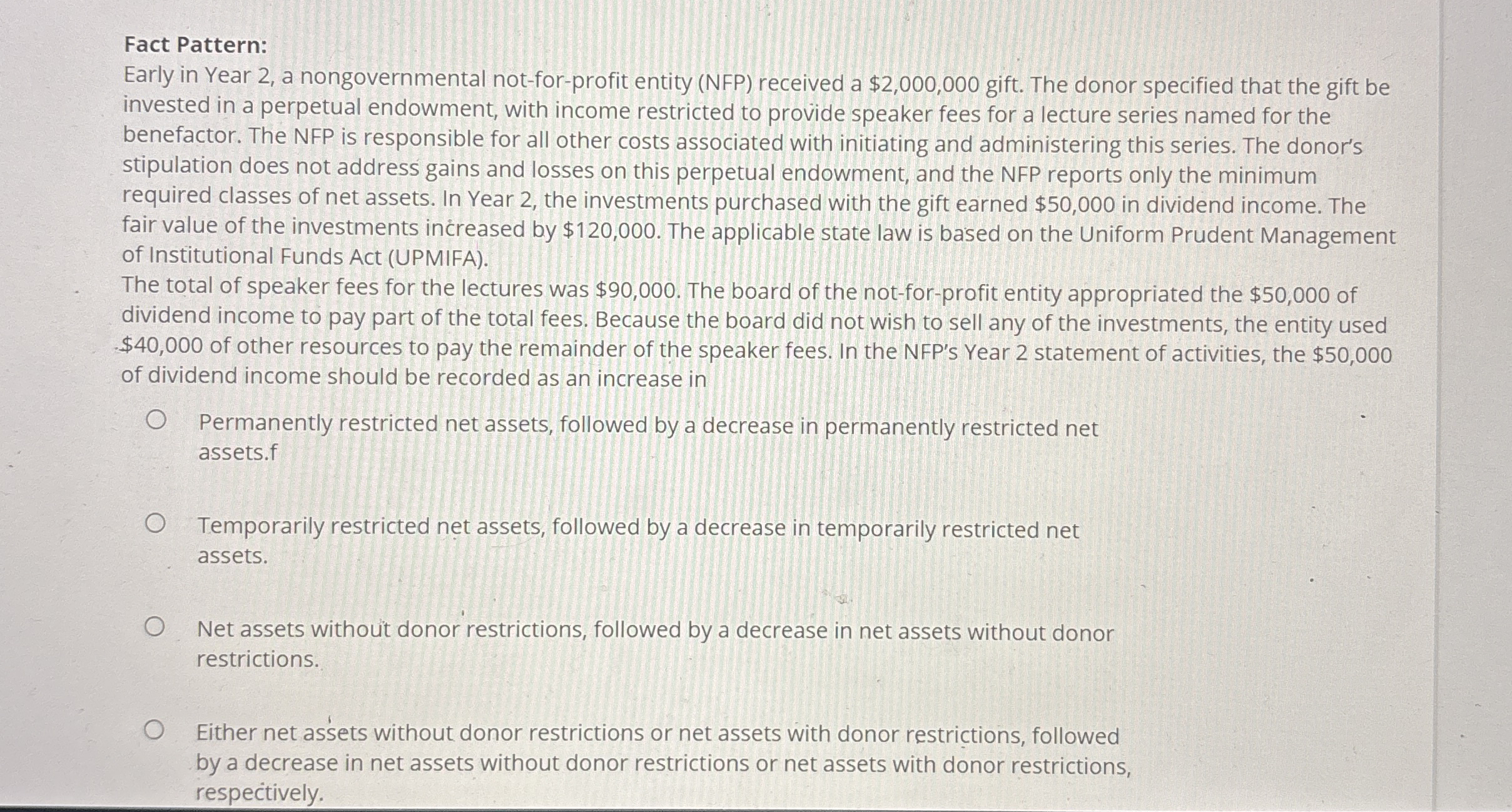

Fact Pattern:

Early in Year a nongovernmental notforprofit entity NFP received a $ gift. The donor specified that the gift be invested in a perpetual endowment, with income restricted to provide speaker fees for a lecture series named for the benefactor. The NFP is responsible for all other costs associated with initiating and administering this series. The donor's stipulation does not address gains and losses on this perpetual endowment, and the NFP reports only the minimum required classes of net assets. In Year the investments purchased with the gift earned $ in dividend income. The fair value of the investments increased by $ The applicable state law is based on the Uniform Prudent Management of Institutional Funds Act UPMIFA

The total of speaker fees for the lectures was $ The board of the notforprofit entity appropriated the $ of dividend income to pay part of the total fees. Because the board did not wish to sell any of the investments, the entity used $ of other resources to pay the remainder of the speaker fees. In the NFPs Year statement of activities, the $ of dividend income should be recorded as an increase in

Permanently restricted net assets, followed by a decrease in permanently restricted net assets.f

Temporarily restricted net assets, followed by a decrease in temporarily restricted net assets.

Net assets withot donor restrictions, followed by a decrease in net assets without donor restrictions.

Either net assets without donor restrictions or net assets with donor restrictions, followed by a decrease in net assets without donor restrictions or net assets with donor restrictions, respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock