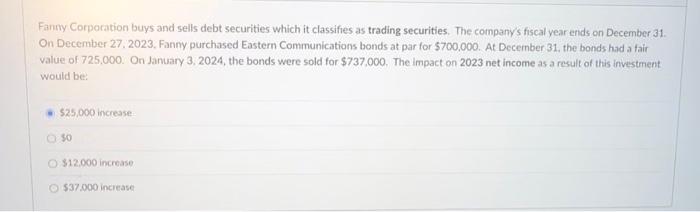

Question: Fanny Corporation buys and sells debt securities which it classifies as trading securities. The companys fiscal year ends on December 31. On December 27. 2023,

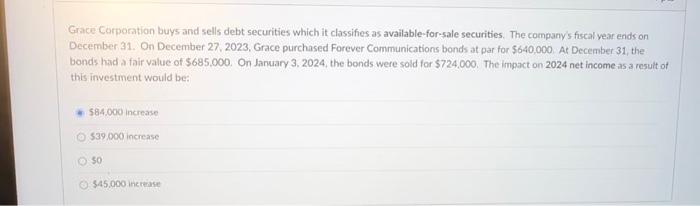

Fanny Corporation buys and sells debt securities which it classifies as trading securities. The companys fiscal year ends on December 31. On December 27. 2023, Fanny purchased Eastern Communications bonds at par for $700,000. At Decernber 31 , the bonds had a fair value of 725,000 . On January 3, 2024, the bonds were sold for $737,000. The impact on 2023 net income as a result of this investment would be: 525,000 increase 50 $12.000 increase $37,000 increase Grace Corporation buys and sells debt securities which it classifies as available-for-sale securities. The company's fiscal year ends on December 31. On December 27,2023, Grace purchased Forever Communications bonds at par for $640,000. At December 31, the bonds had a fair value of $685,000. On January 3, 2024, the bonds were sold for $724,000. The impact on 2024 net income as a result of this investment would be: 584.000 increase $39.000 increase 50 $45,000 inc rease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts