Question: Factor Markets ( Capital ) A tech startup is considering investing in a new software development project. The initial investment for the project is $

Factor Markets Capital

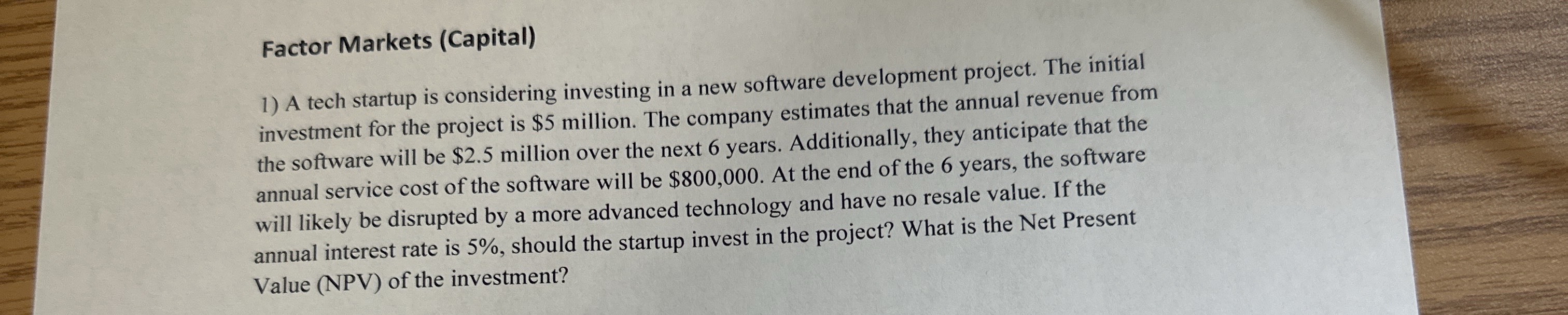

A tech startup is considering investing in a new software development project. The initial investment for the project is $ million. The company estimates that the annual revenue from the software will be $ million over the next years. Additionally, they anticipate that the annual service cost of the software will be $ At the end of the years, the software will likely be disrupted by a more advanced technology and have no resale value. If the annual interest rate is should the startup invest in the project? What is the Net Present Value NPV of the investment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock