Question: Fall 2019, ACCT 3620 Assignments Chapter 21 HW Assignment Chapter 21 HW Assignment Home eTectbook Send to Gradebook Modules Grades Wiley Accounting Weekly Updates Question

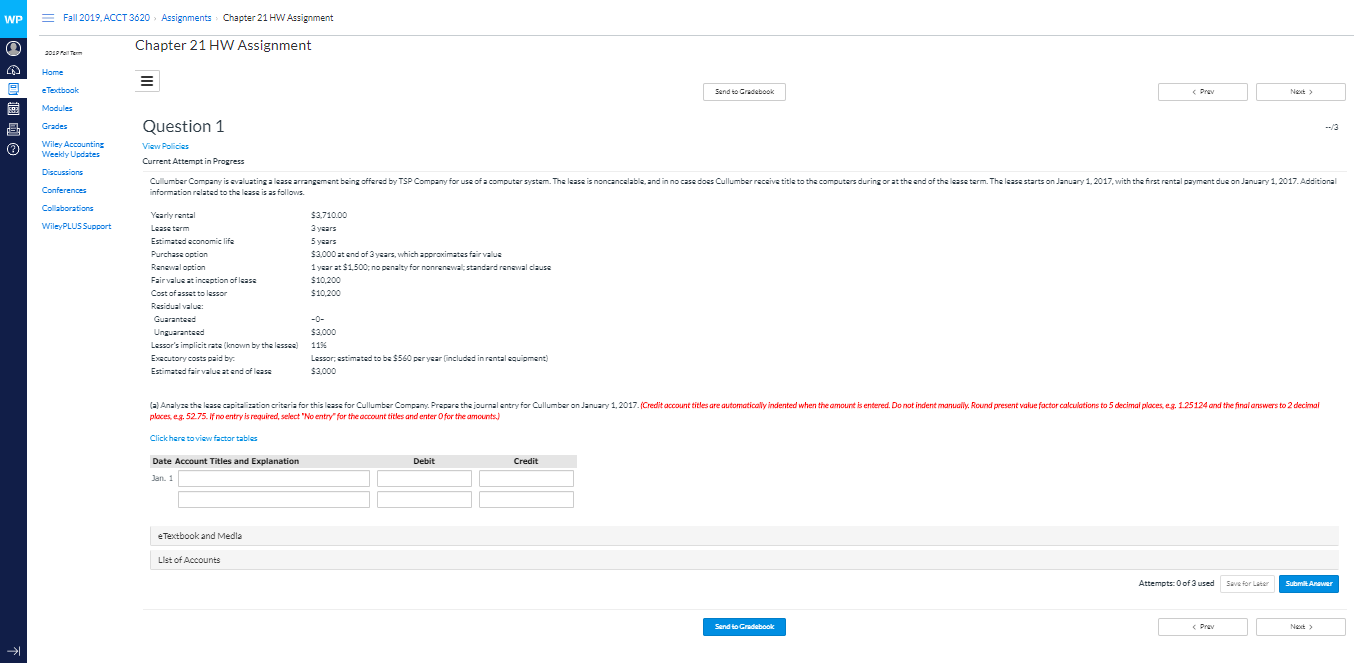

Fall 2019, ACCT 3620 Assignments Chapter 21 HW Assignment Chapter 21 HW Assignment Home eTectbook Send to Gradebook Modules Grades Wiley Accounting Weekly Updates Question 1 View Policies Current Attempt in Progress Cu lumber Company is evaluating a lease arrangement being offered by TSP Company for use of a computer system. The lease is noncancelable, and in no case does Cullumber receive title to the computers during or at the end of the lease term. The lease starts on January 1, 2017, with the first rental payment due on January 1, 2017. Additional information related to the lease is as follows. Discussions Conferences Collaborations WileyPLUS Support Yearly rental Lease term Estimated economic life Purchase option Renewal option Fair value at inception of lease Cost of asset to lassor Residual value: Guaranteed Unguaranteed Lesser's implicit rate (known by the lessee) Executory costs paid by Estimated fair value at end of lease $2.710.00 3 years 5 years $2,000 at end of 3 years, which approximates fair value 1 year at $1,500, no penalty for nonrenewal, standard renewal cause $10.200 $10,200 $3,000 115 Lessor, estimated to be $560 per year (included in rental equipment) $3,000 (a) Analyze the lease capita zation criteria for this lease for Cullumber Company. Prepare the journal entry for Cullumber on January 1, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round present value factor calculations to 5 decimal places. eg. 1.25124 and the final answers to 2 decimal places. eg. 52.75. If no entry is required, select "No entry for the account titles and enter for the amounts) Click here to view factor tabla Debit Credit Date Account Titles and Explanation Jan. 1 e Textbook and Media List of Accounts Attempts:0 of 3 used Save for Later Submit Answer Send to Gradebook Net)

Chapter 21 HW Assignment Fall 2019,ACCT 3620 Assignments WP Chapter 21 HW Assignment 20PTe Home eTextbook Send to Gradabogk Prav Net Modules Question 1 Grades /3 Wiley Accounting Weekly Updates View Policies Current Attempt in Progress Discussions Culumber Company is evaluating a lease arrangament being offered by TSP Company for use of a computar systam. The lease is noncancalable, and in no case doas Cullumber racaive title to the computers during or at the and of the lease term. The lease starts on January 1, 2017, with the first rantal paymant due on January 1, 2017. Additional Conferences information ralated to the lease is as follows. Collaborations Yearly rantal $3,710.00 WileyPLUS Support 3 years Lease tarm Estimated econamic life 5vsars $3,000atand of 3 yaars, whichapproximates fair value Purchasa option Ranewal option 1 yarat $1,500; no panalty for nonrenawal; standard ranewal dause $10,200 Fairvalua atincaption of lease Cost of asset to lessor $10,200 Residual value -0 Guarantesd Unguarantaed $3.000 Lessor's implicit rate (known by the lessea 11% Exacutory costs paid by Lassor; astimated to be $560 peryear included in rental equipment) Estimated fairvalue at and of lease $3,000 (aAnalyza the leasa capital zation critaria for this lease for Cullumber Compamy. Prapare the journal entry for Cullumbar on January 1,2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manualy. Round present value factor calculations to 5 decimal places, eg. 125124 and the final answers to 2 decimal places, eg. 52.75. If no entry is required, select "No entry" for the account titles and enter Ofor the amounts) Click hare to view factor tables Date Account Titles and Explanation Debit Credit Jan. 1 eTextbook and Media List of Accounts Attempts: 0of 3 used Save for Later Submit Anawar Pray Send to Cradebook Ne Chapter 21 HW Assignment Fall 2019,ACCT 3620 Assignments WP Chapter 21 HW Assignment 20PTe Home eTextbook Send to Gradabogk Prav Net Modules Question 1 Grades /3 Wiley Accounting Weekly Updates View Policies Current Attempt in Progress Discussions Culumber Company is evaluating a lease arrangament being offered by TSP Company for use of a computar systam. The lease is noncancalable, and in no case doas Cullumber racaive title to the computers during or at the and of the lease term. The lease starts on January 1, 2017, with the first rantal paymant due on January 1, 2017. Additional Conferences information ralated to the lease is as follows. Collaborations Yearly rantal $3,710.00 WileyPLUS Support 3 years Lease tarm Estimated econamic life 5vsars $3,000atand of 3 yaars, whichapproximates fair value Purchasa option Ranewal option 1 yarat $1,500; no panalty for nonrenawal; standard ranewal dause $10,200 Fairvalua atincaption of lease Cost of asset to lessor $10,200 Residual value -0 Guarantesd Unguarantaed $3.000 Lessor's implicit rate (known by the lessea 11% Exacutory costs paid by Lassor; astimated to be $560 peryear included in rental equipment) Estimated fairvalue at and of lease $3,000 (aAnalyza the leasa capital zation critaria for this lease for Cullumber Compamy. Prapare the journal entry for Cullumbar on January 1,2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manualy. Round present value factor calculations to 5 decimal places, eg. 125124 and the final answers to 2 decimal places, eg. 52.75. If no entry is required, select "No entry" for the account titles and enter Ofor the amounts) Click hare to view factor tables Date Account Titles and Explanation Debit Credit Jan. 1 eTextbook and Media List of Accounts Attempts: 0of 3 used Save for Later Submit Anawar Pray Send to Cradebook Ne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts