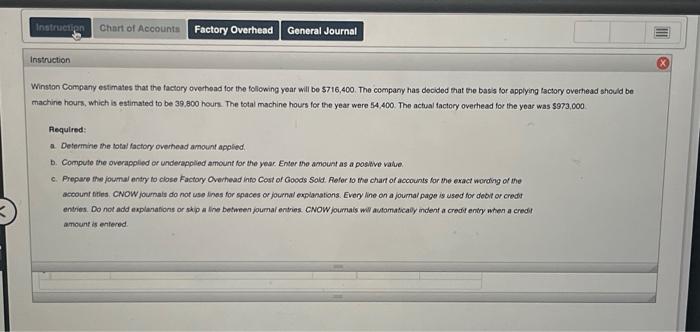

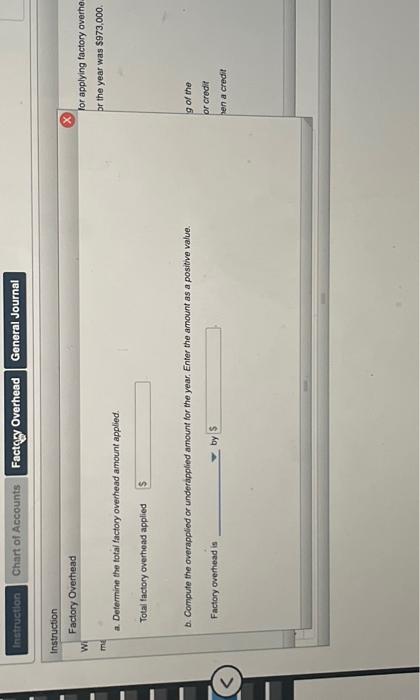

Question: Factory Overhead a. Determine the total factory overhead amount applied. Total factory overhead applied b. Compute the overapplied or underapplied amount for the year. Enter

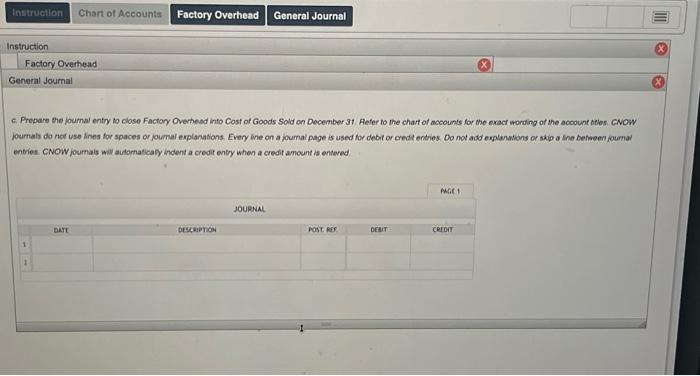

Factory Overhead a. Determine the total factory overhead amount applied. Total factory overhead applied b. Compute the overapplied or underapplied amount for the year. Enter the amount as a positive value. Factory overhead is by c. Prepare the journal entry to close Factory Overhead into Cost of Goods Sold on December 31. Aefer to the chart of accounts for the exact wonding of the account telies. CNOW journals do not use ines for spaces or joumal explanations. Every ine on a joumat page is used for debit or credit entries. Do not add explanations or skip a ine behreen foumal entries CNOW purnals will automaticaly indent a credit entry when a credit amount is entered. Winston Company estimates that the factory overhead for the following yoar will be $716,400. The company has decided that the basis for applying tactory overhead should be machine hours, which is estimated to be 39,800 houn. The total machine hours for the year were 54,400 . The actual factory overhead for the year was $973, 000 Aequired: a. Determine the lotal factory overheas amount applied. b. Compute the overapplied or underappled amount for the year Enter the amount as a positive vatie. c. Prepare the joumul entry to close Factory Overhead into Cost of Goods Sold. Refor to the chart of accounts tor the exact wording of the account bities. CNOW joumalt do not use tines for spaces or joumal explanations. Every hine on a joumal page is usedt for debit or credt entries. Do not add explanafions or skip a Ine between joumal entries. CNOW joumals wil autamaticaly indent a credit entry when a credit amount is entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts