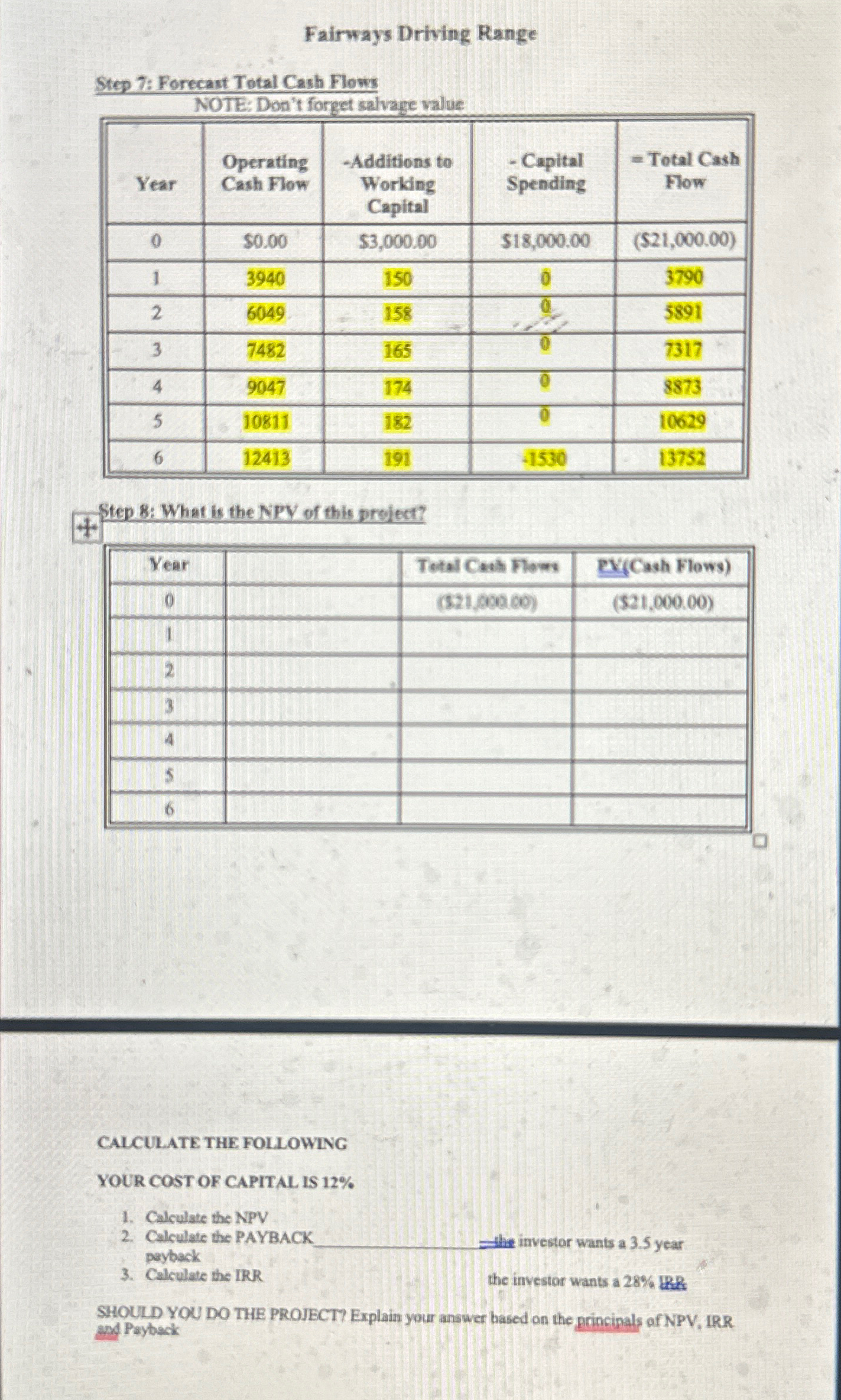

Question: Fairways Driving Range Step 7: Forecast Total Cash Flows NOTE: Don't forget salvage value Operating -Additions to Year Cash Flow Working - Capital Spending

Fairways Driving Range Step 7: Forecast Total Cash Flows NOTE: Don't forget salvage value Operating -Additions to Year Cash Flow Working - Capital Spending = Total Cash Flow Capital 0 $0.00 $3,000.00 $18,000.00 ($21,000.00) 1 3940 150 3790 2 6049 158 5891 3 7482 165 7317 4 9047 174 8873 5 10811 182 10629 6 12413 191 -1530 13752 Step 8: What is the NPV of this project? + Year 0 Total Cash Flows ($21,000.00) PV(Cash Flows) ($21,000.00) 2 3 4 CALCULATE THE FOLLOWING YOUR COST OF CAPITAL IS 12% 1. Calculate the NPV 2. Calculate the PAYBACK payback 3. Calculate the IRR the investor wants a 3.5 year the investor wants a 28% IRR SHOULD YOU DO THE PROJECT? Explain your answer based on the principals of NPV, IRR and Payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts