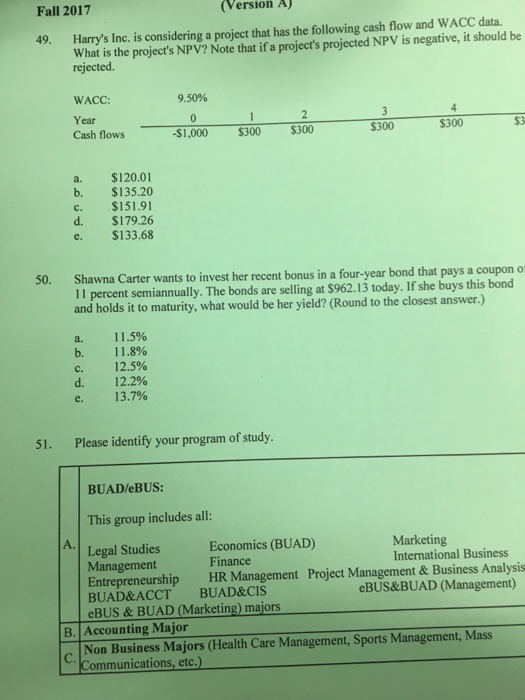

Question: Fall 2017 Version A) 49. Harry's Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV?

Fall 2017 Version A) 49. Harry's Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it should be rejected WACC: Year Cash flows 9.50% $1,000 $300 $300 $300 $300 a. $120.01 b. $135.20 c. $151.91 d. $179.26 e. $133.68 Shawna Carter wants to invest her recent bonus in a four-year bond that pays a coupono 11 percent semiannually. The bonds are selling at $962.13 today. If she buys this bond and holds it to maturity, what would be her yield? (Round to the closest answer.) 50. 11.5% 11.8% 12.5% 12.2% 13.7% a. b. d. e. 51. Please identify your program of study. BUAD/eBUS: This group includes all: A. Economics (BUAD) Finance Marketing International Business Legal Studies Management Entrepreneurship HR Management BUAD&ACCT BUAD&CIS eBUS & BUAD (Marketing) majors Project Management & Business Analysis eBUS&BUAD (Management) B. Accounting Major C. Non Business Majors (Health Care Management, Sports Management, Mass

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts