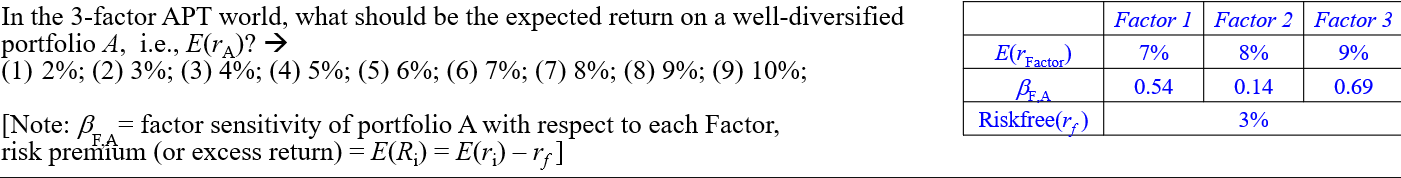

Question: Factor 1 Factor Factor 3 In the 3-factor APT world, what should be the expected return on a well-diversified portfolio A, i.e., E(ra)? (1) 2%;

Factor 1 Factor Factor 3 In the 3-factor APT world, what should be the expected return on a well-diversified portfolio A, i.e., E(ra)? (1) 2%; (2) 3%; (3) 4%; (4) 5%; (5) 6%; (6) 7%; (7) 8%; (8) 9%; (9) 10%; 7% 8% 9% E(rFactor) BEA Riskfree(r) 0.54 0.14 0.69 3% [Note: B = factor sensitivity of portfolio A with respect to each Factor, risk premium (or excess return) = E(R;) = E(r;) rs] F.A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts