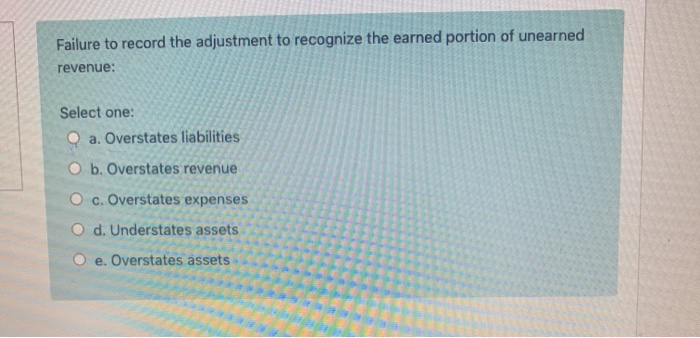

Question: Failure to record the adjustment to recognize the earned portion of unearned revenue: Select one: O a. Overstates liabilities O b. Overstates revenue O c.

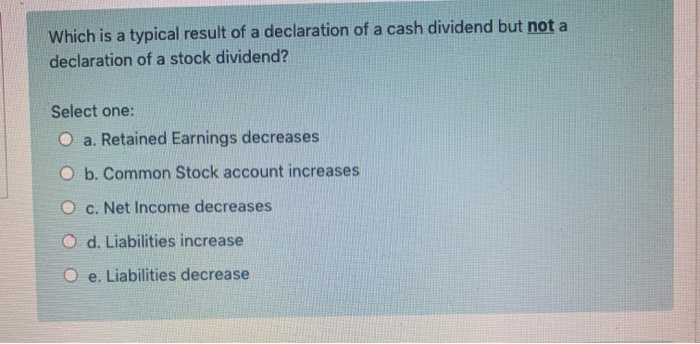

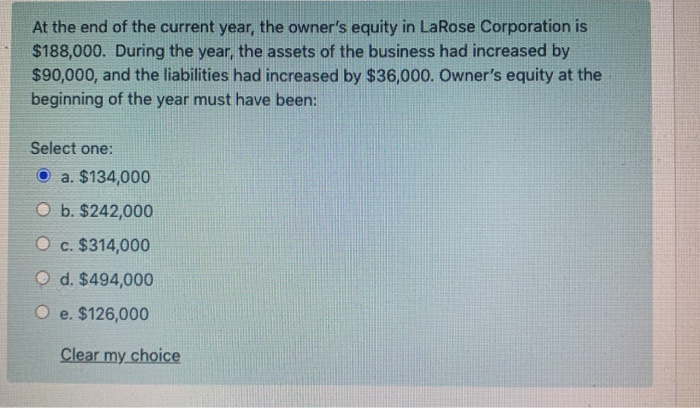

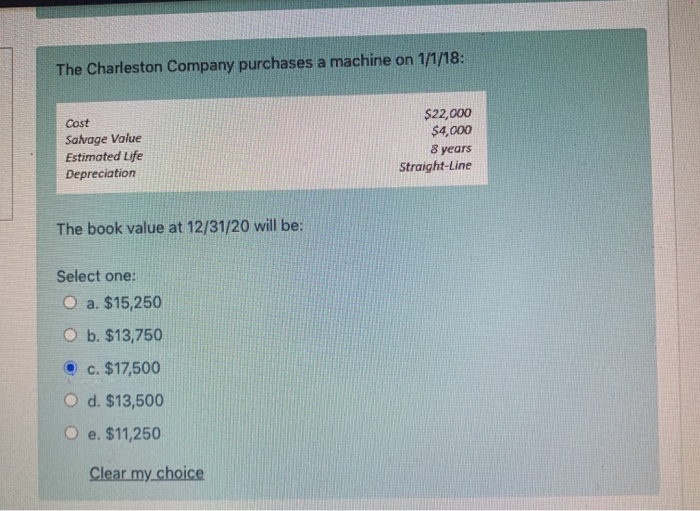

Failure to record the adjustment to recognize the earned portion of unearned revenue: Select one: O a. Overstates liabilities O b. Overstates revenue O c. Overstates expenses O d. Understates assets O e. Overstates assets Which is a typical result of a declaration of a cash dividend but not a declaration of a stock dividend? Select one: O a. Retained Earnings decreases O b. Common Stock account increases O c. Net Income decreases d. Liabilities increase O e Liabilities decrease At the end of the current year, the owner's equity in LaRose Corporation is $188,000. During the year, the assets of the business had increased by $90,000, and the liabilities had increased by $36,000. Owner's equity at the beginning of the year must have been: Select one: O a. $134,000 O b. $242,000 O c. $314,000 d. $494,000 O e. $126,000 Clear my choice The Charleston Company purchases a machine on 1/1/18: Cost Salvage Value Estimated Life Depreciation $22,000 $4,000 8 years Straight-Line The book value at 12/31/20 will be: Select one: O a. $15,250 O b. $13,750 O c. $17,500 O d. $13,500 O e. $11,250 Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts